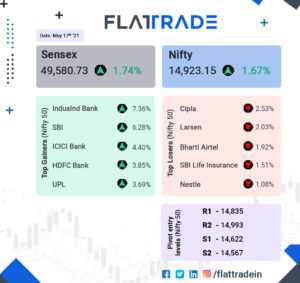

Market Analysis 17-05-2021

Domestic equity markets began trading with gains on Monday morning. S&P BSE Sensex was in the green hovering around the 49,000 mark while the Nifty 50 index was above 14,700. On opening, Larsen & Toubro and State Bank of India were the top index gainers. Banking and Finance sector stocks were surging higher with the Nifty Bank index gained 1% while the Nifty PSU Bank index jumped 1.4%. Broader markets were trading with gains. India VIX, the volatility index slipped earlier but recouped some losses as the trading progressed.

Top Stories of the day:

Krsnaa Diagnostics: Krsnaa Diagnostics filed draft papers with the market regulator Securities and Exchange Board of India (Sebi) for an initial public offering (IPO). The public issue comprises a fresh issue of equity shares worth Rs 400 crore and an offer-for-sale (OFS) of 94 lakh equity shares of a face value of Rs 5 per share by existing shareholders and promoters.

Indo Count Industries: Indo Count Industries’ Q4 consolidated net profit was at Rs 57.9 crore versus Rs 7.9 crore and revenue was up 65.8% at Rs 705 crore versus Rs 425 crore, YoY. Indo Count Industries was quoting at Rs 153.00, up Rs 4.20, or 2.82 percent on the BSE.

Shilpa Medicare: Shilpa Medicare share price jumped 13 percent in the early trade on May 17 after the company entered into a three-year agreement with Dr Reddy’s Laboratories Limited (DRL) for the production of Sputnik V vaccine for coronavirus.

Closing bell:

Sensex and Nifty clock strong gains. Buying interest in FMCG and bank stocks. Selling pressure in metal and pharma counters. Fear gauge VIX eases 4%. UPL top Nifty50 gainer, up 5%. IndusInd Bank, SBI, ICICI Bank and Adani Ports among other top performers. L&T top loser, down 3%. Cipla, Bharti Airtel, NTPC and Titan among other laggards. Analysts await more Q4 earnings for cues.