Market Analysis 23-04-2021

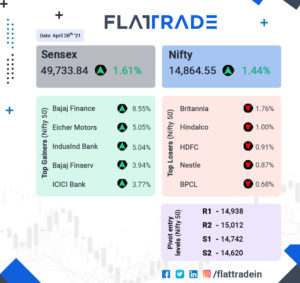

Nifty reclaims 14,800 while Sensex zooms 700 pts and tops 49,600. The market hiked in green all day, with Nifty ending green at 14,864.55. Nifty bank and Nifty Auto sectors made the major gainers including Bajaj Finance, Bajaj Auto, M & M, Indusind bank, SBI and Bharati Airtel. Today was a fine upcurve for almost every sector, trading in green.

Top Stories of the day:

Zomato: Zomato will raise Rs 8,250 crore, of which Rs 7,500 crore will be a fresh issue, while another Rs 750 crore will be an OFS by Info Edge. The company has strengthened its position in the two-player food delivery market with the latest round of funding coming in February this year. Zomato received $250 million in its latest investment round at a post-money valuation of $5.4 billion, Info Edge had said in an exchange filing.

PowerGrid: PowerGrid Infrastructure Investment Trust (InvIT) IPO will open for subscription tomorrow, making it the first InvIT to be sponsored by a state-run firm. PowerGrid InvIT is looking to raise Rs 7,735 crore through the issue which will include a fresh issue as well as an offer for sale (OFS) of existing units. PowerGrid InvIT would become only the third InvIT to be listed on the bourses after IndiaGrid Trust and IRB InvIT, both trading on BSE and NSE since 2017.

SBI: SBI board approves to raise $2 bn through bonds in FY22. To examine the status and decide on long term fundraising in single/multiple tranches up to US$ 2 Billion (US$ Two Billion), through a public offer and/or private placement of senior unsecured notes in US Dollar or any other convertible currency during FY 2021 -22.

Bajaj Finance: Shares of Bajaj Finance gained over 7 per cent on Wednesday after the company reported a 42 per cent jump in consolidated net profit for the fourth quarter of the fiscal ended March 2021. It jumped 7 per cent to Rs 5,215.20 on the BSE.

TVS Motor Shares: Shares of TVS Motor Company on Wednesday jumped over 17 per cent after the company posted nearly four-fold increase in its consolidated net profit for the fourth quarter ended March 31, 2021.

Closing bell:

Nifty 50 began with positive numbers beyond 14600 and ended green at 14,864.55 on Wednesday. Nifty Bank and Nifty Auto drove the market. Almost every sector traded in green and ended positive today. Out of NSE stocks, 1117 stocks advanced, 550 declined while 67 remained unchanged.