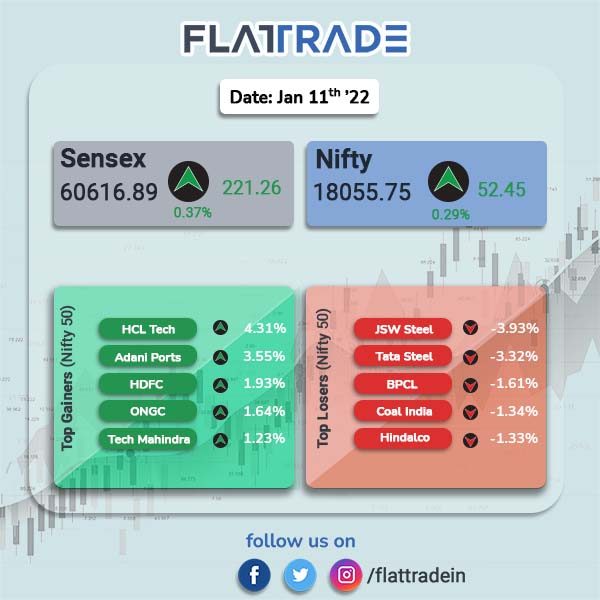

Indian benchmark equity indices closed in the positive territory led by gains in technology and energy stocks. The Sensex closed 0.37% higher at 60616.89 and the Nifty rose 0.29% to 18055.75.

Top gainers were Nifty Energy [1.23%], IT [1.03%], Realty [0.57%], Financial Services [0.30%] and Bank [0.25%]. Top laggards were Metal [-1.90%], FMCG [-0.35%], PSU Bank [-0.22%] and Auto [-0.19%].

Indian rupee gained 14 paise and closed at 73.90 against the US dollar.

Stock in News Today

Vodafone Idea: The company’s board approved conversion of AGR dues, spectrum interest into equity. The conversion will also result in dilution of all the existing shareholders of the company, including the promoters. The Indian government is expected to hold around 35.8% of the total outstanding shares of the company following conversion. Vodafone Group will hold 28.5%, while Aditya Birla Group will hold 17.8%.

JBM Auto Limited: The company has announced the acquisition of 51% stake in JBM Green Energy Systems Private Limited and JBM EV Industries Private Limited through its subsidiary JBM Electric Vehicles Private Limited. Shares of he company closed 5% higher.

Tata Steel and JSW Steel: Brokerage firm Jefferies downgraded the stocks and lowered optimism on metals sector in India. It cut FY23 EPS for Tata Steel by 18% and JSW Steel by 26%. Tata Steel was downgraded from ‘buy’ to ‘hold’ with the target price reduced to Rs 1,240 from Rs 1,600. Meanwhile, it downgraded JSW Steel from ‘buy’ to ‘underperform’ with the target price reduced to Rs 600 from Rs 800.

Meanwhile, JSW Steel posted a 28 per cent year-on-year growth in group combined steel production at 5.35 million tonnes (MT) during the quarter ended December 2021 as against 4.18MT in the year-ago period.

SpiceJet Ltd: The Madras High Court has dismissed the company’s appeal against a single-judge bench order to wind up due to non-payment of $24 million to SR Technics – a maintenance and repair company. A division bench of Justice Paresh Upadhyay and Justice Sathi Kumar Sukumara Kurup rejected the appeal and suspended the order till January 28 to enable the airline to move a further appeal before the Supreme Court.

Aurobindo Pharma Ltd: The drugmaker announced that its subsidiary CuraTeQ Biologics Pvt Ltd has expanded scope of marketing and distribution agreement with Orion Corporation to commercialise biosimilars pipeline to include the Baltic states in Europe. Orion will be responsible for commercialisation of CuraTeQ’s biosimilar products.

Adani Green Energy Ltd: The company’s total operational capacity increased by 84% year-on-year (YoY) to 5,410 MW. The energy sales rose 97% YoY to 2,504 million units in Q3, according to its quarterly business update. Its solar portfolio capacity utilisation factor at 21.9%, up 110bps YoY.

Hinduja Global Solutions Limited: The Board of Directors of the company will meet on January 14, 2022, to consider and explore potential mergers and acquisition opportunities. It will also consider the quantum and timings of buy-back of equity shares of the company.

AU Small Finance Bank: The company’s shares rose after the lenders posted a strong Q3 business update. The bank said total deposits grew by 13% QoQ in Q3 to Rs 44,278 crore. Its CASA ratio stood at 39% versus 30% QoQ. Fund-based disbursements rose 59% QoQ to Rs 8,152 crore. Non-fund-based disbursements grew 48% QoQ to Rs 627 crore.

Shriram Transport Finance Company: The NBFC said that it has raised about Rs 3,500 crore through Reg S Bond, having a tenor of 3.5 years and offering a coupon of 4.15%. The proceeds from the STFC social bond would be used for employment generation, including through micro, small, and medium-sized enterprise (MSME) financing, the lender said in a release.