POST MARKET

Indian equity indices ended on a strong note, as optimism from the U.S.-Japan trade deal lifted the benchmark indices. Further, domestic investors drew support from India and the U.K.’s free-trade agreement, which is slated to be signed tomorrow.

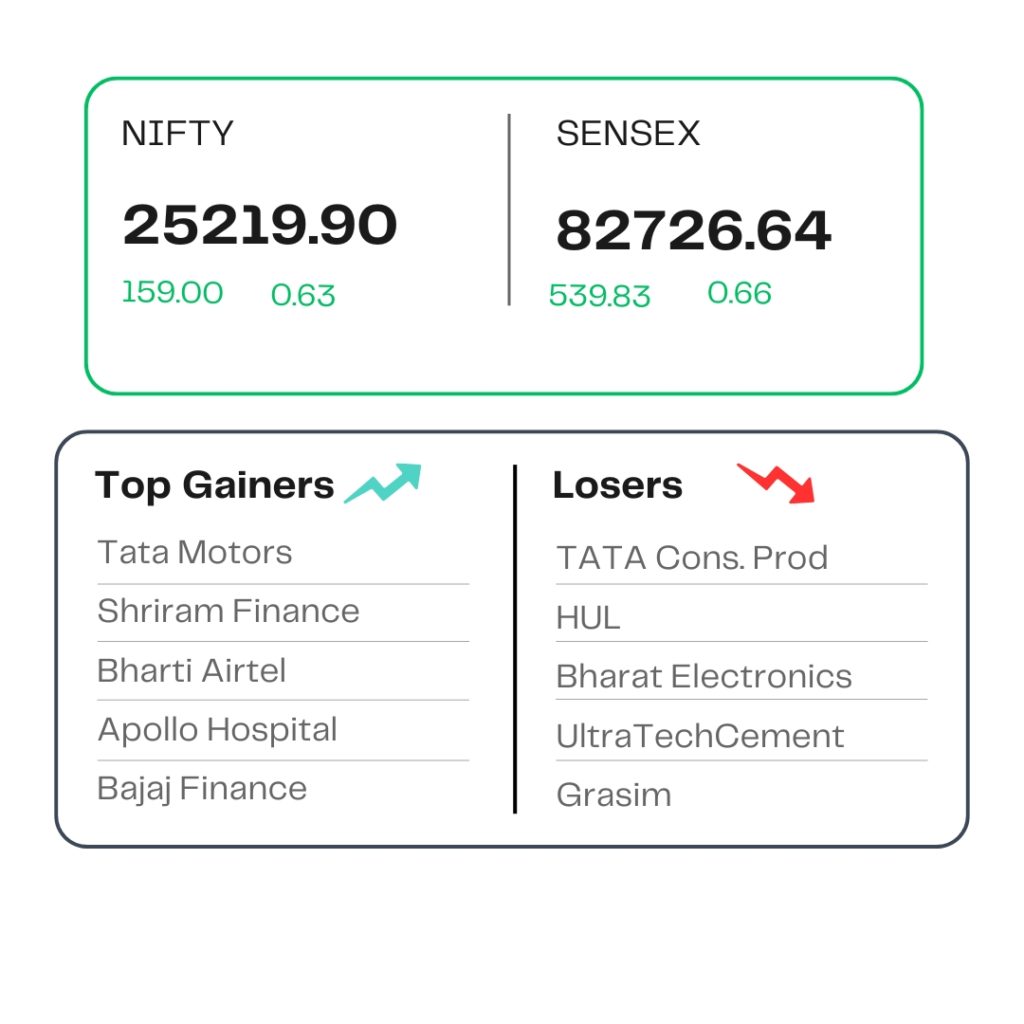

The Sensex was up 539.83 points or 0.66 percent at 82,726.64, and the Nifty was up 159 points or 0.63 percent at 25,219.90. About 1882 shares advanced, 1989 shares declined, and 161 shares remained unchanged.

Tata Motors, Shriram Finance, Bharti Airtel, Apollo Hospitals, and Bajaj Finance were among the top gainers on the Nifty, while losers were Tata Consumer, HUL, Bharat Electronics, UltraTech Cement, and Grasim Industries.

Among sectors realty index slipped 2.6 percent, the media index was down 1 percent, the FMCG index fell 0.5 percent, while the auto, metal, oil & gas, consumer durables, pharma, private bank, PSU Bank, and telecom rose 0.5-1 percent.

Broader indices underperformed main indices with the BSE Midcap rising 0.24 percent while the smallcap index ended flat.

STOCKS TODAY

Colgate Palmolive (India)

Shares slipped 4 percent after the company reported an 11.8 percent year-on-year decline in net profit to Rs 321 crore for the quarter ended June 30, 2025. Revenue from operations also fell 4.3 percent to Rs 1,433 crore, while total income declined to Rs 1,433 crore from Rs 1,496.71 crore in the corresponding quarter of the previous year.

Tata Motors

The stock rallied up to 3 percent, lifted by a surge in auto stocks in Asia after the United States and Japan reached a major trade agreement. The deal, which reduces tariffs on Japanese vehicles entering the US market, has reignited optimism around the possibility of similar trade arrangements with other nations, India included.

One97 Communications

The parent of Paytm surged over 2 percent after it reported consolidated net profit of Rs 123 crore in the quarter ended June 30, 2025, as against net loss of Rs 839 crore a year ago, aided by strong lending business and as it kept a tight lid on expenses, especially marketing and employee costs. Jefferies, Citi Research, and Bernstein gave bullish calls.

Lodha Developers

Shares tanked over 7 percent after as much as 1 percent equity of Lodha Developers changed hands in a block deal on Wednesday, July 23. On Tuesday, July 22, citing sources, that an existing investor in the realty firm was likely to offload around 1 percent equity worth $165 million in the company via a block deal.

JSW Infrastructure

The stock rose over 3 percent on July 23 after the company reported a strong rise in its June quarter net profit. The stock touched an intraday high of Rs 328.5 – its highest level since January 6, before trimming gains. The company currently commands a market capitalisation of Rs 67,809 crore, as per BSE data.

Source – Money Control