POST MARKET

Indian equity indices snapped a two-day fall with Nifty closing above 25,000 in a volatile session on July 21 that saw leadership from auto, realty, metal, and private banks.

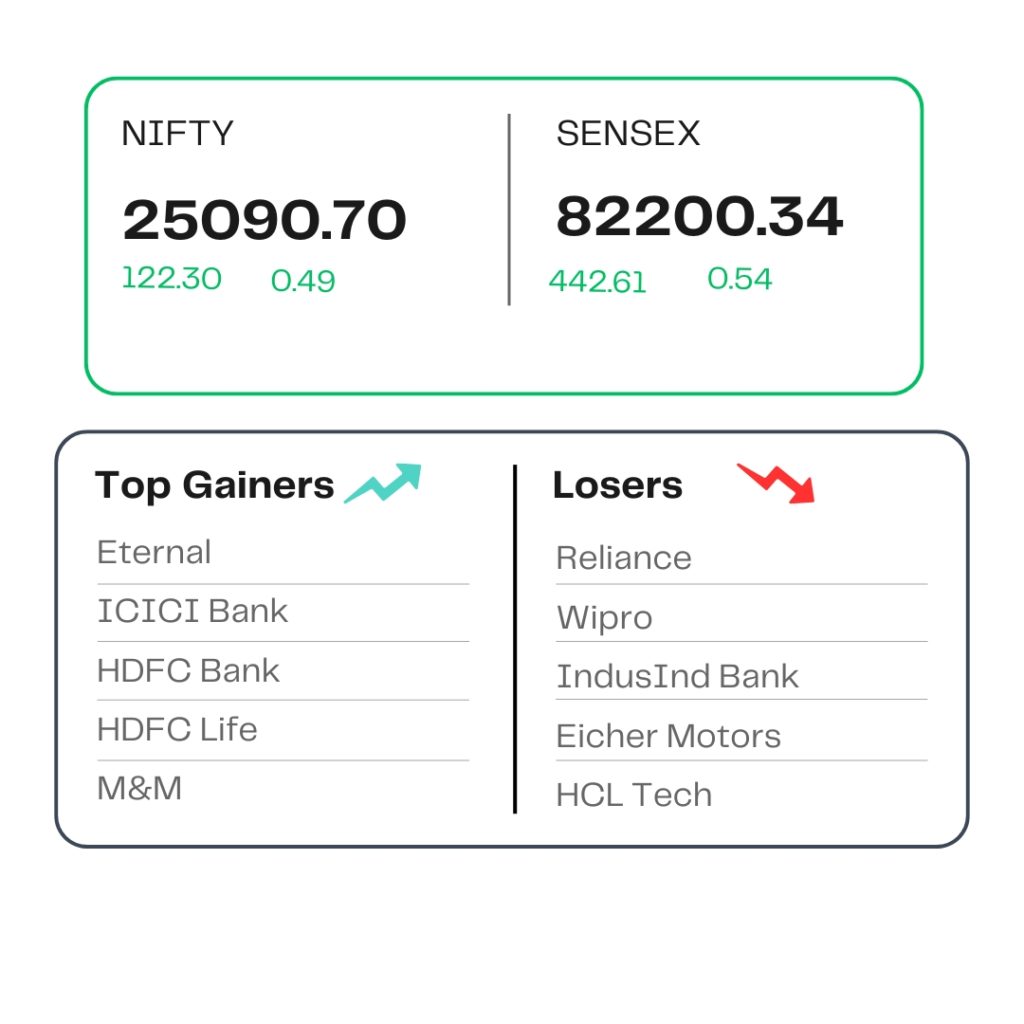

At close, the Sensex was up 442.61 points or 0.54 percent at 82,200.34, and the Nifty was up 122.30 points or 0.49 percent at 25,090.70. About 1883 shares advanced, 2101 shares declined, and 168 shares remained unchanged.

On the sectoral front, auto, capital goods, private bank, power, realty, and metal up 0.5-1 percent, while IT, PSU Bank, oil & gas, and FMCG down 0.4-1 percent.

Eternal, ICICI Bank, HDFC Bank, HDFC Life, and M&M were among the major gainers on the Nifty, while losers were IndusInd Bank, Reliance Industries, Wipro, HCL Tech, and Eicher Motors

Among the broader market indices BSE Midcap index rose 0.5 percent, while the Smallcap index ended flat.

STOCKS TODAY

Eternal

The shares of the parent company of Zomato gained 7.5 percent to close at Rs 276.50 apiece on NSE. This followed positive management commentary. The company reported a 90 percent year-on-year (YoY) decline in quarterly profit after tax (PAT) at Rs 25 crore in the first quarter (Q1) of financial year 2025-26 (FY26), down from Rs 253 crore in the same period a year ago. Its revenue from operations rose 70.4 percent YoY to Rs 7,167 crore in Q1, up from Rs 4,206 crore a year ago. It had reported a revenue of Rs 5,833 crore in the previous quarter.

HDFC Bank

India’s largest private lender HDFC Bank’s shares rose 2% after the lender reported a 12 percent jump in net profit for the quarter ended June 30, 2025. Brokerages rushed to hike their target prices on the bank, expecting stronger growth in the second half of the current fiscal year. HDFC Bank posted a standalone net profit of Rs 18,155 crore for the quarter ended June 2025, marking a 12 percent rise from Rs 16,175 crore in the same period last year. Interest income for the quarter came in at Rs 77,470 crore, reflecting a 6 percent increase over the previous year.

Laxmi Dental

Shares of Laxmi Dental Ltd rallied 4 percent as the six-month lock-in period for certain pre-IPO shareholders ended today, freeing up a significant chunk of equity for potential trade. According to analysis by Nuvama Alternative & Quantitative Research, nearly 2.06 crore shares—or about 37 percent of the company’s outstanding equity—are set to become eligible for trading following the expiry of the lock-in. While these shares can now be sold in the open market, it does not necessarily mean that they will be, as the decision ultimately lies with the shareholders.

IRCON

IRCON shares jumped more than 2 percent after the company’s joint ventures received a project worth a total value of Rs 755.78 crore. Rail Vikas Nigam Limited (RVNL) has awarded a Letter of Award for the project to the joint ventures of the company with JPWIPL (i.e., IRCON – 70% & JPIWL – 30%).

Source – Money Control