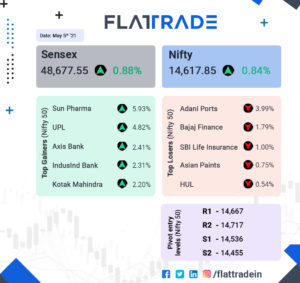

Market Analysis 05-05-2021

Sensex and Nifty ends green following RBI Governor’s speech.

Though Sensex and Nifty had a slow start, the RBI Governor’s speech on monetary measures to tackle Covid-19 wave 2 gave a head start. Sensex ends 424 points high and Nifty hits above14,600. Nifty bank and Nifty pharma shines moving the market up after the monetary measures announcement.

Top Stories of the day:

Zomato IPO: Zomato

has set the ball rolling for its much-awaited initial public offering (IPO) after

it filed the DRHP earlier last week. But, the papers filed with SEBI reveal

that till the end of 2020, Zomato has not managed to turn profitable. Although

retail investors have been eagerly waiting for the Zomato IPO, the company’s

inability to record profits will lead to the retail portion of its issue being

capped at not more than 10%, leaving individual investors with only a small

piece of the pie.

Bajaj Allianz:

For the quarter ended March, net

income declined by 10.3 per cent to Rs 277 crore, from Rs 303 crore, while

gross written premium grew 5 per cent to Rs 2,787 crore, from Rs 2,655 crore.

Lupin: The

shares traded 2.93 per cent up at Rs 1088.25 as a result of the RBI’s

announcements in favor of pharma sector.

Closing bell:

As the Sensex and Nifty were expected to hit green in the

pre-market, RBI’s announcement has made a drastic change in the share prices.

The positive measures for banks and pharma industry have spiked the prices,

leading to a green ending.