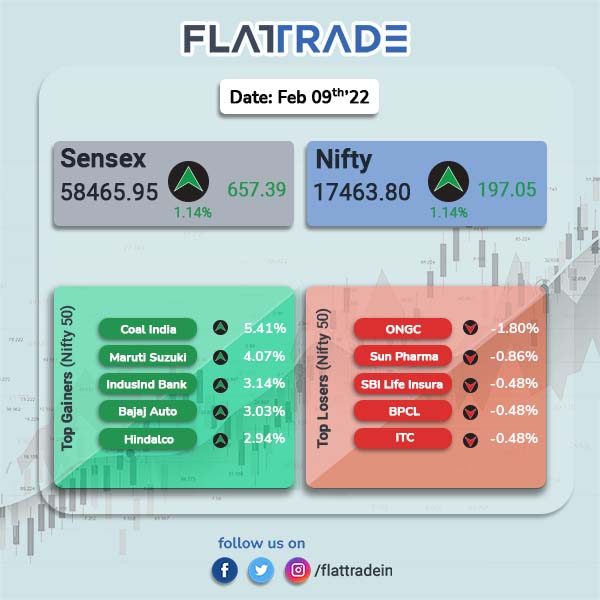

Stock indices closed higher as investors turned to riskier assets amid a marginal fall in oil prices and bond yields. Indian markets were also aided by gains in auto, metal, banking and technology stocks. The Sensex closed 1.14% higher and Nifty climbed 1.14%.

Top gainers among Nifty sector indices were Auto [2.19%], Metal [1.86%], Bank [1.53%] and IT [1.34%]. Only PSU Bank index closed 0.62% lower.

Furthermore, investors’ keenly awaited RBI’s Monetary Policy Committee decision on Thursday.

Indian rupee fell 6 paise to 74.81 against the US dollar.

Stock in News Today

Adani Wilmar: The edible oil manufacturer’s shares extended its rally on the second day of its listing. The company’s shares jumped 20% to close at Rs 321.90 apiece amid a rise in edible oil prices in the global market.

Larsen & Toubro (L&T): The construction arm of the company has secured a significant order from the Bangladesh Hi-Tech Park Authority to construct Hi-Tech I.T. parks at eight locations across the country. The project is being funded by Indian EXIM bank and is the first I.T. and office space order for L&T in Bangladesh. L&T categorizes significant order as those valued between Rs 1,000 crore and Rs 2,500 crore.

Future Retail: The Supreme Court sought a response from the Future Group on Amazon’s plea against the January 5 order of the Delhi High Court staying the ongoing arbitration proceedings before an arbitral tribunal over Future Retail’s Rs 24,500-crore merger deal with Reliance.

A bench comprising Chief Justice N V Ramana and Justices A S Bopanna and Hima Kohli issued notices to the Future group firms, Future Coupons Private Ltd (FCPL) and Future Retail Ltd (FRL) and said that it will hear the matter on February 23 without any adjournment.

Aurobindo Pharma: The drugmaker is in talks with PE funds to sell a stake of about 35% in its injectable business, The Economic Times reported citing people with direct knowledge of the matter. Potential buyers are likely to be TPG Capital Management, Advent International, Bain Capital and Blackstone. The business is being valued at Rs 15,000 crore, according to the news report.

GAIL (India) Ltd: The company has advanced its supply of gas from the US and it is looking to contract more LNG next year as it doubles down efforts to secure affordable energy supplies to meet the needs of Indian economy, chairman Manoj Jain said. It has long-term liquefied natural gas (LNG) supply contracts from the US to Australia and with Russia, supplementing domestic gas supplies.

Bosch: The company’s net profit was up 26% year-on-year (YoY) to Rs 234.96 crore. Revenue rose up 2.6% YoY at Rs 3,109.08 crore. The company plans to buy stake in Zeliot connected services.

Rupa and Company: The company’s net profit increased 34 per cent to Rs 58.3 crore in the third quarter of current fiscal as compared to Rs 43.4 crore in the same period a year ago. Revenues of the company increased 25 per cent during the quarter at Rs 433.2 crore as compared to Rs 345.6 crore in the year-ago period.

Glenmark Pharmaceuticals: The company has launched Nitric Oxide nasal spray (Fabispray) in India for the treatment of adult patients with Covid-19, in partnership with Canadian firm SaNOtize. Fabispray has proven anti-microbial properties with a direct virucidal effect on SARS-CoV-2.

Data Patterns (India) Ltd: The company has posted a net profit of Rs 9 crore during the third quarter of the current financial year, as compared to a loss of Rs 4.4 crore during the same period in FY21. The company’s revenue from operations saw a 96 per cent rise to Rs 43.8 crore as against Rs 22.4 crore during the Q3 of FY21. “We debut with strong earnings in our first results post IPO. In Q3FY22 our topline has doubled and we have maintained high profitability.

DCB Bank: The private-sector lender ‘s net profit fell by 21.9 per cent year on year (YoY) to Rs 75 crore in Q3FY22 due to lower other income. The net profit was Rs 96 crore in Q3FY21. Sequentially, net profit rose marginally from Rs 65 crore in the second quarter ended September 2021 (Q2FY22). The bank’s net interest income rose marginally to Rs 345 crore in Q3FY22 as against Rs 335 crore in Q3FY21. The non-interest income fell by 24.3 per cent YoY to Rs 118 crore in Q3FY22 from Rs 156 crore in Q3FY21.

Stove Kraft: Shares of the company closed nearly 15% lower after it posted weak third-quarter earnings. The company posted a sharp 67 per cent year-on-year (YoY) decline in its profit after tax (PAT) of Rs 11.1 crore in Q3FY22, due to higher operating cost. It had posted a PAT of Rs 33.50 crore in year-ago quarter.

Abbott India: The company’s net profit rose 12% YoY at Rs 199.20 crorein Q3FY22 from Rs 177.14 crore in the year-go period. Its revenue from operations increased 11% YoY at Rs 1,224.36 crore in the reported quarter from Rs 1,095.37 crore in the year-ago period.