Benchmark stock indices plunged more than 1% on negative sentiments after Federal Reserve Chair Jerome Powell said that a 50 bps rate hike is “on the table” for May. Investors dumped stocks across the board and the biggest losers were banking, pharma and metal stocks.

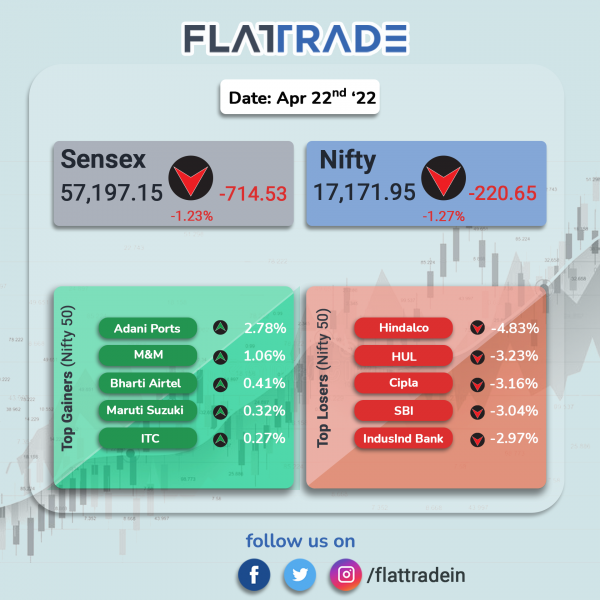

The Sensex fell 1.23% and the Nifty 50 tanked 1.27%. The Nifty Midcap 100 fell 0.94% and BSE SmallCap losr 0.38%.

Top losers among Nifty sector indices were PSU Bank [-2.1%], Bank [-2.1%], Metal [-1.97%], Private Bank [-1.96%] and Pharma [-1.82%]. Rest of the sector indices ended in the red.

Indian rupee depreciated by 34 paise to 76.48 against the US dollar on Friday.

Stock in News Today

Adani Ports and Special Economic Zone (APSEZ): The company’s subsidiary, Adani Harbour Services, is acquiring 100% stake in Ocean Sparkle (OSL), a leading third-party marine services provider, for Rs 1530 crore. The transaction is expected to be completed within one month, according to its exchange filing. The company said the investment is in line with its strategy to increase its footprint in marine service market.

CRISIL: The company’s consolidated revenue from operations in Jan-Mar quarter of FY22 rose 20.1% to Rs 594.9 crore, compared with Rs 495.2 crore in the year-ago period. Profit after tax for the reported quarter rose 45.6% to Rs 121.6 crore, compared with Rs 83.5 crore in the corresponding quarter of the previous year. The Board of Directors declared an interim dividend of Rs 7 per share in the current quarter ended March 31, 2022.

FSN E-Commerce Ventures (Nykaa): The company has bought 18.5% stake in Earth Rhythm for Rs 41.65 crore to expand its D2C business. It also picked up 60% in Nudge Wellness for Rs 3.6 crore and made its entry into dietary supplements and other nutricosmetics products. Further, Nykaa also acquired activewear and athleisure brand ‘KICA’ for Rs 4.5 crore, to help strengthen its active-wear play.

Hindustan Zinc: The company registered a net profit of Rs 2928 crore in Q4FY22, up 8.4% from Rs 2701 crore in Q3FY22. Its revenues were up 10.1% QoQ to Rs 8797 crore in the reported quarter. EBITDA rose 13.5% to Rs 4962 crore in Q4FY22 from Rs 4370 crore in the third quarter of FY22.

Sterlite Technologies: Shares of the company surged in intra-day trades amid reports of stake sale by the company in three of its verticals. Vedanta Group is in talks with strategic investors to sell up to 25 per cent stake in each of the three business units of Sterlite Technologies, according to a Business Line report.

JSW Steel and Jindal Steel & Power: The two companies are in the fray to acquire state-owned helicopter service provider Pawan Hans. According to Bloomberg news report, group of officials headed by cabinet secretary Rajiv Gauba will meet on Saturday to pick the winning bid. Final announcement will be made after the approval by a ministerial panel which is largely procedural.

Zen Technologies: The company announced that it has signed an annual maintenance contract worth Rs 55 crore for a period of five years. With the addition of the latest order, the company’s order book stood at Rs 477.04 crore. The contract pertains to simulators.

Borosil Renewables: Shares of the company rose 13.81% ahead of the company’s board meeting to raise funds through preferential issue on private placement basis.

NBFCs: India’s central bank said that non-banking financial companies (NBFCs) that has Rs 100-crore net worth can issue credit and debit cards. The central bank also said that finance companies will need the regulator’s prior permission before getting into the cards business. The RBI issued its master direction on credit and debit cards in which it included NBFCs as card issuers.

Thomas Cook (India): The company has signed a strategic agreement with Maldives Marketing and Public Relations Corporation (MMPRC) to expand destination visibility and drive increased tourist arrivals from India. This partnership between Thomas Cook India and MMPRC will deploy a multi-pronged strategy focussed on product development, knowledge-training and marketing, the company said in its exchange filing.

Somany Ceramics: The company announced that the modernization and expansion of a production line of double fast firing (DFF) to produce large format wall tile was successfully completed. The commercial production was commenced from April 21 and the total capacity of tile manufacturing at Kassar Plant has increased to 23.32 million squares meters per annum.

Insecticides (India): Shares of the company rose nearly 2% after the company was awarded two patents by the Government of India. The company along with its joint venture received patent for ‘Novel Dithiolane Compound or a Salt’ or N-Oxide. It also received one more patent for ‘Novel Miticidal Benzylamides’ for a period of 20 years starting from July 18, 2016.

Sasken Technologies: Shares of the company fell more than 4% after the IT company reported a 10.6% fall in consolidated net profit to Rs 26.88 crore in Q4FY22 over Q3FY22. Consolidated net sales grew by 2.74% quarter on quarter but declined 1.3% year-on-year to Rs 109.18 crore in Q4FY22.