Intraday Trading with Flattrade: Unlock Your Potential upto 5X Leverage

Intraday trading, or day trading or MIS stands for the Margin Intraday square-off., is the most common trading option among retail traders who want to take advantage of short-term price movements. You may be seasoned trader or beginner, the brokerage house you opt for can be the determining factor – not only for profits but also for your trading experience as such.

If you are engaged in intraday trading or looking to get into it, then Flattrade is a name that is worth checking out. Here’s why.

What Is Intraday Trading?

Intraday trading is a process of buying and selling stocks or contracts in the same trading session. The objective is to make profits out of small price changes during the day. Unlike delivery trades where you retain the stock after more than a day, intraday trades need to be squared before the market closes at the end of the day.

Why Flattrade is Unique for Intraday Traders?

There are many dozens of brokers available in India, but Flattrade is making a name for itself with some special features that directly attract intraday traders.

Zero Brokerage on Intraday:

- In Intraday, usually trades are placed multiple times in order to gain from the stock price movements. If each time brokerage is charged, imagine the amount of money that you need to spend alone on the brokerage. But with Flattrade, no brokerage, hence no extra deduction other than the exchange, government charges and taxes. The money gained is completely yours alone.

5X Leverage on Intraday Trades:

This is where it gets interesting for day traders.

- Flattrade provides upto 5X leverage on chosen intraday trades, which means that you can trade as much as 5 times what the amount you hold in your account. Suppose you hold ₹10,000 in your trading account. You can trade positions of value upto ₹50,000.

- This increases your profit potential – but keep in mind, leverage is a double-edged sword. Your profits can increase, but so can your losses. Risk management is vital.

Who Can Use Intraday Leverage?

- Skilled traders familiar with technical analysis and market trends

- Scalpers who trade frequently throughout a day

- High-volume traders who prefer to earn maximum returns with minimal capital

- If you’re new to intraday trading, Flattrade is a great advantage platform for you. You can use different options such as StopLoss, Trailing stop loss to monitor your losses and gain knowledge without having to pay any brokerage fee

- Tools & real time support from us

Flattrade is not just about leverage. Our platform features,

- Quick order execution

- Real-time charts and analytics

- There are other Intraday products too such as MIS, Cover order/ Bracket order and MTF.

- Web and mobile trading apps

- Strong support during trading hours

- With our zero-delivery brokerage model, these features make it one of the most cost-effective and performance-friendly solutions in the Indian market.

To take full advantage of the 5X leverage, consider these tricks:

- Trade tight spread liquid stocks/contracts

- Always have a stop-loss to safeguard capital

- Avoid tip-based or rumour-based trading

- Back test your strategy prior to going live with high leverage

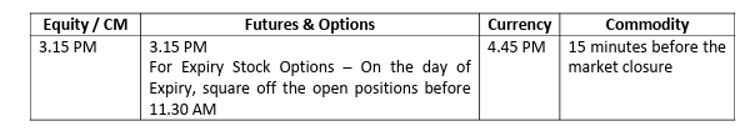

Intraday square-off timing:

Last Thoughts:

Intraday trading provides the thrilling chance to increase your capital on a daily basis — but only with the discipline and appropriate tools. Flattrade’s 5X leverage option provides the competitive advantage you require to make the most out of possibilities without bearing excessively high costs.

If you are in need of a trusted and registered platform that comes with speed, reliability, and affordability, Flattrade is your best partner in your intraday adventure.

Sign up today from the below link to embark on your Intraday adventure,