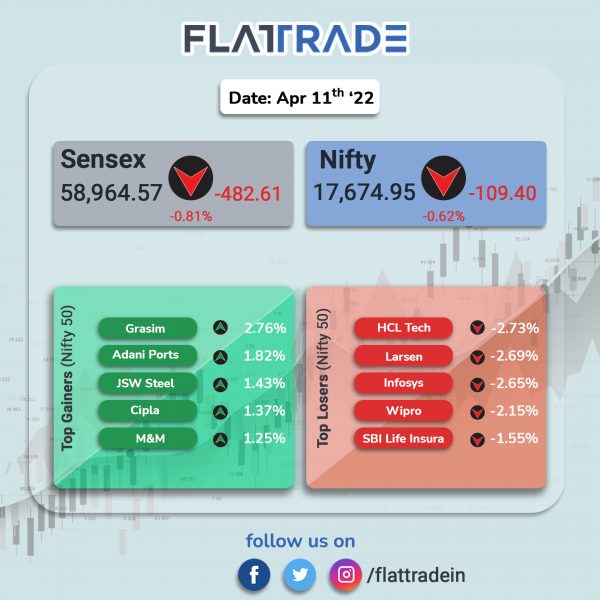

Benchmark stock indices closed lower due negative global sentiments and higher bond yield. IT and banks were the biggest laggards. The Sensex fell 0.81% and the broader peer Nifty lost 0.62%.

The broader markets fared better than benchmark indices. The Nifty Midcap 100 gained 0.62% and BSE SmallCap rose 0.38%.

Top losers among Nifty sector indices were IT [-1.41%], PSU Bank [-0.44%], Bank [-0.37%], Private Bank [-0.29%] and FMCG [-0.23%]. Top gainers were Energy [2.63%], Media [1.36%] and Realty [1.13%].

Indian rupee fell 5 paise to 75.95 against the US dollar on Monday.

Stock in News Today

Tata Steel: The company has acquired 32.64 crore equity shares of Rs 10 each at premium of Rs 9.15 per share, for Rs 625 crore. Post the acquisition, Tata Steel Mining will continue to be a wholly-owned subsidiary of the company. Tata Steel logged a revenue of Rs 536.73 crore for FY2020-21.

Multi Commodity Exchange of India (MCX): The company plans to advise Chittagong Stock Exchange on setting up a commodities derivatives platform in Bangladesh. The two firms is likely to sign an agreement on April 12. MCX will provide consultancy in regulations, products, clearing and settlement services, trading and warehousing.

Ruchi Soya Industries: The company in an exchange notification said that its board has approved evaluating the best way to enhance synergies with Patanjali Ayurved Ltd. The company has also decided to change the name to Patanjali Foods Ltd.

Glenmark Pharmaceuticals: The company’s subsidiary has received an approval from Drug Controller General of India to conduct a phase 1 clinical trial of its molecule to treat patients with advanced solid tumors and Hodgkin’s Lymphoma. The trial will begin in India by June 2022.

SMS Lifesciences: Shares of Hyderabad-based biotech company closed 10.7% higher after the US FDA completed inspection at the company’s API manufcturing facility located in Telangana. The inspection commenced on April 4 and concluded on April 8.

Veranda Learning Solutions Ltd: Shares of Veranda Learning Solutions Ltd. had a mixed debut, listing at a discount on NSE and a premium on BSE. The stock listed at Rs 157 apiece on the BSE, a premium of 14.6% to its IPO price of Rs 137. Meanwhile, the stock listed at Rs 125 on the NSE, a discount of 8.8%. At the end of the day, shares of the company closed at Rs 131.25 apiece in NSE and Rs 160.40 per share in BSE.

Sandur Manganese & Iron Ores: Shares of the company climbed 20% on the BSE after the company approved raising funds via a rights issue. The company plans to issue 1,80,03,882 equity shares of face issued value of INR 10 each aggregating Rs 18 crore. The company will offer 2 new equity shares for 1 equity share held as on the record date.