POST MARKET

Indian equity indices swung between the green and the red through the session on Tuesday, July 22, as investors remained cautious. The lack of strong directional cues led to the headline indies taking a breather, while sharp stock-specific moves were seen instead.

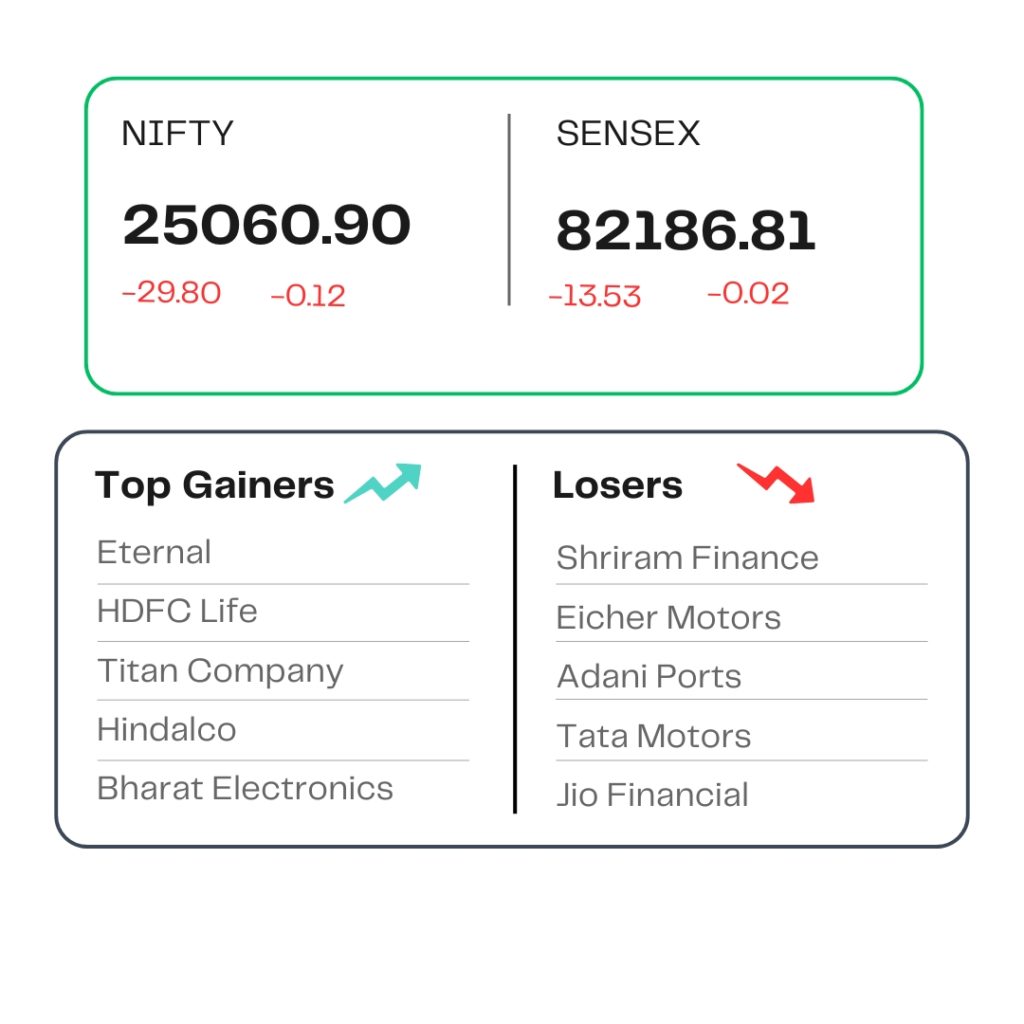

At close, the Sensex was down 13.53 points or 0.02 percent at 82,186.81, and the Nifty was down 29.80 points or 0.12 percent at 25,060.90. About 1724 shares advanced, 2126 shares declined, and 172 shares were unchanged.

Eternal, HDFC Life, Titan Company, Hindalco Industries, Bharat Electronics were among the major gainers on the Nifty, while losers were Shriram Finance, Jio Financial, Eicher Motors, Adani Ports, and Tata Motors.

All the sectors ended in the red, with the media index falling 2.5 percent, PSU Bank index shedding 1.6 percent, realty index down 1 percent, auto index slipping 0.6 percent, and pharma index was down 0.9 percent.

BSE Midcap index shed 0.6 percent, while the smallcap index ended marginally lower, also ending half a percent lower.

STOCKS TODAY

Eternal

Eternal, the parent company of Zomato and Blinkit, ended the day with a share price over 10 percent higher, extending significant gains for the second consecutive session. This is after Eternal released its results for the first quarter of the financial year 2026. Zomato’s parent company reported a 90 percent year-over-year drop in net profit to Rs 25 crore in Q1 FY26. Its revenue from operations, however, rose 70 percent year-on-year to Rs 7,167 crore during the quarter under review.

Titan Company

Titan shares gained over a percent as the country’s leading branded jewellery maker company announced to acquire a majority 67 percent stake in UAE-based Damas Jewellery in an all-cash deal. The move will help the Tata group-managed firm to expand its business in GCC countries.

360 ONE WAM

Capital markets player 360 ONE WAM shares tumbled over 6.31 percent, following a block deal involving shares worth Rs 2,273 crore that took place in the early session on Tuesday, July 22, with the likely seller being Bain Capital and Canada Pension Plan Investment Board.

One97 Communications

One 97 Communications Ltd, the parent of Paytm, shares went up over 3.2 percent, after the company reported a consolidated net profit of Rs 123 crore in the quarter ended June 30, 2025 as against net loss of Rs 839 crore a year ago, aided by strong lending business and as it kept a tight lid on expenses, especially marketing and employee cost.

Afcons Infrastructure

Afcons Infrastructure’s share price gained over 2 percent on July 22 following the company securing a Croatian Railway reconstruction contract worth Rs 6,800 crore. The company has been declared the lowest bidder (L1) by HŽ INFRASTRUKTURA d.o.o. (HŽ Infrastructure Ltd) for rehabilitation & construction of a railway line in the Republic of Croatia.

Source – Money Control