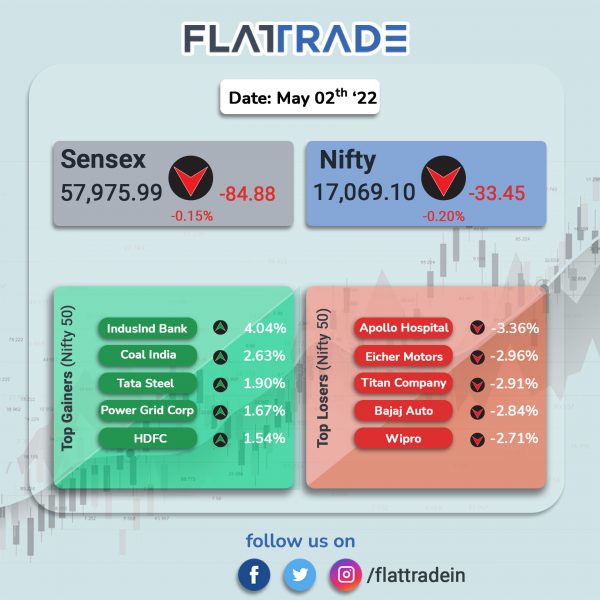

Benchmark indices rebounded from its session’s lows on heavy buying by investors in the last hour of the trading session. However, both indices closed in red. The Sensex closed 0.15% lower and the Nifty ended 0.2% down.

Broader markets underperformed compared to headline indices. The Nifty Midcap 100 fell 0.6% and BSE SmallCap lost 0.9%.

Top losers among Nifty sector indices were IT [-1.53%], Auto [-1.26%], PSU Bank [-0.46%]. Top gainers were Metal [0.57%], Private Bank [0.48%] and FMCG [0.21%].

Indian Rupee fell 9 paise to 76.51 against the US Dollar on Monday.

Stock in News Today

HDFC Ltd: The company reported a standalone net profit of Rs 3,700 crore for the Jan-Mar quarter 2022, up 16% from Rs 3,180 crore in the year-ago period. The net interest income (NII) for the March quarter came at Rs 4,601 crore compared to Rs 4,027 crore in the previous year — a growth of 14 per cent. The company said demand for home loans and pipeline of loan applications continues to remain strong. The HDFC Ltd board has recommended a dividend for the year ended March 31, 2022 of Rs 30 per equity share.

Reliance Industries Ltd (RIL): The energy conglomerate is planning to build a mega land bank in its bid to set up renewable energy parks and projects, Mint reported, citing sources aware of the matter. Land aggregation exercise is underway to set up solar power projects of 100 GW by 2030, Mint reported. The news report added that it takes about four acres of land to set up solar panels for installing 1 MW capacity.

Tata Chemicals: Shares of the company surged over 9% after the company reported a multi-fold jump in consolidated profit after tax at Rs 470.24 crore for the quarter ended March 2022. The company’s profit after tax stood at Rs 29.26 crore in the year-ago period. Its consolidated revenue from operations grew 32% during the quarter under review to Rs 3,481 crore, from Rs 2,636 crore in the same period last fiscal.

Coal India Limited: The state-owned company said coal supply to the power sector rose 15.6% to 49.7 million tonne last month in the wake of high demand of the dry fuel from electricity generating plants and stressed that it is planning to augment its dispatches further, especially to power plants in the coming months.

Adani Group: The group is in talks with healthcare players for investments in the sector in India and has earmarked up to $4 billion in debt and equity for this purpose, Mint reported, citing two people directly aware of the matter. The group is in talks with investors and lenders for a long-term funding plan to back investments in the healthcare sector, according to the report. The plan may involve the acquisition of hospitals, diagnostic chains as well as pharmacies.

Info Edge: the company in a regulatory filing said that it will invest in three new schemes in partnership with Temasek. The total size of all the three proposed funds and schemes is $325 million (Rs 2,485 crore) with Temasek and Info Edge committing 50% each.

Easy Trip Planners Ltd: The company announced that it will apply for a full-fledged Money Changer License from RBI. After receiving this license, EaseMyTrip will be able to provide its more than 11 million customers and nearly 60,000 travel agents with a much-needed service of currency exchange.

Solara Active Pharma: The company quarterly net profit plunged 99.62% to Rs. 0.22 crore in March 2022 from Rs. 57.15 crore in March 2021. Its net sales stood at Rs 360.82 crore in March 2022 down 18.77% from Rs. 444.21 crore in March 2021. The company also announced that it approved the resignation of MD & CEO Rajender Juvvadi Rao, effective April 28. Jitesh Devendra has been appointed as the new MD and CEO of the company. Shares of the company closed 20% lower on Monday.

DB Realty: Shares of the company fell over 5%, after the company informed exchanges that the CBI carried out searches on the premises of its subsidiary Neelkamal Realtors and its managing directors, Vinod Goenka and Shahid Balwa, on April 30. The CBI searches pertain to some financial transactions of Neelkamal Realtors when the company was being managed by IIRF Holding VII Ltd. and Vistra ITCL Ltd.

Welspun Corp: The company has secured an order worth Rs 706 crore from Indian Oil Corporation. The order pertains to the construction of a large sector of Mundra Panipat Crude Oil Pipeline project. The order will be executed in FY2022-23. In addition, the company has secured orders worth Rs 2,450 crore, across oil and gas, CGD and water sectors. Most of these orders are to be executed within this financial year.

Fino Payments Bank: Shareholders have voted against reappointment of chairman Mahendra Kumar Chouhan and reappointment of independent director Punita Kumar Sinha. Shareholders also voted against employee stock auction plan.

Man Industries India: Shares of the company rose over 4% after the company bagged a new order worth Rs 807 crore. The order from Indian Oil Corporation pertains to the supply of API High Grade Large Diameter Carbon Steel pipes along with coating.

Ajanta Pharma: Shares of the company rose over 8% in intraday trading after the company informed the exchanges that it will consider the issue of bonus shares on May 10, subject to shareholders’ approval.