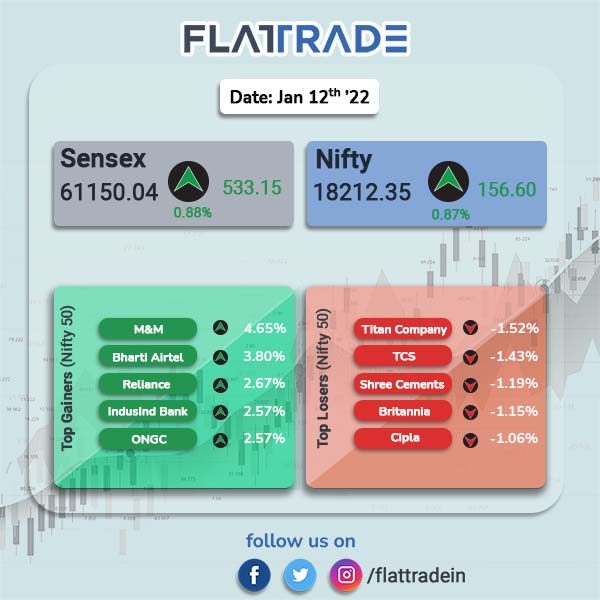

Benchmark stock indices closed higher led by gains in index heavyweights like RIL, Airtel and ICICI Bank. In addition, broader markets also rose aided by gains in energy, auto, metal and private banking stocks. The Sensex closed 0.88% higher to 61150.04 and Nifty rose 0.87% to 18212.35.

Top gainers were Nifty Energy [2.14%], Nifty Auto [1.45%], Metal [1.33%], Private Bank [1%]. Nifty IT closed flat and Nifty Pharma fell 0.15%. BSE Telecom index surged 3.15%.

India rupee closed flat at 73.91 against the US dollar on Wednesday.

Stock in News Today

Larsen & Toubro (L&T): A consortium led by L&T Hydrocarbon Engineering (LTHE), a wholly owned subsidiary of Larsen & Toubro, has secured two offshore contracts from a prestigious overseas client. The scope of work comprises of EPC for new facilities and integration with existing installations. The order is classified as mega order and its value is expected to be more than Rs 7000 crore, according to the company’s regulatory filing.

Hindalco Industries Limited: The company’s American subsidiary Novelis will build $365 million recycling center to support North American automotive customers and reduce carbon emissions by more than one million tonnes per year. The new recycling facility will be built adjacent to Novelis’ existing automotive finishing plant in Guthrie, Kentucky.

Vodafone Idea Ltd (VIL): The Indian government has no plans to convert Vodafone Idea Ltd., into a state-run firm, and it is not keen on a board seat, according to unnamed senior officials, the Economic Times newspaper reported. Shares of the company closed 8.47% higher.

Axis Bank: The lender has partnered with MinkasuPay to offer an easy net banking payment experience for its customers through a biometric authentication solution. Transaction time will reduce from the current 50-60 seconds to just 2-3 seconds with Fingerprint or Face ID authentication while increasing success rates significantly.

Federal Bank: The private-sector bank said in an exchange filing that its board has approved raising up to Rs 700 crore via bonds. The bank will issue unsecured Basel III Tier-II subordinate bonds in the nature of debentures, amounting up to Rs 700 crore on a private placement basis, the company said.

Bajaj Finance: The financial services company said that it will consider raising capital by debt issue/issue of non-convertible debentures in its board meeting on Jan. 18. The company will also report the financial results for the December quarter on Jan. 18.

RattanIndia Enterprises: The company will be making its foray into e-commerce business and it has approved an investment of Rs 350 crore in its wholly owned subsidiary Cocoblu Retail Ltd. Cocoblu will offer digital end-to-end value-chain management solutions to several brands to bring them onto leading online platforms.

Easy Trip Planners Ltd (EaseMyTrip): The Indian online travel company’s board has recommended bonus issue of equity shares in the proportion of one equity share of face value Rs 2 each for one equity share of face value Rs 2 each on the back of consistent earnings, according to its exchange filing. The record date will be announced in due course.

HiedelbergCement India Ltd: the company has commissioned a state-of-the-art facility to substitute part of fossil fuels with alternate fuels in cement production, the company said in its exchange filing. The facility will be built at Damoh in Madhya Pradesh with an investment of Rs 16 crore. This will help the company achieve thermal substitute rate of 5% in the first phase. The facility is expected to reduce the company’s carbon dioxide emissions by 42,000 tonnes per annum.

Kalpataru Power Transmission Ltd: The utilities company said in an exchange filing that it has raised Rs 200 crore through the issuance of non-convertible debentures (NCDs). The company allotted 2,000 NCDs of the face value of Rs 10 lakh each on private placement basis. The NCDs will be listed on the wholesale debt market segment of BSE Limited, the filing added.