POST MARKET

Indian equity indices ended on a weak note on June 12.

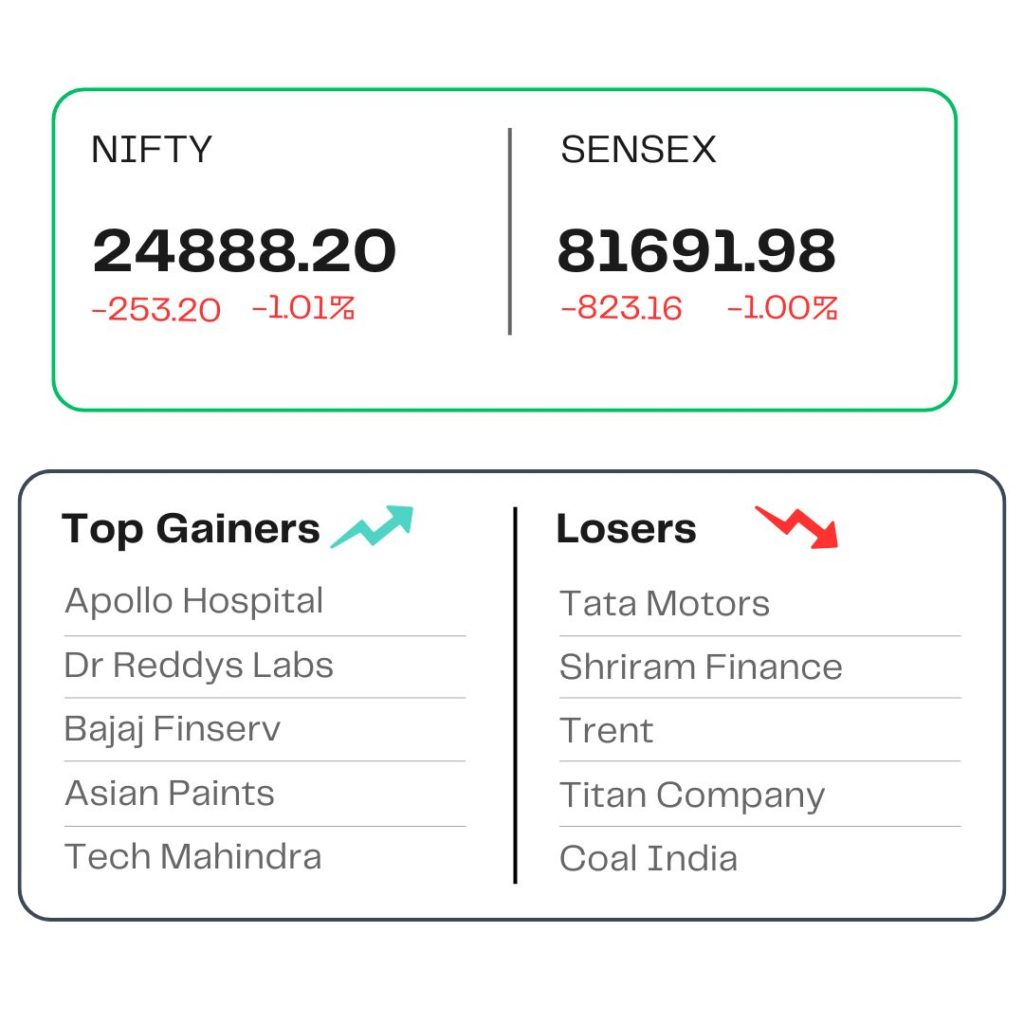

At close, the Sensex was down 823.16 points or 1.00 percent at 81,691.98, and the Nifty was down 253.20 points or 1.01 percent at 24,888.20. About 1249 shares advanced, 2606 shares declined, and 134 shares remained unchanged.

The biggest Nifty losers were Tata Motors, Shriram Finance, Trent, Titan Company, and Coal India, while gainers were Apollo Hospitals, Dr Reddy’s Labs, Bajaj Finserv, Asian Paints, and Tech Mahindra.

All the sectoral indices ended in the red with auto, Consumer Durables, FMCG, metal, IT, power, oil & gas, and realty down 1-2 percent.

The broader market indices went down as the BSE midcap index shed 1.5 percent and the smallcap index went down 1.3 percent.

STOCKS TODAY

Indigo

IndiGo shares sharply fell over 3 percent, while SpiceJet shares were down 1.5 percent. This came after a London-bound Air India flight with over 200 passengers onboard crashed soon after takeoff from the Ahmedabad airport, crashing near the airport, in a densely populated area.

Ixigo

The travel website Ixigo shares went down 3.72 percent. As airline stocks saw a sharp decline, companies that offer flight booking services also decreased. Along with Ixigo, Thomas Cook, Easemytrip, TBO Tek, Mahindra Holidays, and Yatra online also saw a sharp fall in their stocks, following the Air India flight crash.

Paytm

Paytm shares closed over 7 percent lower, after the Finance Ministry issued a clarification that no merchant discount rate (MDR) will be charged on UPI transactions. Finance Ministry’s clarification came after reports suggested that the government is planning to introduce MDR on transactions worth Rs 3,000 and above to support banks and payment solution providers.

Hyundai Motor India

Shares of Hyundai Motor India climbed nearly a percent on June 12 after reports suggested the company is unlikely to face any near-term disruption in electric vehicle (EV) production despite mounting concerns over a global rare earth magnet shortage.

Source – Money Control