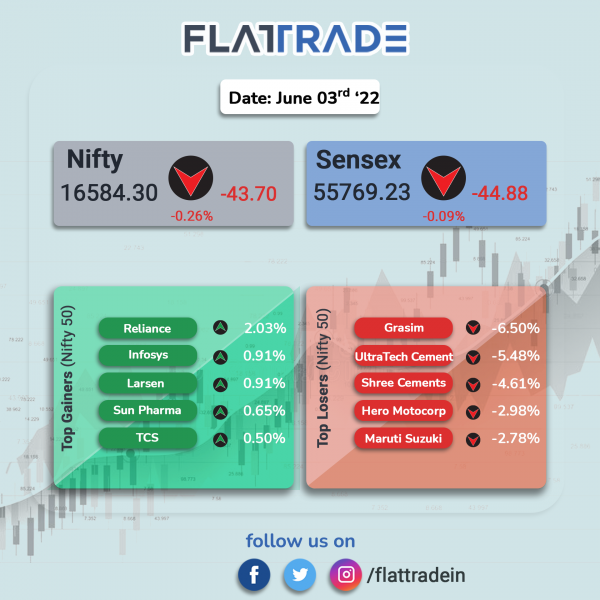

Benchmark equity indices pared early gains to close lower, dragged by losses in auto, bank and metal stocks. The Sensex slipped 0.09% and the Nifty fell 0.26%.

Broader markets underperformed benchmark indices. The Nifty Midcap 100 dropped 1.64% and the BSE Smallcap lost rose 1.16%.

Top losers in Nifty sectoral indices were Auto [-1.82%], PSU Bank [-1.42%], Metal [-1.27%], Private Bank [-1.04%] and Realty [-0.96%]. Meanwhile, IT index was the only index that gained 0.37% and ended in the green.

Indian rupee fell 3 paise to 77.63 against the US dollar on Friday.

S&P Global Services PMI in May 2022 stood at 58.9 compared with 57.9 in April 2022. The survey reflected better demand and strong inflows of new orders. However, May data showed a twenty-third successive month of rising input prices at Indian service providers.

Stock in News Today

Reliance Industries Ltd (RIL): The company and US-based Apollo Global Management are teaming to bid for Boots, which is the international chemist and drugstore unit of Walsgreen Boots Alliance, Economic Times reported. The combined bid from Reliance and Apollo for Boots could come in as early as Friday, June 3.

HDFC: The mortgage lender has collaborated with Accenture to digitally transform its lending business. The transformation exercise is aimed at making HDFC’s lending lifecycle paper-less and nimble. The partnership will revamp HDFC’s customer experience and business processes to provide greater operational agility and efficiency, and drive business growth.

Titan Company: The company informed that rating agency ICRA has assigned various credit ratings to the company’s debt instrument. The rating agency has migrated the rating of the company’s fixed deposit programme worth Rs 3,500 crore, to ‘ICRA AAA’ from ‘MAAA’ . It has given a stable outlook for the fixed deposit programme.

Aether Industries: The company’s shares has strong debut as the shares were locked at the upper circuit on Friday. The stock opened at Rs 704 on the NSE over its issue price of Rs 642 and hit a high of Rs 774.4 apiece. Shares of the company closed at Rs 774.4 per equity share.

Mahindra & Mahindra Financial Services: The company said that disbursement in the month of May 2022 rose 272% YoY to Rs 2,973 crore. In FY22, the year-to-date disbursements grew 169% YoY to Rs 5,686 crore. The collection efficiency was 95% for May compared to 67% in the same month, a year ago.

Aegis Logistics: Brokerage firm Nomura reiterated a ‘buy’ rating and raised target price of Aegis’ shares to Rs 425 apiece. Nomura said that the midstream LPG distributor and logistics provider is likely to see volume growth in FY23E due to commissioning of Kandla LPG terminal. Nomura expects a string of growth project anouncements in industrial terminals and estimates strong uptick in high profitability distribution segment.

GR Infraprojects: The company’s subsidiary GR Madanapalli Pileru Highway executed the concession agreement with NHAI for construction of four lane project in Andhra Pradesh, under Bharatmala Pariyojna. The bid project cost is Rs 1,577 crore. The project is to be completed within 730 days from the date of appointment. The operation period extends to 15 years from commercial operation date.

VA Tech Wabag: The water technology firm The rise comes after the company bagged a consortium ‘design, build, operate’ order worth 146 million euro for 50 MLD (million liters per day) Mamelles Sea Water Desalination Project from the National Water Company of Senegal. Wabag will provide design, engineering and supply of electromechanical equipment. It will supervise the installation and commissioning of the project followed by a 2 year O&M of the plants.

Angel One: The broking services firm added gross 4.7 lakh clients in May 2022 compared to 4.4 lakh in April 2022. The client base stood at 1.01 crore in May compared to 96.4 lakh in April, a 4.7% rise. The number of orders in May rose 6.8% MoM (48.4% YoY) to 70.63 million.

Force Motors: The company’s domestic sales jumped 31% to 1,709 units in May 2022 from 1,306 units sold in May 2021. The domestic sales were higher by 29.4% over April 2022. Export sales aggregated to 317 units in May 2022, jumping 105% YoY and surging by 272% on a month on month (MoM) basis. The company’s production in May 2022 stood at 2,047 units, up 56% from 1,306 units produced in May 2021.