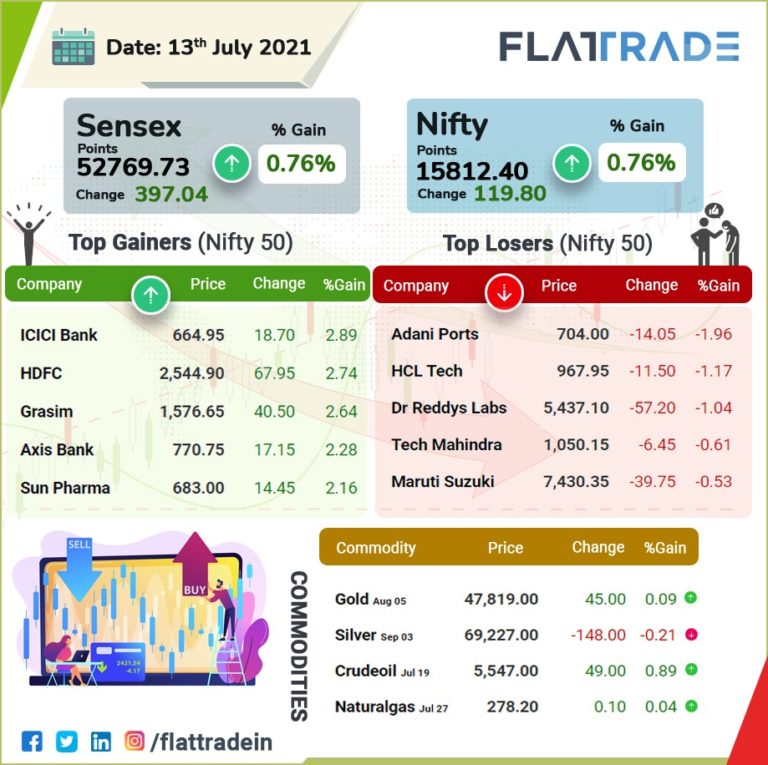

The Indian market Sensex, Nifty end almost a percent higher; mid, smallcaps underperform. Sensex gains by 397.04 points to 52,769.73. The Nifty gains by 119.75 points to 15,812.35.

Indian rupee ended near the day’s low at 74.49.

Shares on News Today

Ashoka Buildcon: It has received Letter of Acceptance (LoA) from National Highways Authority of India (NHAI) for Rs.726 crore

FDC: The company launch of India’s first oral suspension of Favipiravir – Favenza Oral Suspension, used to treat mild to moderate cases of COVID-19. This prescription-only solution is currently available at all retail medical outlets and hospital pharmacies across the country.

Ceat: The company has tied up with Tata Power to establish a 10MW captive solar plant at the latter’s Solapur site for powering its tyre manufacturing facility in Bhandup (Mumbai).

NMDC: The Board of Directors of NMDC, at its meeting held on July 13, 2021, has approved the Scheme of Arrangement for Demerger between NMDC Ltd and NMDC Steel Limited and their respective shareholders.