POST MARKET

The equity benchmark indices settled lower for the seventh consecutive session, as market participants remained cautious ahead of the RBI’s monetary policy meeting.

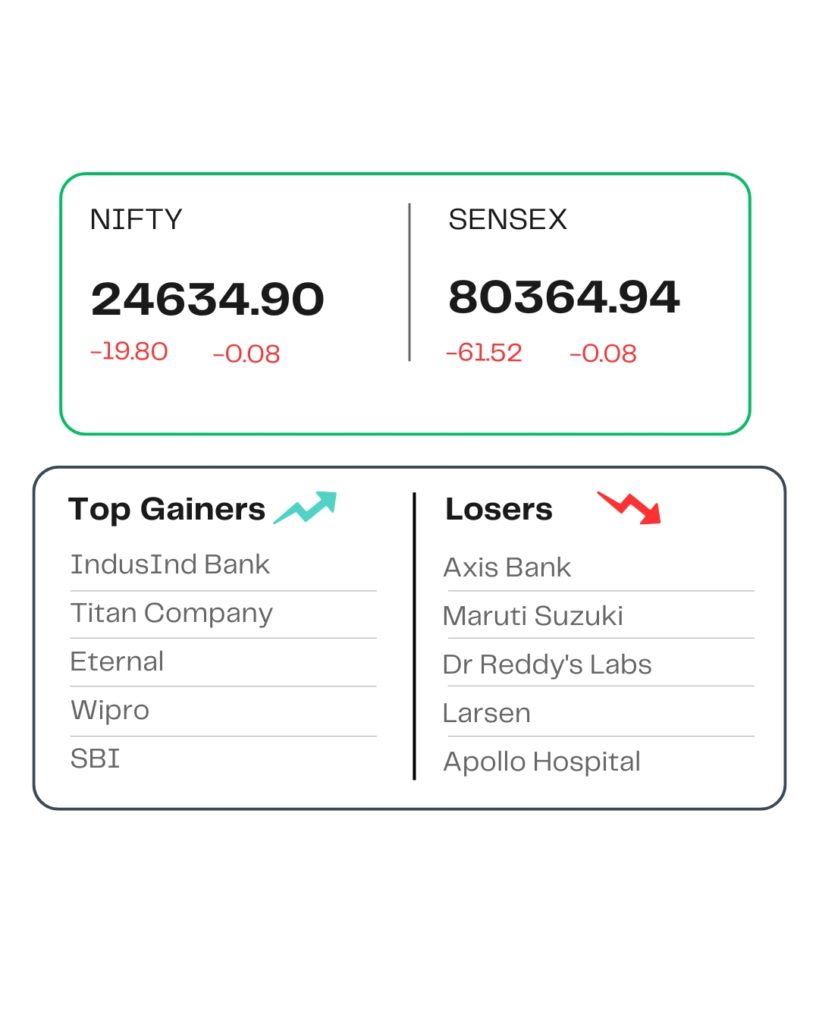

At close, the Sensex was down 61.52 points or 0.08 percent at 80,364.94, and the Nifty was down 19.80 points or 0.08 percent at 24,634.90. About 1837 shares advanced, 2163 shares declined, and 171 shares were unchanged.

Axis Bank, Maruti Suzuki, L&T, Apollo Hospitals, Dr Reddy’s Labs were among the top losers on the Nifty, while gainers were Eternal, Bharat Electronics, IndusInd Bank, Titan Company, Wipro.

Among sectors, oil & gas, PSU Bank, energy, and realty added 1 percent each, while the media index shed nearly 1 percent.

Among the broader market indices, the BSE Midcap index rose 0.3 percent, while the smallcap index went down marginally.

STOCKS TODAY

BEL

Shares of state-owned Bharat Electronics were higher by more than 1 percent, following reports over the weekend that the defence PSU has received the much-awaited Request For Proposal (RFP) from the Indian Army to supply Quick Reaction Surface-to-Air Missiles (QRSAM) for an new air defence system to be inducted as ‘Anant Shastra’ cover.

Wockhardt

Shares of Wockhardt are higher by more than 17 percent, as investors added bets after clarification emerged that US President Trump’s fresh tariff on branded pharma imports will not apply to countries with which America has negotiated agreements – a relief for the European Union and Japan – a move that is expected to help the Indian drugmaker, which has manufacturing facilities in Europe.

Kalyan Jewellers

Shares went down 1.65 per cent as investors remained concerned over the possibility of slowing demand amid record high gold prices. Gold and silver prices have been hitting fresh record highs consecutively for several sessions this month, dodging market volatility.

HUL

Shares of consumer staples giant Hindustan Unilever Ltd (HUL) tumbled in trade on Monday, September 29, after posting a weaker-than-expected business update for the September quarter, with the Goods and Services tax (GST) rationalisation impacting the sales for the period.

Source – Money Control