POST MARKET

Indian benchmark indices snapped a 3-day gaining streak and ended lower on Friday, amid cautious investor sentiment ahead of the Union Budget scheduled for Sunday, February 1.

At close,

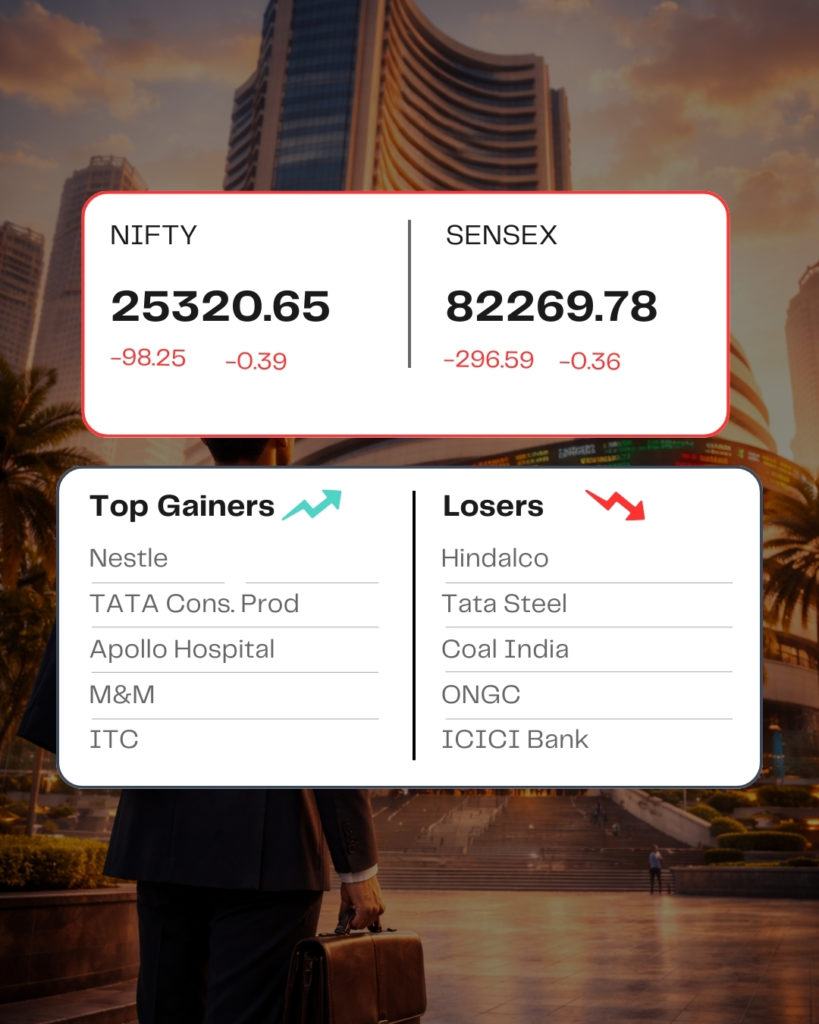

Sensex ↓ – 296.59 points or – 0.36 percent at 82,269.78

Nifty ↓ – 98.25 points or – 0.39 percent at 25,320.65.

About 2319 shares advanced, 1716 shares declined, and 149 shares were unchanged.

Top gainers – Tata Consumer, Apollo Hospitals, Nestle, M&M, ITC.

Top losers – Hindalco, Tata Steel, Coal India, ONGC, ICICI Bank.

Among sectors, the metal index shed 5%, while oil & gas, Banking, IT, and Energy shed 0.5-1%. In contrast, pharma, media, consumer durables, and FMCG rose 0.7-1.8%.

Among the broader market indices, the Nifty Midcap index fell 0.2%, while the smallcap index added 0.3%.

STOCKS IN NEWS

Vedanta

The shares of metals-to-oil conglomerate Vedanta dropped more than 11.5 percent on January 30 after the company released strong results for the third quarter of the ongoing financial year 2026. The fall came amid a broader downturn in metal stocks, buoyed by profit booking, falling metal prices, and speculation of a hawkish Federal Reserve Governor. Brokerages have mixed views on the stock.

GRSE

Garden Reach Shipbuilders & Engineers Ltd (GRSE) shares rose 6.81 percent, along with other defense shares, on Friday, as the sectoral index logged its biggest weekly gain since May 2025, amid expectations of higher capital outlay in the upcoming Union Budget on February 1.

Muthoot Finance

Shares of gold loan financier Muthoot Finance fell 6.68 percent on Friday, tracking a sharp decline in gold and silver prices amid profit booking after a recent record rally. The share closed at Rs 3818.00 per share.

Hindustan Zinc

The shares of Hindustan Zinc tumbled nearly 13 percent on January 30 as silver prices crashed after a record rally. The sharp fall in global prices of the precious metals comes amid speculations that the US Federal Reserve may get a more hawkish chair.

Nestle India

Nestle India shares went down almost 3.5 percent as the company reported a strong set of earnings for Q3 FY26, posting record quarterly sales and a sharp rise of over 46 percent in profit. The FMCG major also announced an interim dividend of Rs 7 per share for the financial year 2025-26.

Source – Moneycontrol