POST MARKET

Indian benchmark indices closed in the green on Tuesday, but gave up a portion of their midday gains as rising tensions in the Middle East weighed on investor sentiment and dragged the markets off their highs.

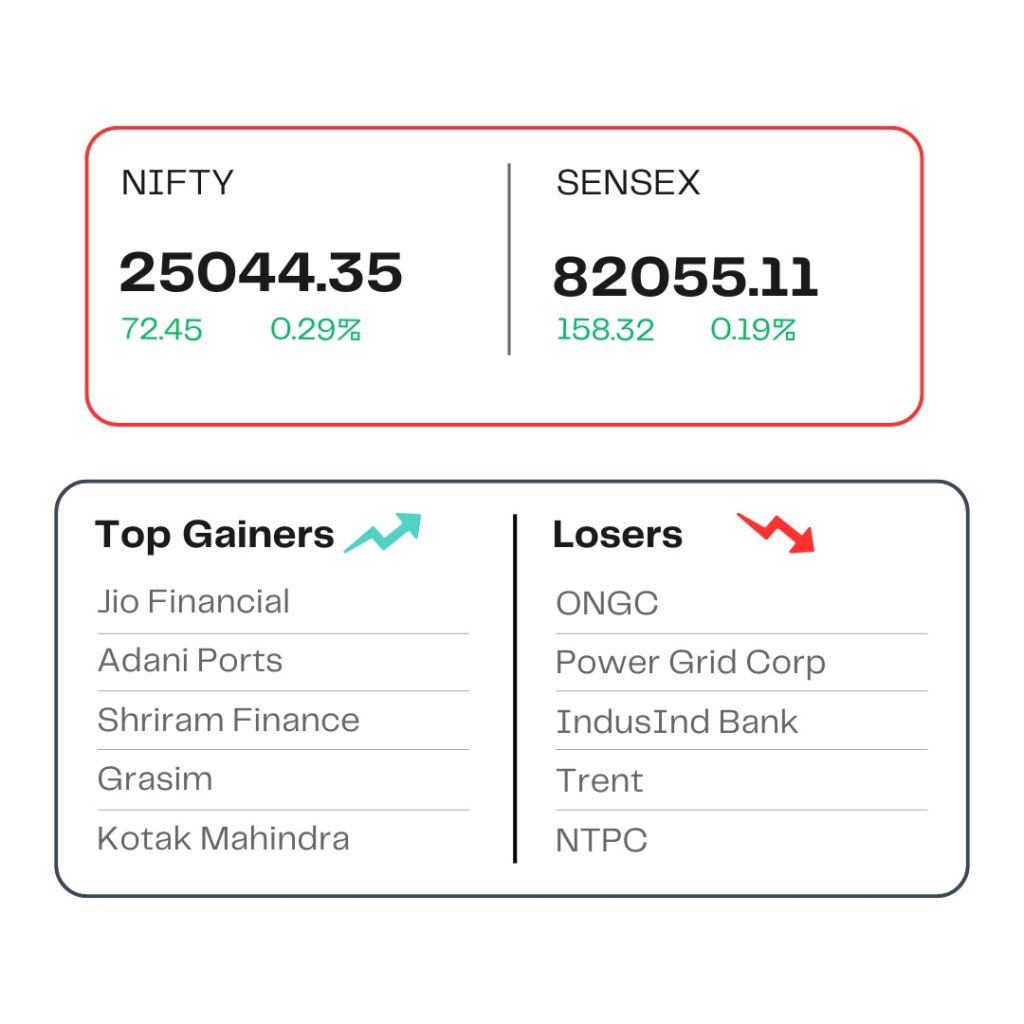

At close, the Sensex was up 158.32 points or 0.19 percent at 82,055.11, and the Nifty was up 72.45 points or 0.29 percent at 25,044.35. About 2570 shares advanced, 1289 shares declined, and 129 shares remained unchanged.

Top gainers included Jio Financial, Adani Ports, Shriram Finance, Grasim, Kotak Mahindra, while losers were ONGC, Power Grid Corp, Trent, IndusInd Bank, and NTPC

Among sectoral gainers, the Nifty PSU Bank index rose 1.5 percent, followed by Nifty Metal, which gained 1 percent. Other gainers included Nifty Bank, Auto, Private Bank, and Consumer Durables—each up 0.7 percent. On the losing side, Nifty Media declined 1 percent.

The broader market indices saw an increase, with both the midcap and smallcap indices rising over half a percent.

STOCKS TODAY

Adani Ports and SEZ

Shares rallied nearly 5 percent after the US brokered a ceasefire between Israel and Iran. The stock had come under pressure earlier due to safety concerns around its Haifa Port in Israel, following heightened tensions and missile attacks in the region.

Bondada Engineering

Stock gained 5 percent on Tuesday, June 24, after the company said it had secured its highest-ever battery energy storage systems (BESS) capacity order worth Rs 836 crore. It received the letter of award from the Tamil Nadu Green Energy Corporation Ltd. (TNGECL).

SBI Cards

Shares rallied 3 percent after the financial services firm reported strong growth in its spend market share for May. SBI Card’s spend market share rose to 17.1 percent from 16 percent in April. Monthly spending grew 10.1 percent for the company, outperforming the industry’s 3 percent growth.

Interglobe Aviation

Shares surged as much as 4 percent after crude oil prices declined following a ceasefire between Iran and Israel. The global benchmark Brent crude fell 2.6 percent to USD 69.62 per barrel, leading to broad-based gains in crude oil-sensitive sectors, including aviation, oil marketing companies, among others.

Vodafone Idea

Shares surged over 6 percent after a report claimed that the central government is considering providing the telecom significant relief on regulatory dues. The positive sentiment was further fuelled after Telecom Minister Jyotiraditya Scindia said that India’s telecom sector can’t afford a duopoly and the government supports competition in all sectors.

Source – Money Control