POST MARKET

Indian benchmark indices ended lower for the second consecutive session on October 31 amid selling seen in the metal, IT, and media names. However, buying in PSU Banks helped to limit the losses.

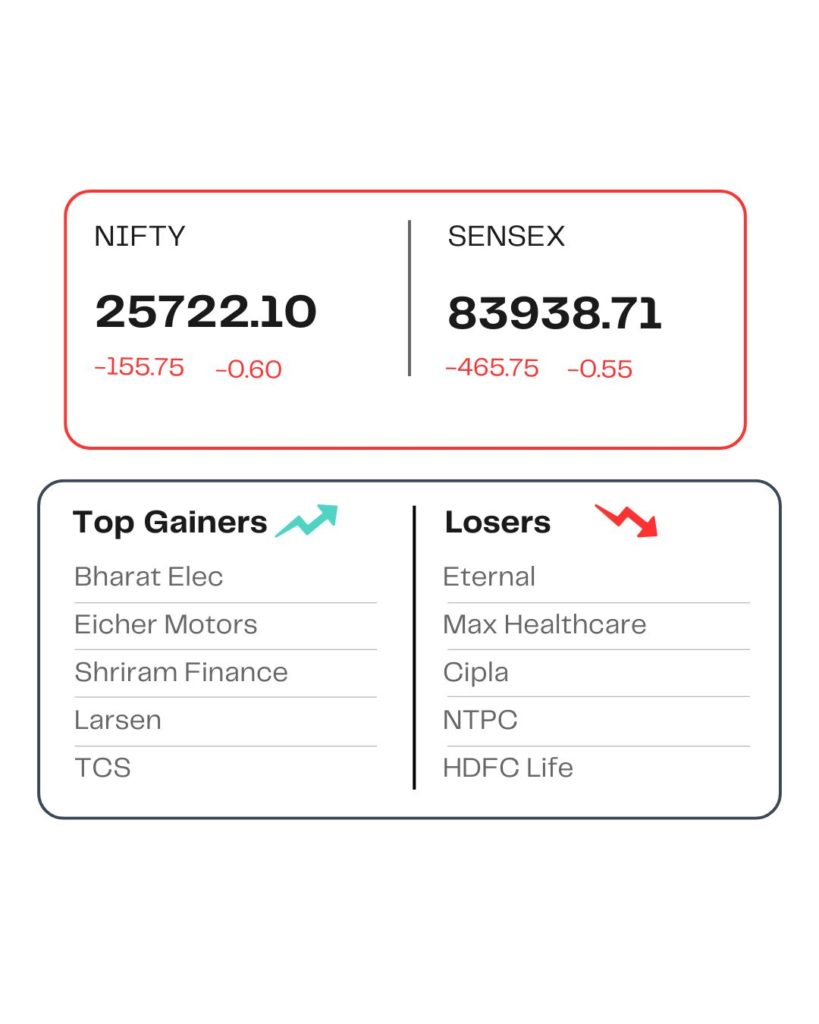

At close, the Sensex was down 465.75 points or 0.55 percent at 83,938.71, and the Nifty was down 155.75 points or 0.60 percent at 25,722.10. About 1731 shares advanced, 2240 shares declined, and 138 shares were unchanged.

Bharat Electronics, Eicher Motors, Shriram Finance, L&T, and TCS were among the major gainers on the Nifty, while losers were Cipla, Eternal, Max Healthcare, NTPC, and Interglobe Aviation.

Among sectors, the PSU Bank index rose 1.5%, while power, metal, and media shed 1% each, and the IT, private bank, and healthcare indices were down 0.5% each.

Among the broader market indices, the BSE Midcap index slipped 0.5% and the Smallcap index was down 0.4%.

STOCKS TODAY

Bharat Electronics

Bharat Electronics share price ended with gains, rising almost 4 percent after the company secured additional orders worth Rs 732 crore for Software Defined Radios (SDRs), tank sub systems, communication equipment, missile components, financial management software, cyber security solution, upgrades, spares, services, etc.

MTAR Technologies

MTAR Technologies’ share price hits 52-week high, rising 3.27 percent on October 31 following the company receiving an international order from the existing customer worth USD 29.95 million (Rs 263.54 crore approximately), which is to be executed over the next one-year.

Vedanta

Vedanta went down 2.64 percent after reporting a 59 percent decline in consolidated net profit attributable to owners at Rs 1,798 crore for the quarter ended September 30, 2025, after the company booked exceptional loss of Rs 2,067 crore during the quarter. The mining conglomerate had posted a net profit of Rs 4,352 crore in the year-ago period.

Union Bank

Union Bank shares went up 4.46 percent along with other PSU Bank shares after SEBI notified new rules for Bank Nifty, including the requirement that the sectoral index should have a minimum of 14 constituents as against the current 12.

Source – Money Control