POST MARKET

Indian equities ended marginally lower on September 30 as investors stayed cautious ahead of the Reserve Bank of India’s bi-monthly policy review.

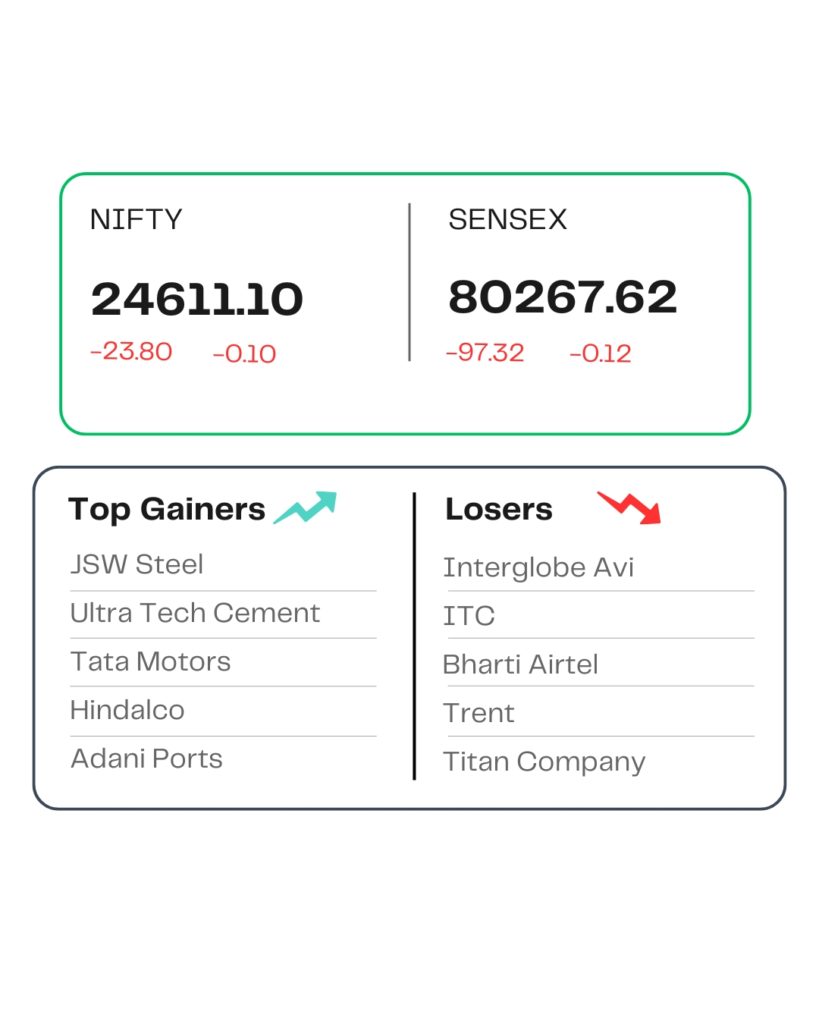

At close, the Sensex was down 97.32 points or 0.12 percent at 80,267.62, and the Nifty was down 23.80 points or 0.10 percent at 24,611.10. About 1970 shares advanced, 1939 shares declined, and 153 shares remained unchanged.

JSW Steel, UltraTech Cement, Bharat Electricals, Adani Ports, and Tata Motors were among the top gainers, while the top losers were Interglobe Avi, ITC, Bharti Airtel, Trent, and Titan Company.

Among sectors, Nifty PSU Bank went up 1.7 percent, followed by Nifty Metal, which advanced 1.49 percent. On the other hand, Nifty Media went down 1.32 percent, Realty down 0.71 percent, and FMCG fell 0.27 percent.

STOCKS TODAY

Blue dart

Shares of courier services provider Blue Dart Express rose up 2.34 percent after the company announced a hike of 9-12% in its average price of shipments. The company on September 29 said that the new rates will come into effect from January 1, 2026, and will vary based on the product to be shipped and the customer’s shipping profile.

Prime Focus

Shares of media and entertainment company Prime Focus went down 5 percent along with other stocks on Tuesday after US President Donald Trump announced a 100 percent tariff on movies made outside the United States.

Coforge

Shares of IT firm Coforge rose 2.5 percent after brokerage firm CLSA initiated coverage on the company with an ‘outperform’ rating. CLSA was bullish on the stock, citing strong execution, domain expertise, and said a consulting mindset may drive robust order book, revenue, and earnings growth.

Deccan Gold Mines

Listed mineral exploration company Deccan Gold Mine’s shares ended sharply higher by nearly 6 percent on September 30 after the company said it is on track to commence production from a mine in Kyrgyzstan starting next month.

TIC

Tata Investment Corporation’s share price surged 19.85 percent to a fresh 52-week high and settled at a record high on Tuesday as Tata Capital gears up to launch its initial public offering (IPO) next week.

Source – Money Control