POST MARKET

Indian benchmark indices erased previous session losses to end higher with Nifty finishing near 25,200 on October 9, led by buying across the sectors.

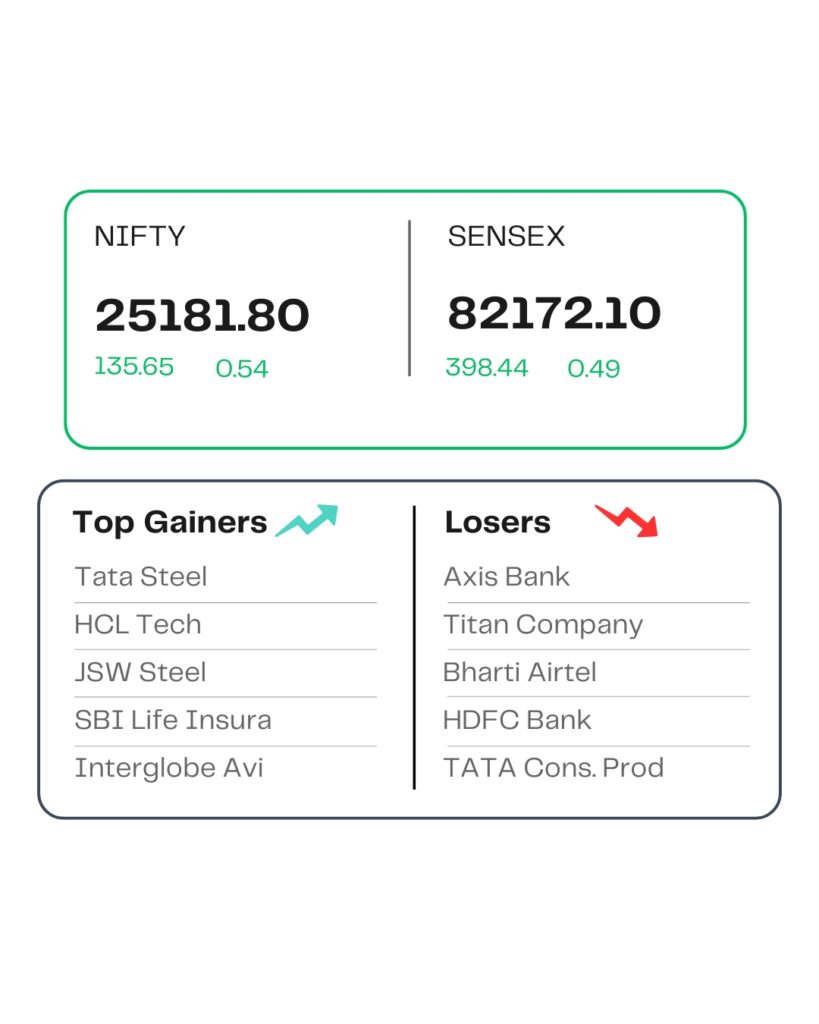

At close, the Sensex was up 398.44 points or 0.49 percent at 82,172.10, and the Nifty was up 135.65 points or 0.54 percent at 25,181.80. About 2015 shares advanced, 1978 shares declined, and 159 shares remained unchanged.

On the sectoral front, pharma, oil & gas, realty, metal, PSU Bank IT added 0.5-1 percent.

The biggest Nifty gainers were HCL Technologies, JSW Steel, Tata Steel, SBI Life Insurance, Interglobe Aviation, while losers were Tata Consumer, Axis Bank, Maruti Suzuki, Titan Company, and Bharti Airtel.

Among the broader market indices, the BSE Midcap index jumped 0.75%, while the smallcap index ended flat.

STOCKS TODAY

GMDC

The shares of Gujarat Mineral Development Corporation (GMDC) jumped more than 7 percent on October 9. This comes after a report that the Indian government is working on a first-of-its-kind scheme worth Rs 7,300 crore for setting up rare earth magnet processing units and supply chains in the country.

Hindusan Zinc

The shares of Hindustan Zinc jumped 4.43 percent in trade, tracking the optimism around silver’s recent bull run. Domestic prices of silver continued to extend their rally, while futures fell on profit booking at elevated levels.

Hindustan Copper

The shares went up 6.77 percent, as base metal prices rose on supply concerns from major mines, including Freeport’s Grasberg mine in Indonesia. Nifty Metal was the top sectoral gainer on October 9 by rising 1.6% after falling 1.4% in the previous three sessions.

Lupin

Lupin’s share price rose 2.59 percent in the opening trade on October 9 following the company announcement of a plan to build a new state-of-the-art manufacturing facility in Coral Springs, Florida.

Saatvik Green Energy

Saatvik Green Energy’s share price added 10 percent after the company received strong numbers in the quarter ended June 2025 (Q1FY26) and also received an order aggregating to Rs 488 crore from power producers/EPC for the supply of solar PV modules, which will be executed in FY26.

Source – Money Control