POST MARKET

Indian equity indices fell on the fifth consecutive session on September 25, with Nifty finishing below 24,900 amid selling seen across the sectors, barring metals.

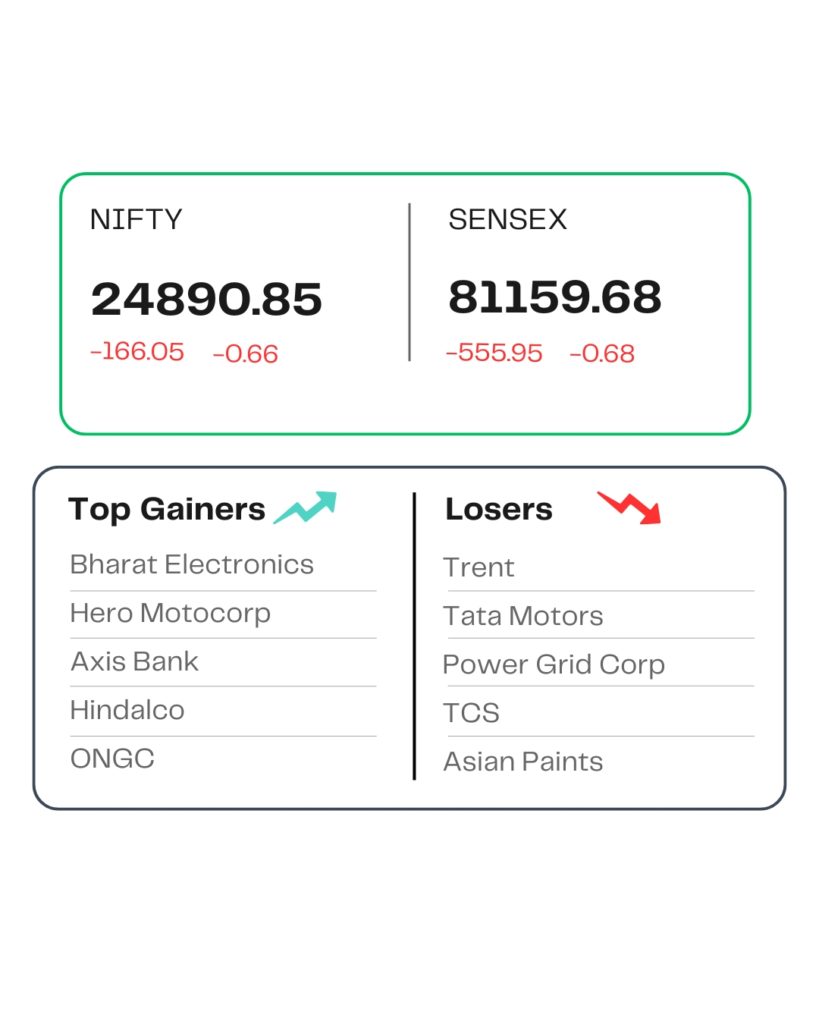

At close, the Sensex was down 555.95 points or 0.68 percent at 81,159.68, and the Nifty was down 166.05 points or 0.66 percent at 24,890.85. About 1405 shares advanced, 2586 shares declined, and 125 shares remained unchanged.

Tata Motors, Trent, Shriram Finance, TCS, and Power Grid were among the major losers on the Nifty, while gainers were Bharat Electronics, Hindalco, Axis Bank, ONGC, and Hero MotoCorp.

On the sectoral front, except metal (up 0.22%), all other indices ended in the red with consumer durables, auto, power, IT, and realty down 1% each.

Among the broader market indices, the BSE Midcap and Smallcap indices are down 0.7% each.

STOCKS TODAY

Tata Motors

Shares of Tata Motors were lower by almost 3 percent, emerging as the top Nifty 50 and F&O loser after a report by the Financial Times said that subsidiary JLR may face a Euro 2 billion hit as it was not insured against a recent cyberattack that disrupted operations.

Cochin Shipyard

The shares went up 1.68 percent along with the shares of other defence companies tracking gains in European defence stocks after US President Donald Trump voiced support for Ukraine’s efforts to reclaim all of its lost territory.

Hindustan Zinc

The shares of Hindustan Zinc jumped over 3 percent on September 25, as silver prices hit fresh record highs, extending a record bull run. The shares have now gained over 7.5 percent in one month.

Polycab India

Shares of wires and cables manufacturer Polycab India fell more than a percent following a large block trade, which likely saw 21.9 lakh shares change hands, or worth 1.5 percent of equity, more than what was initially reported, with promoter and promoter group family members seen as likely sellers following an upsize of the deal.

Zydus Lifesciences

Shares went down 1.68 percent, as they have been penalized of ₹33.50 million following an order related to the alleged availment and utilization of CENVAT (Central Value Added Tax) credit on sales commission paid to foreign entities. The order, issued by the Commissioner of CGST, Ahmedabad, was communicated to the company via email on September 24, 2025.

Source – Money Control