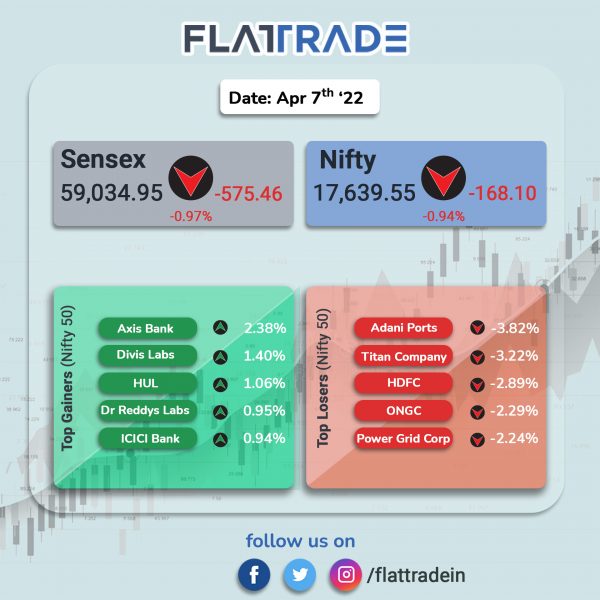

Dalal Street ended lower as investors were on the sidelines due to weak global cues and concerns over the Reserve Bank of India’s monetary policy decision tomorrow. Energy, metal and IT stocks weighed on the markets. The Sensex fell 0.97% and the Nifty lost 0.94%.

The broader markets mirrored the benchmark indices. The Nifty Midcap 100 tanked 1.02% and BSE SmallCap was down 0.75%.

Top losers among Nifty sector indices were Energy [-1.7%], Metal [-1.66%], Media [-1.27%] and IT [-1.25%]. Top gainers was Pharma [0.41%].

Indian rupee fell 20 paise to 75.96 against the US dollar on Thursday.

Stock in News Today

State Bank of India, Axis Bank and IDBI Bank: India’s antitrust body is investigating the trustee units of the three banks for suspected collusion on fees, triggering a lawsuit by a group representing them, Reuters reported. The antitrust case was triggered by a complaint from Muthoot Finance. When Muthoot wanted to raise debt in August last year, the gold loan company received a costing proposal which was 300% higher than previous rates.

YES Bank: Rating agency CARE has upgraded the rating for YES Bank’s tier-II bonds and infrastructure bonds from “BBB” to “BBB+” on stabilisation of operations, growth in business and continued improvement in profitability. The ratings continue to factor in the improvement in the credit profile of the bank post the implementation of the reconstruction scheme for the private sector lender. Shares of the company closed 5.76% higher.

Jet Airways India Ltd: The airline plans to return with a hybrid of premium and no-frills services that would allow the company to win some market share while managing costs in the fiercely competitive Indian aviation market, Bloomberg reported. The bankrupt airline will have a two-class configuration where business class passengers will be offered services including free meals, its new Chief Executive Officer Sanjiv Kapoor said. The economy class will, however, be modeled similar to low-cost carriers where flyers pay for meals and other services, he said.

BSE Ltd: The company’s subsidiary, BSE Technologies, has received authorisation from capital markets regulator Sebi to act as a KYC Registration Agency (KRA).

Indian Hotels Company and Lemon Tree Hotels: Brokerage firm ICICI Securities has given a ‘buy’ call for hospitality stocks such as Indian Hotels Company and Lemon Tree Hotels. For Indian Hotels Company, the brokerage had set the target price at Rs 285 per share and for Lemon Tree Hotels, the target price is pegged at Rs 80 per equity share. However, the brokerage firm said that key risks to the sector are fresh Covid waves globally and in India impacting demand and rise in operating costs denting margins.

Godrej Properties Ltd: The realty firm will develop a new housing project at Kandivali East in Mumbai with an estimated sales revenue of Rs 1,000 crore. This project is an extension of Godrej Tranquil and Godrej Nest, and will offer about 7 Lakh square feet of saleable area.

MTNL: Share price of the state-run telecom company surged 11.85% after the government said it has deferred the merger of BSNL and MTNL due to financial reasons.

Alembic Pharma: Shares of the company gained nearly 2% after the company received a tentative approval from U.S. FDA for Dabigatran Etexilate Capsule, a drug used to reduce the risk of stroke and systemic embolism in adult patients.

Lupin: The company has completed the acquisition of a portfolio of brands from Anglo-French Drugs & Industries (AFDIL) and its associates. The company said that the acquisition will strengthen its India formulation business by adding the rapidly growing portfolio of vitamins, minerals, supplements and neurological products.

Uma Exports: Shares of the company has a strong debut on the bourses on Thursday, listing at Rs 80 apiece on the BSE, a 17.6 per cent premium against its issue price of Rs 68 apiece. The company closed at Rs 84 per equity share.