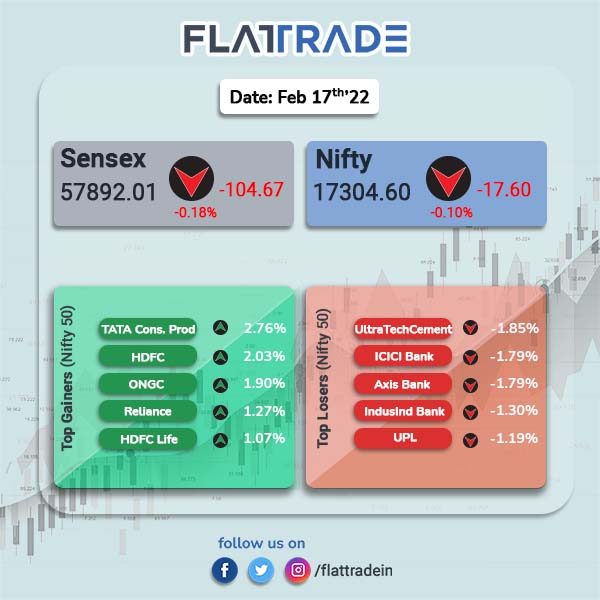

Dalal Street closed lower in a volatile session as gains in energy and FMCG stocks were offset by losses in banking and pharma stocks. The Sensex closed 0.18% lower and Nifty slipped 0.10%.

BSE Smallcap index fell 0.67% and Nifty Midcap 100 dropped 0.30%.

Top losers among Nifty sectoral indices were PSU Bank [-1.19%], Private Bank [-1.18%], Bank [-1.11%], Pharma [-0.75%] and IT [-0.48%]. Top gainers were Energy [1.5%] and FMCG [0.30%].

Indian rupee slipped 4 paise to 75.11 against the US dollar.

Stock in News Today

Reliance Industries Ltd (RIL): The energy conglomerate deferred shutdown of its oil-refining unit at its Jamnagar complex in Gujarat to capitalise on high fuel margins, reported Bloomberg news. The shutdown was initially scheduled for three weeks in March. However, maintenance works have been postponed to September.

In a separate news. RIL lists its existing foreign currency bonds aggregating over $7 billion on India INX, the largest such listing by a private entity in India INX and GIFT IFSC. This includes the $4 billion jumbo bonds raised recently in January 2022, which was termed as the largest ever foreign currency bond issuance by an Indian entity.

Maruti Suzuki India (MSI): India’s largest carmaker announced a deal with Quiklyz by Mahindra Finance for its Subscribe program. Quiklyz will offer white plate subscription for the Maruti Suzuki range of vehicles. The company has also added Kolkata city to the subscription program. Under the program, cars are offered across 20 cities.

Nestle India: The food and drink processing company posted revenues at Rs 3,739 crore in Oct-Dec 2021 quarter, up 9% YoY from Rs 3,432.5 crore in the year-ago period. Its net profit fell 20% to Rs 387 crore in the reported quarter from Rs 483 crore in the corresponding quarter last fiscal. EBITDA was up 11% at Rs 865.6 crore in the quarter, compared with Rs 776.9 crore in the year-ago period.

Schaeffler India: The company shares ended 9.81% higher at Rs 1786.25 after the company’s net profit rose 34.61% to Rs 190.64 crore on 19.58% rise in net sales to Rs 1523.22 crore in Oct-Dec 2021 quarter over the year-ago period.

Easy Trip Planners: The company has fixed Feb 25, 2022 as the record date, to ascertain eligibility of shareholders for issue of bonus equity shares of the company in the proportion of one share of Rs 2 each to every share of face value Rs 2 each. The approval for the issue of bonus shares was obtained through postal ballot on Wednesday.

Affle India: The Company plans to invest in Bobble AI. Affle had received an offer for pre-emption from Bobble AI for their next round of fundraise and the company has decided to unconditionally accept the pre-emption offer of 1,207 Series D CCPS at Rs 323,188 per share, for which the company has 30 days to make the payment towards subscription amount.

Puravankara Group: The realty firm plans to invest over Rs 1,550 crore to construct a 3 million mixed-use project, mainly housing, at Kochi, Kerala, as part of its plan to expand business amid rise in demand of apartments. The company’s subsidiary Provident Housing Ltd will develop 3 million square feet in the project, which is spread over 18 acres, named ‘Provident Winworth’ at Kochi. Puravankara is expecting a sales realisation of about Rs 3,000 crore from this project over the next 6-7 years.

Hikal Ltd: Shares of the company fell over 12% in intraday trade, but recouped some losses to end 4.83% lower than yesterday’s close, after the company received a notice from the Maharashtra Pollution Control Board on Tuesday. The state pollution board sent a notice to Hikal to close its manufacturing unit in Taloja. The unit will be shut within 72 hrs of receipt of the notice.