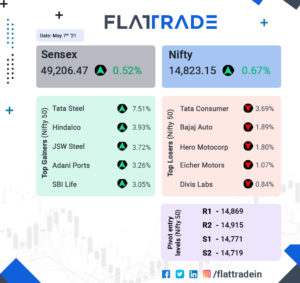

Market Analysis 07-05-2021

Sensex and Nifty extend gains to third day in a row. Strong buying interest in metal stocks. Financial services shares also in demand. Tata Steel rises 8% to record high; top gainer in Nifty50 universe. Hindalco, JSW Steel, Adani Ports and SBI Life among other top performers. Tata Consumer top laggard, down 4%. Hero MotoCorp, Bajaj Auto, Eicher Motors and UPL among top losers.

Top Stories of the day:

Tata Steel: Tata Steel price hits high on the record and surges 8%. The company on Wednesday reported a 250 per cent on-year rise in consolidated EBITDA to Rs 142 bn (its highest ever) on the back of higher steel prices. Tata Steel stock price surpassed its high of Rs 1,128.80 apiece, touched in the previous session

Nuvoco Vistas: Nirma group cement company Nuvoco Vistas Corporation Ltd has filed a draft red herring prospectus with capital markets regulator SEBI to launch an IPO worth Rs 5,000 crore

JSW Steel: JSW Steel said in view of the steadily increasing demand for electric power, the growing adoption of renewable energy and the electrification of automobiles, continued growth is forecasted in India and globally for grain-oriented electrical steel sheets primarily used in transformers.

Closing bell:

Sensex and Nifty ended in green for the third day in the row. Nifty Bank and Nifty Financials made the top gainers while the Nifty Motors and other stocks dragged the market by making the top losers.