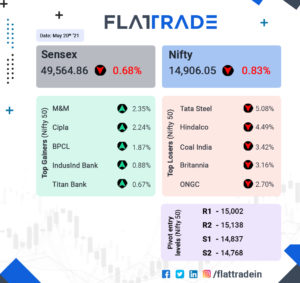

Domestic markets closed with losses for the second day straight. S&P BSE Sensex ended 337 points lower at 45,564 while the Nifty 50 index was down at 14,906. Among the top drags on Sensex were ONGC, Sun Pharma, and Power Grid. Mahindra & Mahindra, IndusInd Bank, and Titan were the top gainers. Metal stocks were down along with banking names. HDFC Bank, ICICI Bank, and Axis Bank all closed with losses. Broader markets mirrored the fall, except some smallcap indices. India VIX, inched higher but closed below 20 levels.

Top Stories of the day:

Hindalco: Hindalco the country’s largest aluminium manufacturer, is likely to report a 78 per cent year-on-year jump in consolidated net profit to Rs. 1,194.2 crore for the quarter ended March.

TCI Express: TCI Express on Wednesday reported a 123.9 per cent rise in net profit at Rs 42.57 crore for the quarter ended March 31. The company had posted a net profit of Rs 19.01 crore in the year-ago period, TCI Express said in a filing to the BSE.

Cipla: Drug major Cipla on Thursday announced the commercialisation of its RT-PCR test kit ‘ViraGen’ for COVID-19 in India, in partnership with Ubio Biotechnology Systems.

Closing bell:

Sensex and Nifty closed in the red for the second day straight today. Nifty gave up 15,000 on closing bell, Broader markets followed. Sensex traded 350 points lower ahead of the closing bell. Nifty is at 14,900. Index heavyweights such as HDFC Bank, ICICI Bank, and Relaince Industries are the biggest contributors to the fall.