POST MARKET

Indian equity indices erased most of their intraday gains, ending marginally higher amid final-hour profit booking. However, the winning run continued on the sixth consecutive session on October 23 amid hopes over the US-India trade deal.

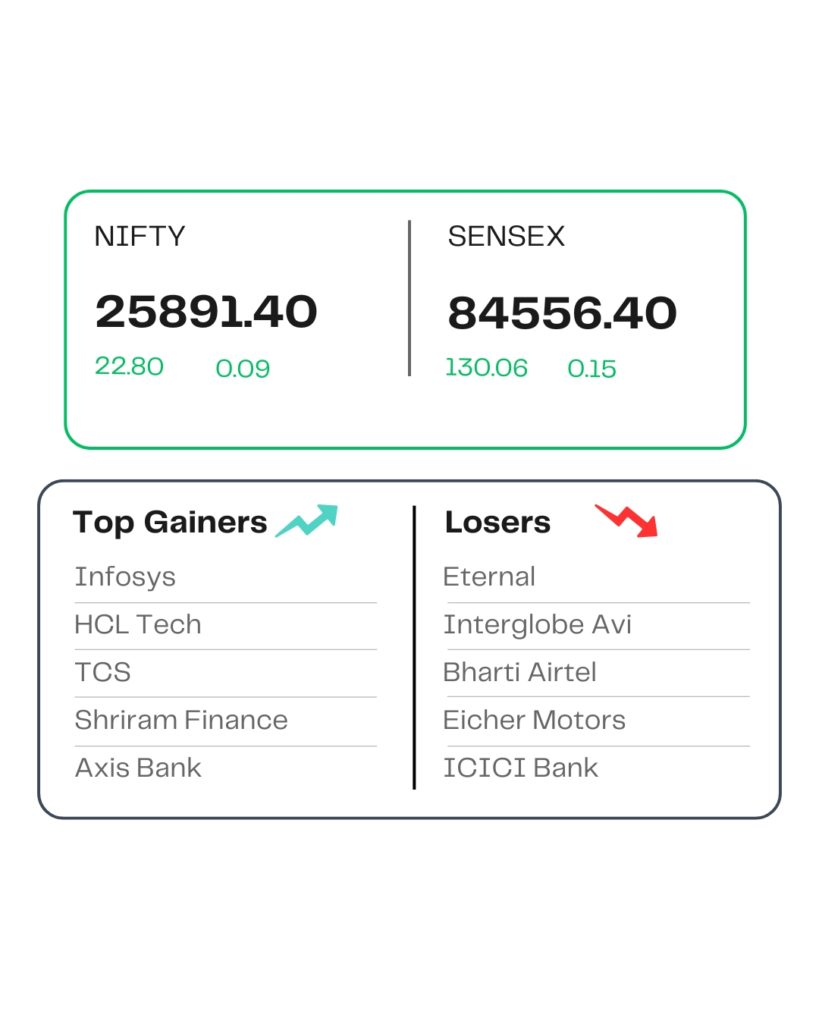

At close, the Sensex was up 130.06 points or 0.15 percent at 84,556.40, and the Nifty was up 22.80 points or 0.09 percent at 25,891.40. About 1692 shares advanced, 2299 shares declined, and 121 shares remained unchanged.

Infosys, HCL Technologies, TCS, Shriram Finance, Axis Bank were among the top gainers on the Nifty, while losers were Eternal, Interglobe Aviation, Bharti Airtel, Tata Consumer, Eicher Motors.

On the sectoral front, the IT index rose 2%, the Private Bank index up 0.5%, while the oil & gas index down 0.6%.

Among the broader market indices, the BSE Midcap index was down marginally, while the smallcap index shed 0.4%.

STOCKS TODAY

Dixon Technologies

The shares of Dixon Technologies extended losses to almost 3 percent on Thursday, and the shares have also declined over three sessions after the company released its results for the second quarter of the financial year 2026.

Varun Beverages

The FMCG major went up 1.27 percent after the company posted a 4 percent year-on-year increase in consolidated net profit for the July-September quarter (Q2 FY26) at Rs 2,694 crore. Revenue from operations rose 2 percent to Rs 16,061 crore, the company said in a regulatory filing.

Infosys

The shares of Indian IT company Infosys went up 3.81 percent, amid rising hopes for a trade deal between India and the US, along with other key factors. The sharp rise in the prices of IT shares pushed the Nifty IT index up more than 2 percent to close at 36,078.65.

KPR Mills

The shares of textile exporter KPR Mills rallied upwards by over 5.5 percent, amid rising hopes for India and the US reaching a trade deal. This would likely result in a reduction in tariffs levied on Indian exports to the US, benefiting the export-oriented sectors significantly.

Epack Prefab

Shares of the company went over 13 percent after the company reported a two-fold jump in its consolidated net profit to Rs 29.46 crore in the second quarter of this fiscal year on higher income.

Source – Money Control