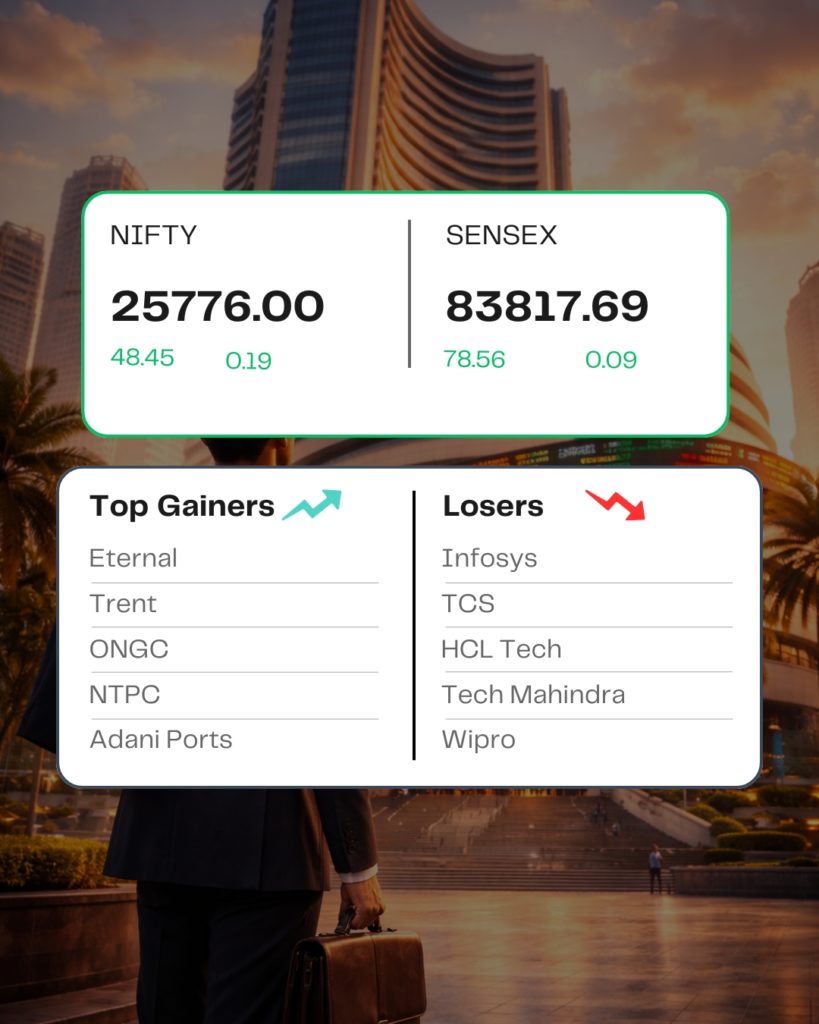

POST MARKET

Indian benchmark indices ended marginally higher in a volatile February 4 session, despite a sharp selloff in IT stocks.

At close,

Sensex ↑ was up 78.56 points or 0.09 percent at 83,817.69,

Nifty ↑ was up 48.45 points or 0.19 percent at 25,776.00.

About 2626 shares advanced, 1413 shares declined, and 143 shares remained unchanged.

Top gainers – ONGC, Eternal, Trent, Adani Ports, and NTPC

Top losers – Infosys, TCS, Tech Mahindra, HCL Technologies, and Wipro

Sectorally, the IT index plunged 6 percent amid AI-led concerns, while auto, energy, consumer durables, PSU, realty, metal, oil & gas, and power advanced 1–2 percent.

Broader markets outperformed, with the Nifty Midcap index rising 0.6 percent and the Smallcap index gaining 1.2 percent.

STOCKS IN NEWS

Bharat Coking Coal

The shares of Bharat Coking Coal ended almost 3 percent lower on February 4 after the company released its results for the October-December quarter of the ongoing financial year 2026. The company reported a net loss of Rs 23 crore for the October-December quarter of the ongoing FY26, as against a net profit of Rs 425 crore in the corresponding quarter of the previous financial year.

HAL

Shares of Hindustan Aeronautics Ltd (HAL) fell almost 6 percent on Wednesday after a report said the state-owned defence major is no longer in the race to develop India’s next-generation stealth fighter jet under the Advanced Multirole Combat Aircraft (AMCA) programme.

Gokaldas Exports

Export-oriented stock Gokaldas Exports ended higher Win ednesday’s trade, rising as much as 20 percent, amid positive sentiment following the India-US trade deal. The stock has risen over 41 percent in the past two sessions.

Info Edge

The shares of the BPO (Business Process Outsourcing) company Info Edge plunged over 5 percent on February 4, amid a broader tech selloff triggered by Anthropic’s launch of a legal tool for its Claude AI chatbot.

Kansai Nerolac Paints

Kansai Nerolac Paints shares lost 2.72 percent on February 3 reported a consolidated net profit of Rs 121.36 crore for the third quarter of the ongoing financial year 2026. This marks an 82 percent YoY fall from the Rs 680.87 crore net profit reported in Q3 FY25.

Source – Moneycontrol