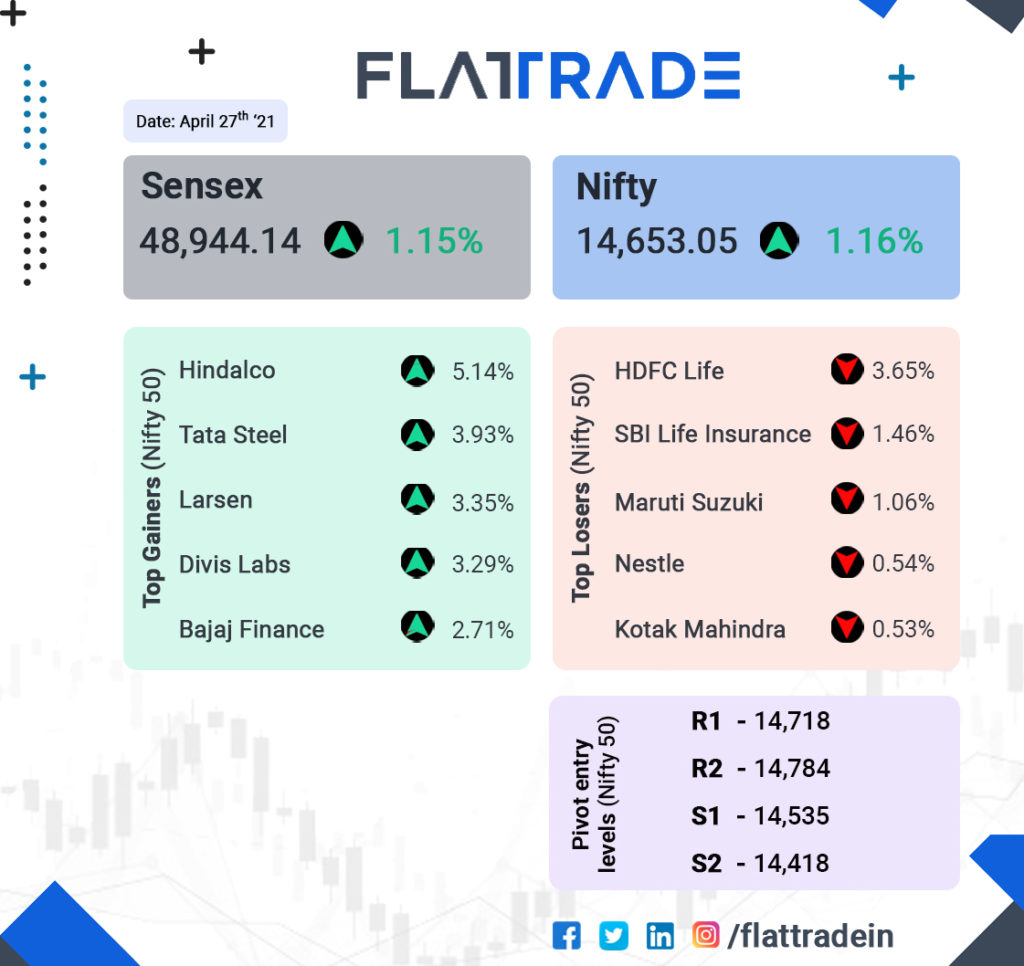

Market Analysis 27-04-2021

The market today began with Sensex gaining over 150 pts and Nifty topping 14500. As the market moved, Nifty continued to stay above 14500 and ended at 14,653.05. IT and pharma stocks increased while banks and financials made the top drags.

Top Stories of the day:

Maruti: Today reported a near 10 per cent year-on-year fall in net profit to Rs 1,166 crore for the quarter ended March. The company’s sales, however, soared 33.6 per cent on-year to Rs 22,958.6 crore.

ICICI Pru Life: Shares fall 3.14 per cent in Tuesday’s trading session despite the benchmark Nifty ruled at 14633.75, up 148.75 points. The company reported 65.03 per cent YoY de-growth in net profit at Rs 62.51 crore for the latest quarter.

Berger Paints: Shares of Berger Paints (India) Ltd. fell 1.29 per cent to Rs 712.9 in Tuesday’s session though the equity benchmark Sensex traded 481.49 points higher at 48868.0. The promoters held 149.96 per cent stake in the company as of April 27, while FII and MF ownerships stood at 22.48 per cent and 1.64 per cent, respectively.

Gateway Distriparks: The company’s consolidated net profit rose to Rs 46.1 crore in the quarter ended March 2021 against Rs 11.1 crore, while revenue was up 17.1% to Rs 350.3 crore versus Rs 299.1 crore in the year-ago. The company has declared an interim dividend of Rs 5 per share.

Jindal Power and Steel: Said its board has approved divesting its entire equity interest in Jindal Power to Worldone, a promoter group company, for Rs 3,015 crore. The board of directors of JSPL has approved the divestment of its entire equity interest (representing 96.42 per cent of the issued and paid up capital) in Jindal Power by way of sale of shares, to Worldone Pvt Ltd

Closing bell:

Nifty 50 began with positive numbers beyond 14500 and ended green at 14,653.05 on Tuesday. Nifty IT and pharma drove the market while Nifty bank stocks sunk into the negative zone. The new shares began to fall beyond the issue price, concerning the IPO investors.