POST MARKET

Indian benchmark indices extended gains from the previous session, supported by positive global cues and broad-based buying across sectors, after the announcement of an interim trade framework with the US that includes a reduction in reciprocal tariffs to 18 percent on several Indian goods.

At close,

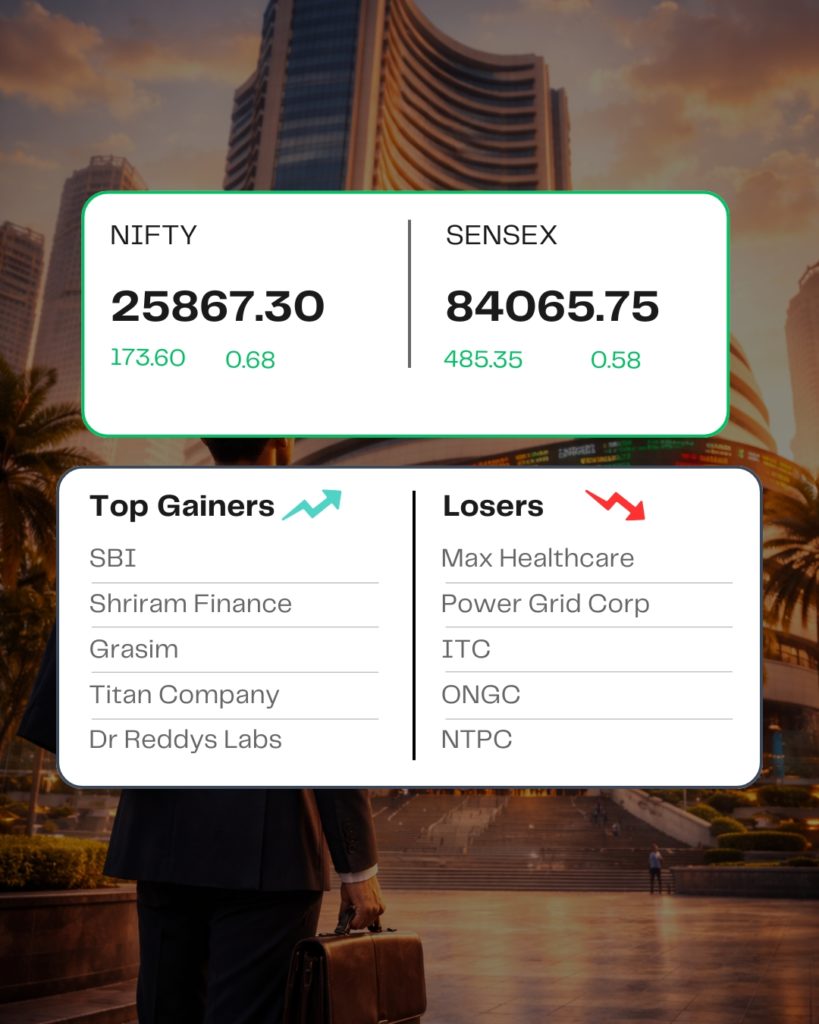

Sensex ↓↑ 485.35 points or 0.58 percent at 84,065.75,

Nifty↑ 173.60 points or 0.68 percent at 25,867.30.

About 3003 shares advanced, 1181 shares declined, and 152 shares unchanged.

Top gainers – State Bank of India, Shriram Finance, Titan, Dr Reddy’s Laboratories, Grasim Industries

Top losers – Max Healthcare, Power Grid Corporation, ITC, ONGC, NTPC.

All the sectoral indices ended in the green with media, consumer durables, realty, PSU Bank, pharma, healthcare, and metal up 1-3%.

Among the broader market indices, the Nifty Midcap index rose 1.6% and the smallcap index added 2.6%.

STOCKS IN NEWS

Goldiam International

The shares of gems and jewellery stock rallied 11.45 percent upwards on February 9 after India and the US announced a framework for their much-awaited interim trade deal agreement, which confirmed that the US reciprocal tariffs on Indian exports of gems and diamonds will be slashed to zero.

SBI

The shares of State Bank of India (SBI) jumped over 7 percent on February 9 after the public lender’s Q3 results surpassed expectations, with a net profit after minority interest of Rs 21,028.15 crore for the October-December quarter of the ongoing financial year 2026. Several brokerages raised their target prices for the stock.

Dynamatic Technologies

Shares of aerospace-linked firm Dynamatic Technologies rose over 10 percent on Monday after India and the US announced an interim trade framework aimed at easing tariff barriers and boosting bilateral cooperation.

Gokaldas Exports

The shares of export-oriented textile stock Gokaldas Exports jumped over 7.5 percent on February 9 after India and the US announced a framework for their much-awaited interim trade deal agreement, which confirmed that the US tariffs on Indian exports would be reduced to 18 percent.

Blue Cloud Softech Solutions

Blue Cloud shares rose 20 percent on Monday after the software products company announced plans to invest up to USD 1 billion in a phased manner to develop AI-native data centre and digital cloud infrastructure across India.

Source – Moneycontrol