POST MARKET

In the volatile session, the Indian equity indices ended on a positive note after helping Nifty to cross 25,200 intraday, for the first time since October 15, 2024, but failed to hold on to the gains and settled with marginal gains.

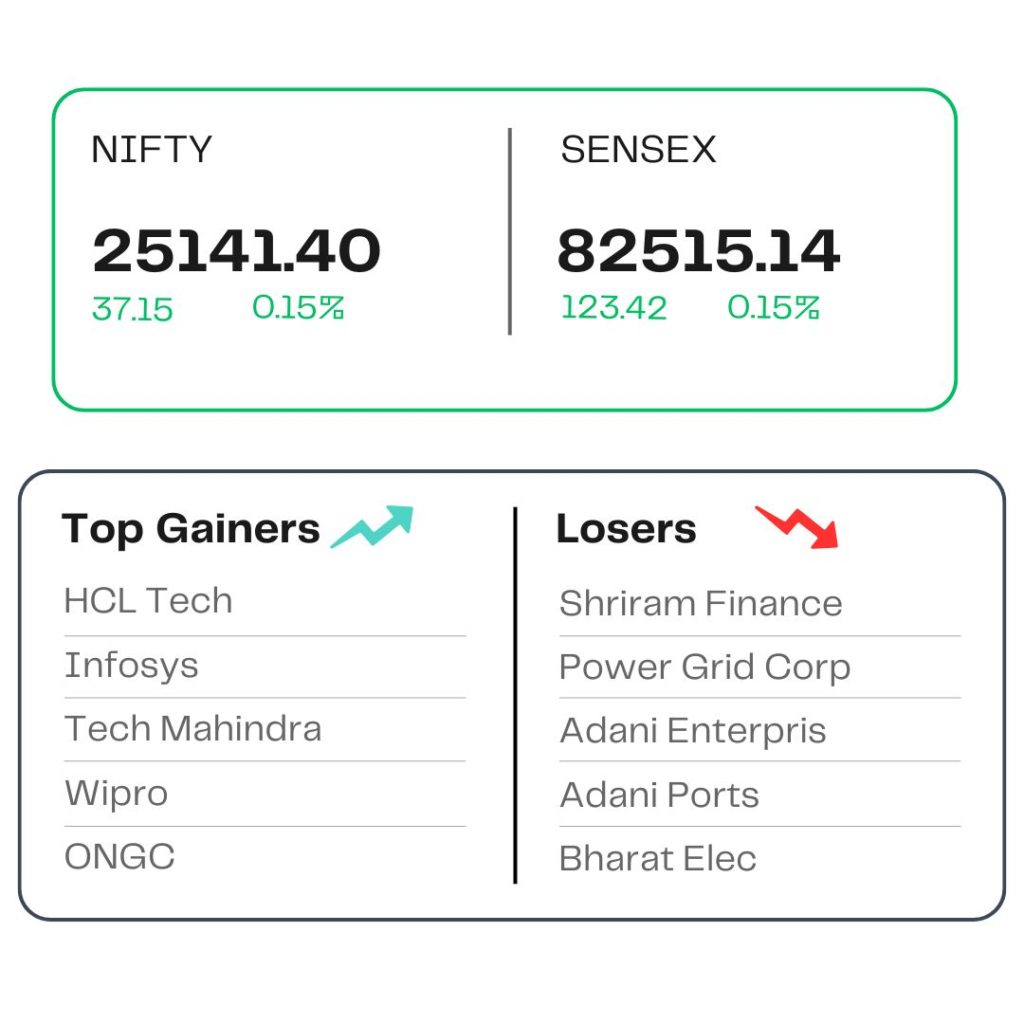

At close, the Sensex was up 123.42 points or 0.15 percent at 82,515.14, and the Nifty was up 37.15 points or 0.15 percent at 25,141.40. About 2173 shares advanced, 1730 shares declined, and 120 shares remained unchanged.

HCL Technologies, Infosys, Wipro, Tech Mahindra, and ONGC were among the major gainers on the Nifty, while losers included Shriram Finance, Power Grid Corp, Adani Enterprises, Adani Ports, and Bharat Electronics.

On the sectoral front, FMCG, Power, and PSU Bank are down 0.5-1 percent, while Oil & Gas, Pharma, and IT are up 0.5-1.2 percent.

The broader market indices showed weak performances with BSE midcap and smallcap indices ending on a flat note.

STOCKS TODAY

Wipro

Shares of the technological company increased by over 1.6 percent after the company announced an extension of its partnership with Metro AG, a global food wholesaler. The deal has been extended for another two years. This ongoing collaboration is expected to strengthen Wipro’s IT services presence in the retail and wholesale sector.

RIL

Reliance Industries Limited shares have increased nearly 1 percent on today’s trade. Along with Reliance shares of several other Oil Marketing Companies (OMC) and oil &gas firms also increased, as falling oil prices boosted investor interest.

Maruti Suzuki

Shares of Maruti Suzuki slipped 0.3 percent after the company’s electric pivot is encountering early roadblocks, with the launch of its much-anticipated e-Vitara likely to be pushed back. This comes after China tightened export controls on these magnets, a move seen as part of its strategic counter to US-led trade pressure under Donald Trump’s administration.

Marksans Pharma

Pharmaceutical firm Marksans Pharma Ltd shares jumped over 5.6 percent, as a block deal estimated at around Rs 250 crore took place on the exchanges. Around 1.02 crore shares, valued at Rs 257 crore, which represent 2.27 percent of the total outstanding equity, exchanged hands in a block trade at Rs 250 per share.

Credit Access Grameen

Shares of CreditAccess Grameen surged over 3 percent in Wednesday’s trading session on securing a USD 100 mn multi-currency syndicated social loan facility. The non-bank microfinance institution qualified as an External Commercial Borrowing (ECB) under the automatic route of the Reserve Bank of India (RBI).

Source – Money Control