POST MARKET

Indian equity indices ended in the red for a second session on June 13, weighed down by rising tensions in the Middle East after Israel’s military strikes on Iran, but a recovery helped the markets close off the day’s low.

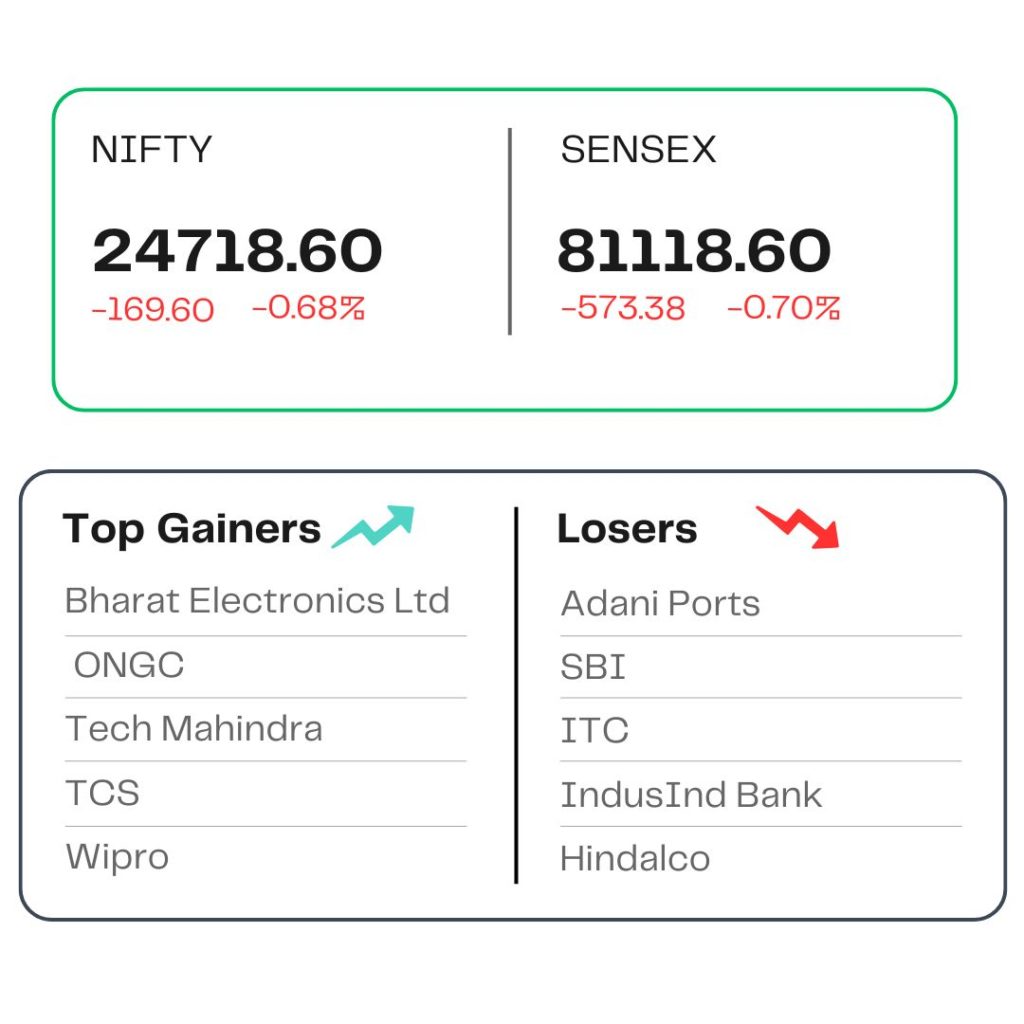

At close, the Sensex was down 573.38 points or 0.70 percent at 81,118.60, and the Nifty was down 169.60 points or 0.68 percent at 24,718.60. About 1520 shares advanced, 2326 shares declined, and 124 shares remained unchanged.

Biggest Nifty losers were Adani Ports, ITC, SBI, IndusInd Bank, Hindalco Industries, while gainers included Bharat Electronics, ONGC, Tech Mahindra, TCS, Wipro.

Except media, realty, all other sectoral indices ended in the red with FMCG, PSU Bank, oil & gas, power, telecom down 0.5-1 percent.

The broader market indices went down as the BSE midcap and smallcap indices shed 0.3 percent each.

STOCKS TODAY

Nazara Technologies

Shares of Nazara Technologies surged nearly 7 percent to record their biggest single-day jump in 21 weeks on June 13 after a large block deal reportedly took place on exchanges. This comes days after veteran investor Rekha Jhunjhunwala sold nearly 2 percent stake in the gaming company.

State Bank of India

Shares of State Bank of India (SBI) closed nearly 1.6 percent lower at Rs 793 apiece, accompanying other bank stocks which tracked declines in Asian markets, after Israel launched military strikes on Iran. The Nifty Bank index dropped nearly 1 percent to end the session at 55,527.35, while the Nifty PSU Bank index fell over 1.18 percent.

GRSE

Garden Reach Shipbuilders and Engineers (GRSE) shares closed over 3 percent higher at Rs 3,072 apiece. Defence stocks significantly surged on June 13 as the war between Israel and Iran continued to escalate, fueling hopes of higher defence equipment orders amid heightened global uncertainties.

Indigo

Shares of listed carrier InterGlobe Aviation (IndiGo) fell up to 4 percent in early trade as investors reacted to the incident of the Air India flight crash. The selloff in aviation stocks was also influenced by rising geopolitical tensions in the Middle East.

Adani Ports and SEZ

Adani Ports and SEZ (APEZ) shares dropped nearly 3 percent intraday to trade at Rs 1,406 apiece, as the escalating war between Israel and Iran raised concerns over disruption at the port in Israel. Adani Ports owns a majority stake in Haifa Port in Israel. The company acquired the port for a total consideration of $1.18 billion in 2023. The port is one of Israel’s major seaports.

Source – Money Control