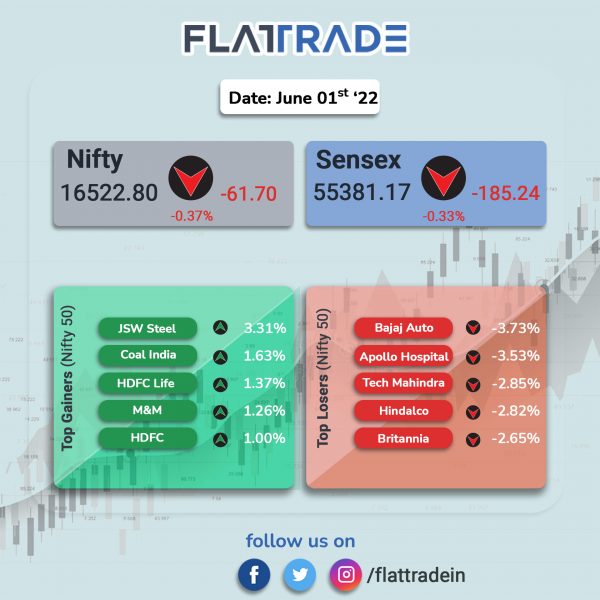

Benchmark indices ended lower in a volatile trading session due to worsening geopolitical situation in Europe and weighed by IT as well as pharma stocks. The Sensex fell 0.33% and the Nifty dropped 0.37%.

Broader markets performed better than headline indices. The Nifty Midcap 100 inched up 0.04% and BSE Smallcap gained 0.62%.

Top losers in Nifty sectoral indices were IT [-1.41%], Pharma [-1.27%], Realty [-1.12%], Media [-0.75%] and FMCG [-0.72%]. Top gainers were PSU Bank [0.7%], Bank [0.38%] and Private Bank [0.32%].

Indian rupee fell 11 paise to 77.51 against the US dollar on Wednesday.

S&P Global Manufacturing PMI stood at 54.6 in May 2022 compared with 54.7 in April 2022. The survey pointed to a sustained recovery across the manufacturing sector. However, output prices increased at a faster pace.

Gross GST collections for May stood at Rs 1,40,885 crore. This is the third consecutive month where collections have remained above Rs. 1.4 lakh crore

Stock in News Today

Tata Motors: The automaker has achieved a total sales of 76,210 units in month of May 2022 compared to 26,661 units in May 2021, registering a growth of 185.8%. Total sales comprise of domestic sales of 74,755 units, higher by 204% over May 2021.

The company sold 31,414 commercial vehicles, up 235% YoY and 43,341 passenger vehicles, higher by 185% YoY in the domestic market. The company posted 626% growth in electric passenger vehicle sales of 3,454 units in May 2022 over May 2021.

Maruti Suzuki India (MSI): The company said its total wholesales in May 2022 stood at 1,61,413 units. The company had sold 46,555 units in May 2021. The company said sales in the compact segment, including models such as Swift, Celerio, Ignis, Baleno and Dzire, stood at 67,947 units in May 2022.

HDFC: The NBFC has increases its Retail Prime Lending Rate (RPLR) on housing loans by 5bps, with effect from June 1, 2022, according to its regulatory filing.

Aditya Birla Group: The group announced the formal launch of its new ‘House of Brands’ entity– TMRW, which is in line with the group’s strategy to launch and back new-age digital ventures. TMRW will create India’s largest portfolio of disruptor brands in the fashion & lifestyle space and enable the next phase of direct-to-consumer (D2C) growth in India, which is poised to be $100billion market by 2025, the company said in a release.

Bajaj Auto: The company reported nearly flat sales for the month of May at 275,868 units. The two- and three-wheeler manufacturerhad sold 271,862 units in May 2021. Due to chip shortage, premium motorcycles above 150cc are having a waiting period of nearly 15 days.

VST Tillers Tractors: The company’s total sales jumped 36.33% to 3,628 units in May 2022 from 2,661 units sold in May 2021. Sequentially, the company’s total sales rose 27.65% in May 2022 from 2,842 units sold in April 2022.

NTPC: The public sector enterprise has named Renu Narang, Executive Director (Finance) as Chief Financial Officer with immediate effect. She succeeds Anil Kumar Gautam, whose term came to an end of May 31, 2022. Renu Narang has over 34 years of experience in Finance, with a career spanning over areas of international finance, budgeting, financial concurrence, investor services, treasury and commercial and regulatory issues.

Punjab National Bank (PNB): The state-owned bank raised its marginal cost of funds-based lending rate (MCLR) by 15 basis points across all tenures. This will lead to an increase in EMIs for borrowers. The new rates are effective from June 1, PNB said in a regulatory filing. With the revision, one-year MCLR has risen to 7.4% from 7.25% earlier.

Vedant Fashions: Brokerage firm ICICI Securities initiated coverage of the stock, citing first-mover advantage, scale efficiences and no discounts on flagship brand Manyavar. ICICI Securities called Manyavar a ‘category leader’ and ‘brand of first recall’ which enjoys significantly higher gross margin compared to most other listed brands. ICICI Securities has set a target price at Rs 1,200 apiece.

Bank of Baroda (BoB): The state-owned bank recommended a revised dividend at Rs 2.85 per equity share (of face value Rs 2) for the FY22. Earlier on May 13, the board of Mumbai-based public sector lender had recommended dividend at Rs 1.20 per equity share for FY22. The dividend payment is subject to shareholders approval at the annual general meeting.

Natco Pharma: The company has launched the first generic version of Nexavar (Sorafenib) Tablets in 200 mg strength in the U.S. market. The product will be launched by NATCO’s commercial partner Viatris, a global pharmaceutical company.

Meanwhile, brokerage firm Nirmal Bang Institutional Equities has upgraded the stock to ‘buy’ from ‘accumulate’, citing valuation comfort and revenue growth from Revlimid. It has given a new target price of Rs 822, down from earlier target price of Rs 936 per equity share.

PNC Infratech: The construction company has signed a concession agreement between National Highways Authority of India and an SPV incorporated by PNC Infratech for construction of a six lane greenfield highway in Karnataka. The bid project cost is Rs 1,575 crore and the length of the highway is 71 kilometres. The project is expected to be completed in 30 months and operated for 15 years, post construction.

Aurobindo Pharma: Brokerage firm ICICI Securities has given a buy call on the company with a target price of Rs 649 apiece. The brokerage firm remains positive on Aurobindo’s long-term outlook considering its strong US pipeline, potential unlocking of injectable business, significant balance sheet improvement and investments in new segments for future growth such as domestic formulation, biosimilars, vaccines, APIs, etc.

VA Tech Wabag: The company has secured an Engineering and Procurement order worth about 18 million euros (about Rs 149 Crore) from DL E&C CO., Korea, towards a Water treatment package for the EuroChem Methanol Production facility in Kingisepp, Russia. The project is scheduled to be completed over a 15 month period.

Zuari Agro Chemicals: The company has completed the sale of its fertiliser plant at Goa and the associated business to Paradeep Phosphates on a slump sale basis.

Rail Vikas Nigam: The company has been awarded a contract by Northeast Frontier Railway for construction of single-kline BG tunnel . The estimated project cost is Rs 560 crore.