POST MARKET

Indian benchmark indices stayed in positive territory on September 9 but were off the day’s highs as the market navigated the weekly derivatives expiry of Nifty contracts.

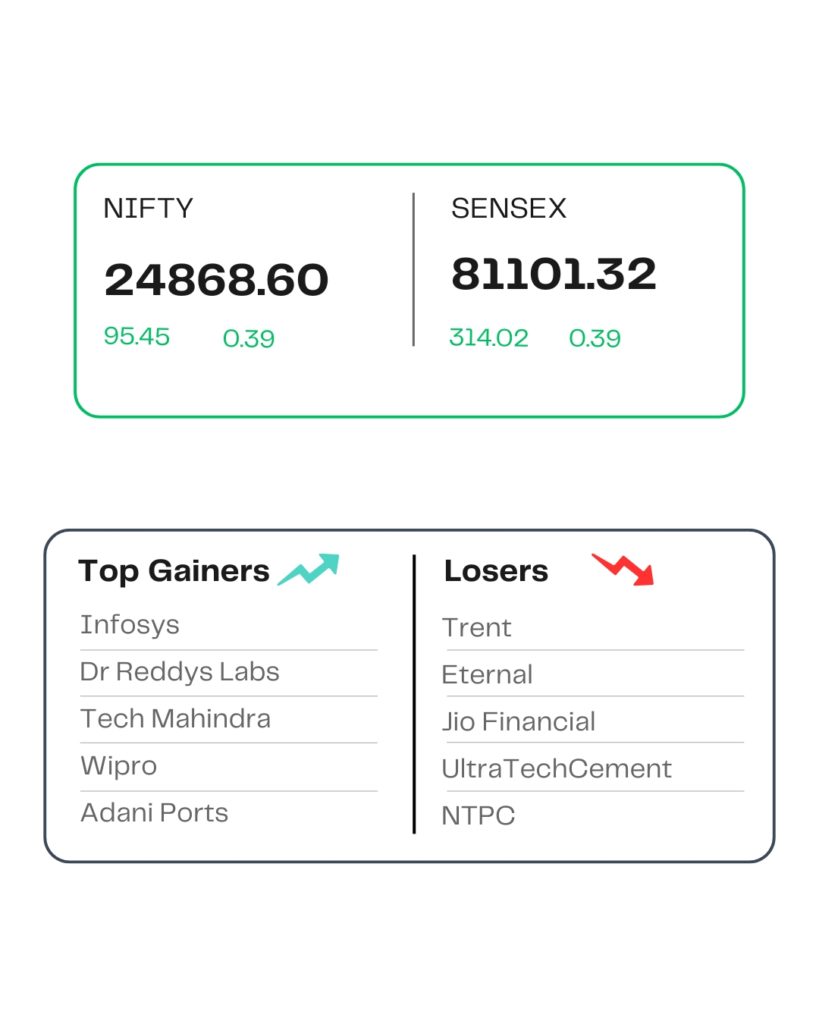

At close, the Sensex was up 314.02 points or 0.39 percent at 81,101.32, and the Nifty was up 95.45 points or 0.39 percent at 24,868.60. About 1893 shares advanced, 2028 shares declined, and 160 shares remained unchanged.

Infosys, Dr Reddy’s Labs, Wipro, Tech Mahindra, Adani Ports were among the major gainers on the Nifty, while losers included Eternal, Trent, Jio Financial, Tata Motors, Titan Company.

On the sectoral front, the IT index is up 2.8%, pharma and FMCG are up 0.5% each, while oil & gas, realty indices are down 0.3% each.

Among the broader market indices, the BSE Midcap and smallcap indices are up 0.2% each.

STOCKS TODAY

Glenmark Pharma

Glenmark Pharma’s wholly owned subsidiary, Ichnos Glenmark Innovation (IGI) shares went up 3.14 percent after they received an upfront payment of $700 million from NYSE-listed AbbVie for a molecule used in cancer treatment, the company informed exchanges, sending the shares higher by over two percent in early trade on September 9.

Trent

Trent shares dropped around 2 percent to close at Rs 5,223 apiece, extending losses for the third consecutive session. This comes after the stock recorded strong gains on expectations of rising demand following GST reforms.

RailTel Corporation of India

RailTel Corporation of India’s share price rose 5.35 percent in the early trade on September 9 after the company announced a project win from Sthe tate Project Director (SPD), Bihar Education Project Council (BEPC).

Infosys

The shares of Infosys jumped almost 5 percent on September 9 after the company announced that its board will meet on September 11 to consider a proposal for buyback of fully paid-up equity shares. If approved, this will be the first buyback of shares announced by India’s second-largest IT firm since 2022, when the company had agreed to a buyback proposal of Rs 9,300 crore.

Eternal

Eternal (formerly known as Zomato) shares dropped 1.2 percent. The stock has now snapped a six-session gaining streak. Nomura has also reiterated a ‘Buy’ rating on Eternal and raised its price target to Rs 370 per share from Rs 300 earlier. This implies an upside potential of more than 12 percent from the stock’s previous closing price.

Source – Money Control