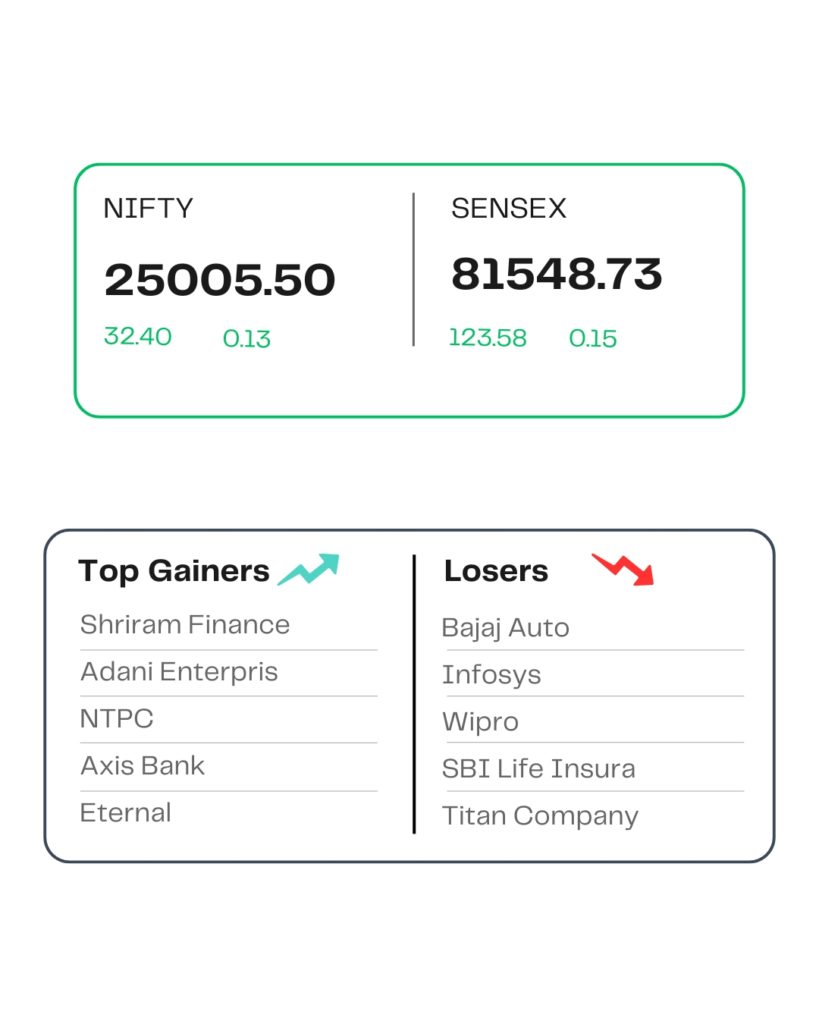

POST MARKET

Indian equity indices ended on a positive note, tracking positive cues from Asian markets amid expectations of a US Federal Reserve rate cut next week.

At close, the Sensex was up 123.58 points or 0.15 percent at 81,548.73, and the Nifty was up 32.40 points or 0.13 percent at 25,005.50. About 1867 shares advanced, 1854 shares declined, and 131 shares remained unchanged.

Adani Enterprises, Shriram Finance, NTPC, Axis Bank, and Power Grid were among the major gainers on the Nifty, while losers were Bajaj Auto, Infosys, SBI Life Insurance, Wipro, and Titan Company.

On the sectoral front, energy, PSU Bank, pharma, oil & gas, and media up 0.5-1%, while the IT index declined 0.5%, auto index shed 0.3%.

Among the broader market indices, the BSE Midcap and smallcap indices ended on a flat note.

STOCKS TODAY

Jupiter Wagons

Jupitar Wagons’ share price almost 4.5 percent after the company received a bogie supply order of approximately Rs 113 crore. The company’s subsidiary, Jupiter Tatravagonka Railwheel Factory, has received a Letter of Acceptance (LOA) from the Ministry of Railways, Railway Board.

PNB

The shares of public sector bank Punjab National Bank (PNB) rose 1.41 percent, and other PSUs rose as well on September 11, pushing the Nifty PSU Bank index higher into the green in the afternoon. This comes as reports on further consolidation of these lenders boosted investor sentiment.

Apex Frozen

The shares of export-oriented shrimp feed Apex Frozen company dropped over 3.3 percent. This comes as investors may have resorted to profit booking, a day after the stocks recorded massive gains. The stocks had seen a significant surge on September 10 (Wednesday) after US President Donald Trump said Washington and New Delhi will resume negotiations to resolve the ongoing trade frictions.

Tata Investment Corporation

The shares of Tata Investment Corporation ended nearly 1.5 percent higher after a report said that Tata Capital is set to launch its IPO to raise around $2 billion (around Rs 17,688 crore) by early October.

Source – Money Control