POST MARKET

The Indian equity indices rose for the second straight session on Wednesday, led by gains in public sector banks and auto stocks, ahead of the US Federal Reserve’s policy outcome.

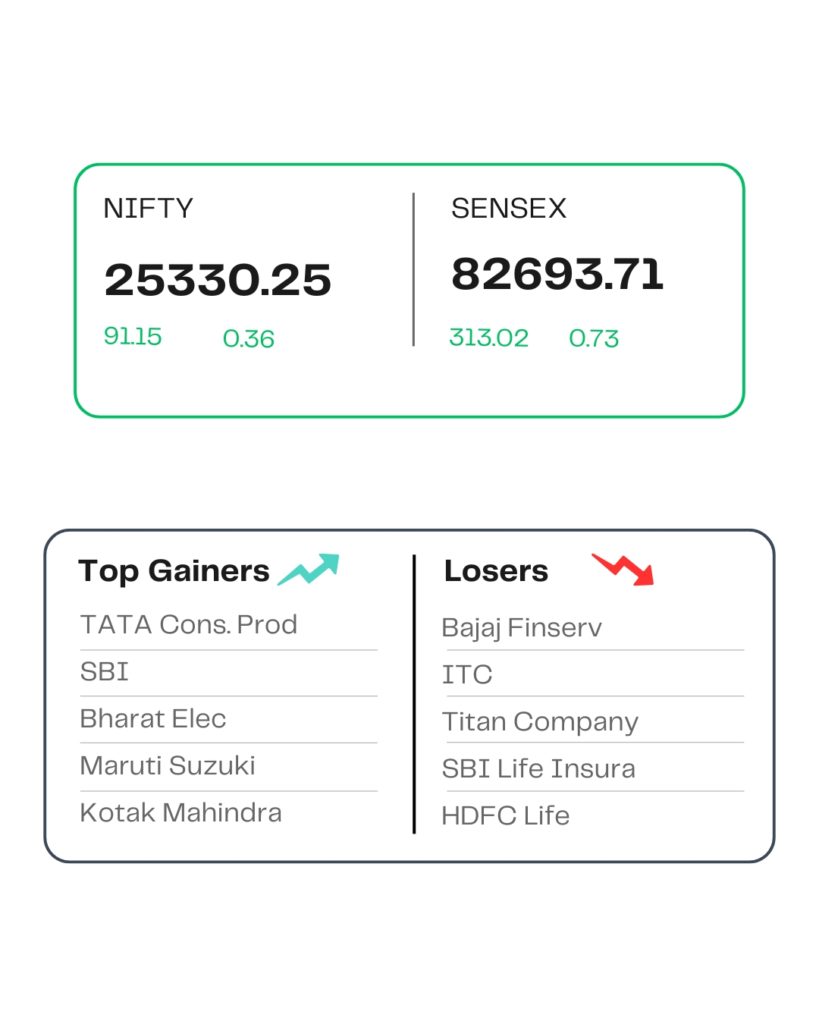

At close, the Sensex was up 313.02 points or 0.38 percent at 82,693.71, and the Nifty was up 91.15 points or 0.36 percent at 25,330.25. About 2311 shares advanced, 1655 shares declined, and 164 shares were unchanged.

Tata Consumer, SBI, BEL, Kotak Mahindra Bank, and Maruti Suzuki were among the top gainers on the Nifty, while losers included HDFC Life, Tata Steel, Bajaj Finserv, Titan Company, and SBI Life Insurance.

Among sectors, FMCG, consumer durables, telecom, metal ended lower while auto, PSU bank, IT, oil & gas rose between 0.5-2.6%.

Among the broader market indices, the BSE Midcap index ended flat, while the smallcap index rose 0.5 percent.

STOCKS TODAY

Hyundai Motors

The shares of Hyundai Motor India jumped almost 2 percent on September 17 after the automaker announced that it had signed a wage settlement agreement, which includes “industry-best salary increase of Rs 31,000 per month”.

Belrise Industries

Belrise Industries surged 6.52 percent to end at Rs 154.38. The rally came after brokerage firm Investec initiated coverage on the auto components maker with a “buy” rating and a target price of Rs 185, implying a potential upside of 29 percent from current levels.

SBI

The shares of State Bank of India (SBI) gained more than 3 percent as the PSU lender announced the completion of the sale of 13.18 percent stake in Yes Bank to Japanese conglomerate Sumitomo Mitsui Banking Corporation (SMBC).

RailTel Corporation of India

RailTel Corporation of India’s share price gained in the opening trade following the company’s receipt of the Letter of Acceptance (LOA) from the Bihar State Educational Infrastructure Development Corporation. The company received a contract worth Rs 57.48 crore for the development of a hybrid smart classroom and ICT Lab at different colleges and universities in Bihar under the PM-USHA Scheme.

Premier Explosives

Premier Explosives’ share price rose 11.86 percent following the Telangana Pollution Control Board (TGPCB) revoking the closure order (which was issued on account of an accident on April 29, 2025) for the company’s factory situated at Katepally Village, Motakondur Mandal, Yadadri-Bhuvanagiri District, Telangana.

TCS

Shares of Tata Consultancy Services (TCS) went up 0.86 percent as investors eagerly awaited a possible rate cut announcement by US Federal Reserve chief Jerome Powell following the FOMC meeting later today.

Source – Money Control