POST MARKET

The Indian equity indices Sensex and Nifty extended losses by noon after a flat start on Friday amid weak global cues and renewed concerns over US tariffs. The indices ended negatively and kicked off the June derivatives series on a subdued note.

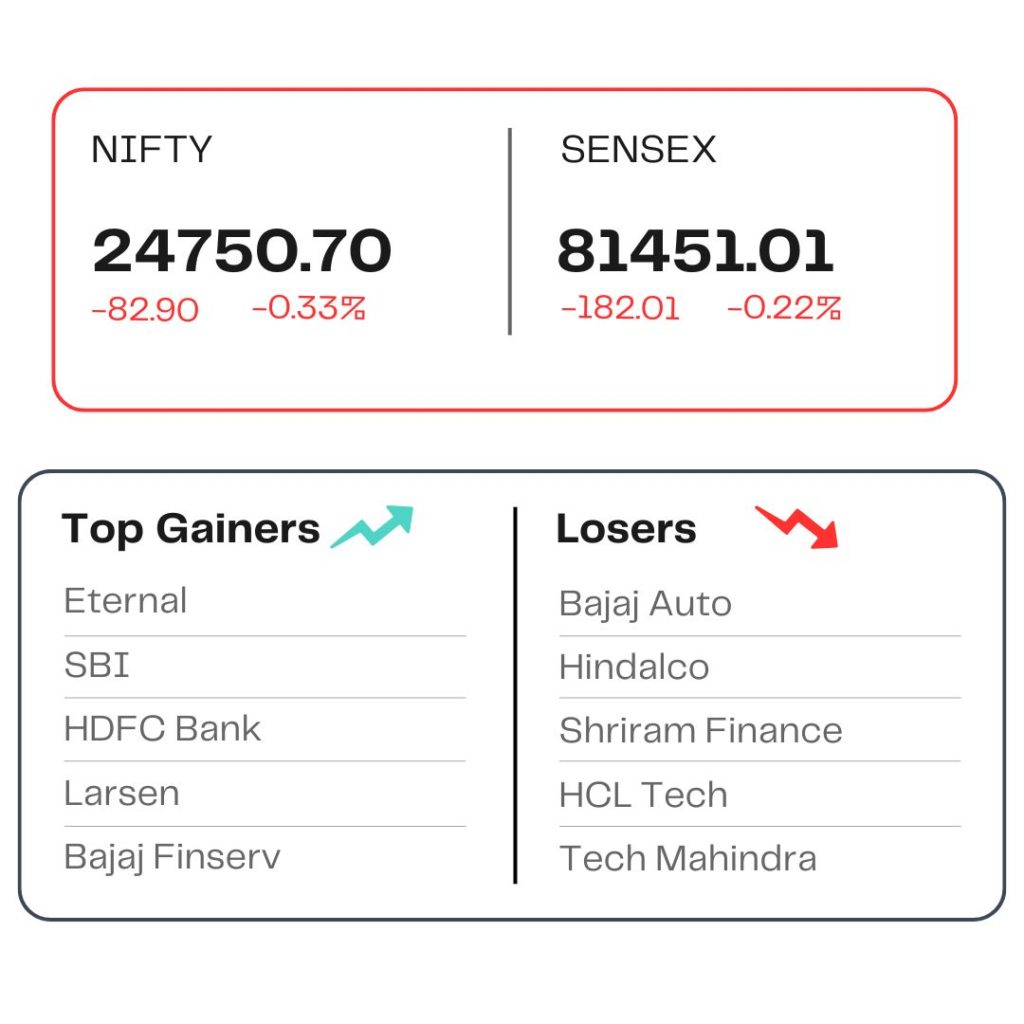

At close, the Sensex was down 182.01 points or 0.22 percent at 81,451.01, and the Nifty was down 82.90 points or 0.33 percent at 24,750.70. About 1,751 shares advanced, 2,087 shares declined, and 114 shares were unchanged.

The biggest Nifty losers were Bajaj Auto, Hindalco, Shriram Finance, HCL Tech, and Tech Mahindra, while gainers included Eternal, SBI, HDFC Bank, Larsen, and Bajaj Finserv.

Sectoral performance was mixed, with PSU banks leading the gains, while private banks saw mild buying interest. On the flip side, metals, automobiles, IT, and media sectors faced selling pressure.

Broader markets showed a mixed performance. While small-cap stocks continued to outperform, mid-cap counters slipped into negative territory.

STOCKS TODAY

Alkem Labs

Shares slipped 3.6 percent after it reported a net profit of nearly Rs 306 crore for the fourth quarter of the financial year 2025. This marks a 4.2 percent rise from the Rs 294 crore net profit reported in the corresponding quarter of the previous financial year. The Mumbai-based pharmaceutical company’s total revenue from operations rose 7.1 percent year-on-year to Rs 3,143.8 crore for the quarter under review.

Suzlon Energy

The firm’s shares jumped nine percent after the renewable energy solutions posted higher-than-expected profit for the quarter ended March 31, 2025. Suzlon Energy reported a 365 percent increase in consolidated net profit to Rs 1,181 crore in the March quarter, mainly due to an exceptional gain boosted by a deferred tax gain of Rs 600 crore.

PNC Infratech

The company’s shares tanked 3.8 percent after it reported a sharp decline in its financial performance for the March quarter, with net profit plunging 81 percent to Rs 75.5 crore from Rs 395.9 crore a year ago. Revenue fell 34.5 percent year-on-year to Rs 1,704 crore, while EBITDA dropped 51 percent to Rs 362 crore from Rs 736 crore. The EBITDA margin also narrowed significantly to 21.26 percent from 28.32 percent in the same period last year.

Ola Electric

Indian electric vehicle manufacturer Ola Electric shares plunged nearly 6 percent on May 30 after the company reported a wider net loss at Rs 870 crore in the fourth quarter of FY25 as compared to a loss of Rs 416 crore a year ago, weighed down by steep discounts and falling sales.

Vodafone Idea

The shares of telecom major Vodafone Idea (Vi) plunged over 3 percent to trade at Rs 6.92 apiece on May 30. The sharp fall in the share price comes ahead of the telecom major’s earnings announcement, which is scheduled for today. The stock has plunged nearly 17 percent in the past six months and over 52 percent in the past year.

Wockhardt

This pharmaceutical company is based in Mumbai, its stock soared 8.6 percent after the company reported a significant narrowing of its net loss for the March quarter (Q4FY25). In Q4FY25, Wockhardt’s net loss narrowed to Rs 45 crore, down from Rs 177 crore a year earlier. The improved bottom line was supported by both revenue growth and a recovery in operational performance.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.