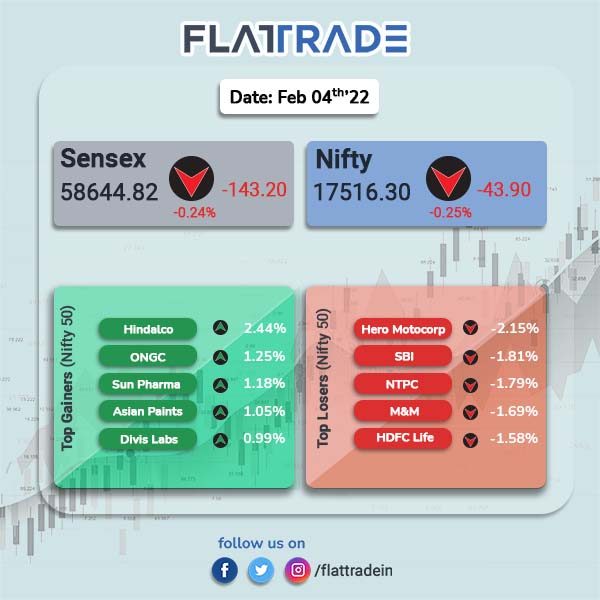

Dalal Street fell on Friday in a volatile session weighed by losses in sector heavyweights and banking stocks. Investors also digested the latest interest rate decisions from both the Bank of England and the European Central Bank. The Sensex closed 0.24% lower at 58644.82 and Nifty fell 0.25% to 17516.30.

Top losers were among Nifty were Realty [-2.76%], PSU Bank [-1.92%], Media [-1.89%], Auto [-1.05%] and Bank [-0.57%]. Top gainer was Nifty Metal index which rose 1.18%.

Indian rupee rose 17 paise to 74.70 against the US dollar.

Stock in News Today

Adani Green Energy Ltd: Three subsidiaries of the company raised Rs 612.30 by their maiden domestic bond issuance, on private placement basis. The three firms collectively house 930 million of operational solar power projects. The rated, listed, secured, redeemable, non-convertible debentures (NCDs) of face value of Rs 10,00,000 each, in multiple series, have a fixed average annualized coupon rate of 7.83% p.a. and a tenure up to 12 years.

Lupin: The pharma company’s consolidated net profit jumped 24.47% YoY to Rs 545.52 crore in the third quarter of FY22. The drug maker posted a 3.57% YoY rise in total revenue from operations to Rs 4160.93 crore in Q3FY22.

Bank of India: The lender reported a 90% rise in standalone net profit to Rs 1,027 crore in Q3FY22 from Rs 541 crore in Q3FY21. Total income during the quarter decreased by 8% YoY to Rs 11,211 crore. Net Interest Income (NII) was Rs 3,408 crore in Q3 FY22, 9% lower from Rs 3,739 crore in Q3FY21.

Aditya Birla Fashion and Retail Ltd (ABFRL): The fashion retailer announced that it will set up a platform to venture into the Direct-to-Consumer (D2C) business. The company will set up a new subsidiary towards building a portfolio of new-age, digital brands across categories such as beauty, fashion and other allied lifestyle segments.

Aditya Birla Finance: the company’s net profit rose 48.30% to Rs 286.70 crore in the quarter ended December 2021 as against Rs 193.33 crore in the year-ago period. Sales rose 11.11% to Rs 1481.42 crore in the quarter ended December 2021 as against Rs 1333.32 crore during the corresponding quarter last financial year.

CE Info Systems: Shares of CE Info Systems fell after the company approved the acquisition of 75.98% of Gtropy Systems Pvt Ltd for Rs 13.5 crore. The indicative time period for completion of the acquisition is 45 days. Gtropy Systems, which belongs to IoE and logistics Software-as-a-Service Tech industry, had a turnover of 8.49 crore in FY21 and Rs 2.58 crore in FY2020.

Reliance Capital: The company reported to Rs 1773.00 crore in the quarter ended December 2021 as against a net loss of Rs 4018.00 crore during the corresponding quarter last fiscal. Sales declined 16.89% to Rs 4025.00 crore in the quarter ended December 2021 as against Rs 4843.00 crore in the year-ago period.

Devyani International: The company’s net profit rose 44.14% to Rs 63.12 crore in the quarter ended December 2021 as against Rs 43.79 crore during the same period last year. Sales rose 64.71% to Rs 624.43 crore in the quarter ended December 2021 as against Rs 379.10 crore during the corresponding quarter last fiscal year.

Alkem Laboratories: The specialty pharmaceutical company’s net profit rose 16.56% to Rs 525.66 crore in the quarter ended December 2021 as against Rs 450.96 crore in the year-ago period. Revenue was up 12.98% to Rs 2618.98 crore in the quarter ended December 2021 from Rs 2318.05 crore during the same quarter last financial year.

Firstsource Solutions: The company’s net profit rose 11.90% to Rs 135.46 crore in the quarter ended December 2021 as against Rs 121.05 crore during the year-ago period. Sales rose 7% to Rs 1445.64 crore in the quarter ended December 2021 as against Rs 1351.01 crore during the corresponding quarter last fiscal.

Venky’s (India): The company’s net profit declined 80% to Rs 21.63 crore in Q3FY22 from Rs 106.50 crore in Q3FY21. Revenue from operations rose 18% YoY to Rs 1,098.50 crore during the quarter. Total expenses increased by 35% YoY to Rs 1,079.77 crore in Q3FY22 over Q3 FY21, due to a surge in in the prices of key poultry feed ingredients, especially soya which has seen steep jump in prices.

Antony Waste Handling: The company’s net profit declined 4.40% to Rs 13.03 crore in the quarter ended December 2021 compared with Rs 13.63 crore during the same period in the previous fiscal. Sales rose 30.64% to Rs 161.32 crore in the quarter ended December 2021 as against Rs 123.48 crore in the year-ago period.

Sigachi Industries: The company reported a 34.3% jump in consolidated net profit to Rs 9.55 crore in Q3FY22 from Rs 7.11 crore posted in Q3FY21. Net sales grew by 35.8% to Rs 65.59 crore in Q3FY22 from Rs 48.30 crore registered in Q3FY21.

PVR: The movie theatre operator signed an agreement with real estate firm M3M India to set-up an 8-screen multiplex at 65th Avenue, the recently delivered largest luxurious retail project in Gurugram.