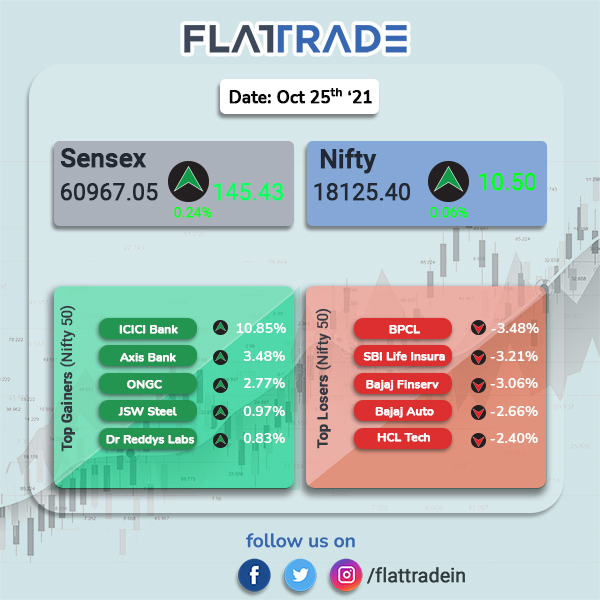

Benchmark Indian indices closed slightly higher as banking and financial services stocks gained. The Sensex was 0.24% higher at 60967.05 and Nifty was nearly flat gaining just 0.06% to close at 18125.40.

Nifty Bank index was up 2.15% and Financial Services closed 1.33% higher. Top loser were Auto (-1.80%), IT (-1.1%) and FMCG (-0.99%).

Indian rupee fell 19 paise to close at 75.08 against the US dollar.

Stock in News Today

Reliance Industries: The telecom arm of the company Jio has unveiled JioPhone Next ahead of Diwali. The phone comes with Pragati OS and the company said the Qualcomm processor on the smartphone will deliver optimised connectivity and performance. The company comes with a host of features like voice assistant, smart camera, automatic software upgrade, long battery life, etc.

Colgate-Palmolive: The company’s consolidated revenue rose 16% to ₹1,343.96 crore, from ₹1,157.86 crore in the previous April-June quarter. Its net income was up 15.38% to ₹269.17 crore, from ₹233.23 crore in the preceding quarter. The total costs for the company spiked to ₹998.05 crore in the September-ended quarter, from ₹856.99 crore in the previous quarter. The company has declared an interim dividend of ₹19 per equity share for the FY22. The record date for the interim dividend is November 2.

Coforge: Shares plunged over 12% in intraday trading after the IT services company posted results but pared its losses and closed 6.1% lower than previous day’s close. Revenue from operations rose to ₹1569.4 cr in Q2FY22 from ₹1153.7 cr in Q2FY21. Net operating profit increased o ₹161.5 cr from ₹122.2 cr in the year-ago period. The company’s board recommended an interim dividend of ₹13 per equity share.

TVS Motor: The two-wheeler maker has signed a tri-party deal with Bahwan International Group, and its subsidiary ARATA International distributor for TVS Motor in Iraq. Bahwan and their channel partners plan to operate more than 30 dealerships for TVS Motor. Sudarshan Venu, joint managing director, TVS Motor, said that Iraq is an important market for the company, and ARATA International FZC’s extensive distribution network makes the Indian major an ideal strategic partner.

Tatva Chintan: Shares of the company rose 16% in intraday trading after it posted robust results in second-quarter of FY22. Its consolidated net profit rose nine times to ₹32.41 crore in Q2FY22, from ₹3.56 crore in the year-ago period. Operating revenue rose to ₹123.62 crore in the quarter, from ₹60.04 crore in the corresponding period last year.

Ramco Cements: The company posted a revenue from operation at ₹1453.08 crore in Q2FY22, from ₹1216.71 crore in the year-ago period. Net profit after tax rose to ₹519.12 crore from ₹238.92 crore.

CSB Bank: The Kerala-based lender registered a 72.1% year-on-year growth in standalone profit at ₹118.6 in Q2FY22 as asset quality improved during the period. The private-sector bank has reported a profit of ₹68.9 crore in the year-ago period. Net interest income grew 21.4% year-on-year to ₹278.4 crore. Advances increased to ₹14,070.11 crore during the quarter, up 12.22% from ₹12,537.61 crore in the same quarter last year. Deposits grew by 9.1% to ₹19,055.49 crore in Q2FY22.