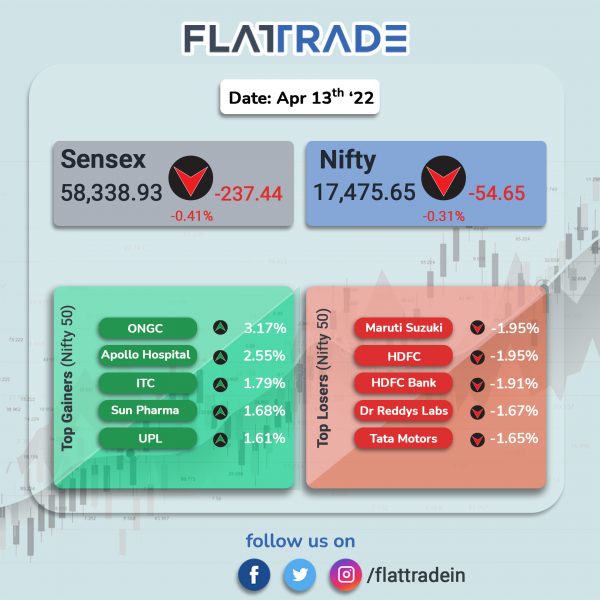

Benchmark stock indices closed lower as investors’ sentiments were dampened by weak global cues. The Sensex fell 0.41% and Nifty lost 0.31%.

In the broader markets, the Nifty Midcap 100 inched down 0.03% and BSE SmallCap rose 0.27%.

Top losers among Nifty sector indices were Private Bank [-0.87%], Financial Services [-0.87%], Auto [-0.84%], Media [-0.77%] and Bank [-0.75%]. Top gainers were FMCG [0.69%], Metal [0.57%], Energy [0.48%].

Indian rupee fell 4 paise to 76.17 against the US dollar on Wednesday.

Trade deficit narrowed to $18.51 billion in March 2022 compared to $20.88 billion in February 2022. Exports rose by 19.8% year-on-year to $42.22 billion, while imports rose by 24.2% year-on-year to $60.7 billion. Merchandise trade deficit for the full year rose to $192.24 billion in FY22, compared to $102.63 billion in FY21 and $161.35 billion in FY20.

Stock in News Today

ICICI Bank Ltd: The private sector bank and GIFT SEZ have signed a memorandum of understanding to promote GIFT SEZ to Indian as well as global businesses including IT / ITeS and financial services. Both organisations will promote GIFT SEZ among Indian and foreign MNCs as the preferred location for access to cross-border trade finance, according to a press release.

Jindal Stainless (Hisar) (JSHL): The company registered a total sales volume of 7,02,168 MT in FY22, rising 22% as compared to FY21 while Q4 FY22 sales volume remained stable at 1,78,784 metric tonnes (MT). Domestic demand rose across segments like railways, lifts and elevators.

HCL Technology: The IT services firm expanded global partnership with Swiss Firm Avaloq. HCL will develop lifecycle management center for Avaloq clients and invest in training and development for HCL teams working with Avaloq products.

RITES Ltd and Tata Steel: The company and Tata Steel have signed an MoU to jointly explore integrated infrastructure services. RITES and Tata Steel would collaborate to offer services in the areas of railway rolling stock exports and enhance infrastructural capabilities for buildings, airports, urban engineering, and information technology.

Prestige Estates Ltd: The company registered sales of Rs 10,382 crore, up 90% year-on-year and has clocked highest ever collections of Rs 7,466 crore, up 47% year-on-year. “Our business plan will be anchored by a principal focus on revenue expansion by capitalizing on our brand premium, execution track record and market consolidation theme,” Venkat K Narayana, chief executive officer, Prestige Group said.

Mahanagar Gas: The company hikes Mumbai CNG, PNG prices for second time this month. CNG in Mumbai was hiked by Rs 5 and it will cost Rs 72 per kg. PNG rates raised to Rs 45.5 per unit, a rise of Rs 4.5. The company had raised prices by Rs 7 and Rs 5 for CNG and PNG, respectively, on April 6.

Arman Financial Services: The NBFC said that its consolidated Asset Under Management (AUM) as on 31 March 2022 stood at about Rs 1,222 crore, higher by 50% year-on-year (YoY) and 17% sequentially. The improvement was helped by enhanced branch network, demand from existing customers, and addition of new customers in existing geographies. Consolidated disbursements for Q4FY22 stood at Rs 339 crore and for FY22 at Rs 1,049 crore, higher by 23% and 106% YoY respectively.

IIFL Wealth Management: Brokerage firm Motilal Oswal reiterated ‘buy’ and raised target price to Rs 2,200 from Rs 2,100, a return of 23.85%. Motilal Oswal expects the core focus segment of IIFL Wealth Management – Ultra High Net worth Individual clients – is expected to see rapid growth.

Man Infraconstruction: The company received Letter of Acceptance (LoA) from Bharat Mumbai Container Terminal Pvt, for Rs 937.89 crore. The LoA pertains to execution of Phase II works at JNPT, Navi Mumbai, Maharashtra. Bharat Mumbai Container is a subsidiary of the Singapore-based PSA International.

Thermax: Shares of the company rose 11.7% after the company won an order worth Rs 522 crore. The order involves supplying utility boilers and associated systems for a grassroot refinery and petrochemical complex in Rajasthan.

Zydus Lifesciences: The company announced that it has received the Prior Approval Supplement (PAS) Approval from the US Food and Drug Administration (USFDA), which allows for a site transfer and manufacturing of the drug, Sagent’s Caffeine Citrate Oral Solution, at Jarod. It will be used in treatment of breathing problem in premature infants.

Blue Star: The air conditioning and commercial refrigeration manufacturer, will double its production capacity of deep freezers by opening its new manufacturing facility at Wada, Maharashtra. This facility has the capacity to produce around 2,00,000 deep freezers and 1,00,000 storage water coolers per annum.

Brightcom Group: The company is partnering with Intent IQ, the next generation identity resolution leader, to enhance its bidding capability in RTB and programmatic advertising environments. Brightcom is looking for significant increases in targeted revenues in such environments by up to 30%.

Hariom Pipe Industries: The steel and iron pipe manufacturer made a strong debut on Dalal Street. Its shares listed at Rs 220 on NSE, a premium of 44% over its issue price of Rs 153. The stock listed at a premium of 40 per cent on BSE. The stocks closed Rs 231 apiece.