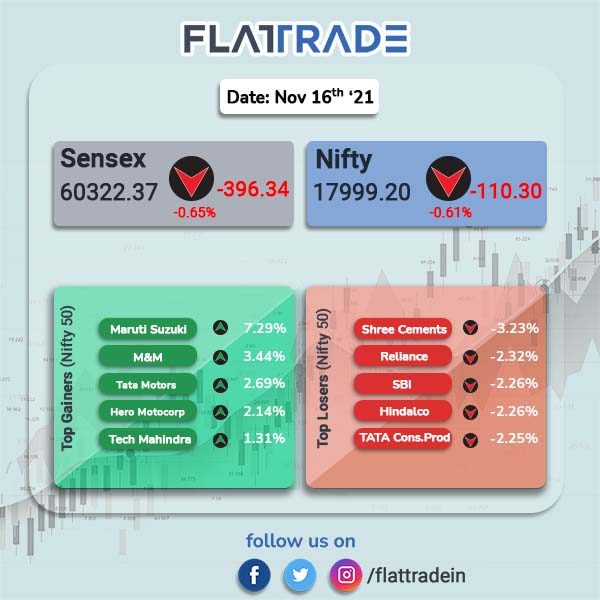

Benchmark indian indices closed lower, weighed by banking, energy and pharma stocks. The Sensex closed lower 0.65% to 60322.37 and Nifty ended 0.61% down to 17999.20.

Nifty PSU Bank plunged 2.14%, Energy was down 1.34%, Pharma fell 1.26% and Bank lost 1.02%. The gainers were Nifty Auto (2.48%) and IT (0.49%).

Indian rupee gained 11 paise to close at 74.37 against the US dollar on Tuesday.

Stock in News Today

Glenmark Pharmaceuticals: The company’s share price fell over 3.72% to close at Rs 517.45 after foreign broking and financial services company Morgan Stanley kept “underweight” rating on the stock with the target at Rs 554. The core business should grow in the low to mid-teens and margin should be stable, it said. Morgan Stanley added cash conversion and specialty monetisation are the key value drivers.

Coforge: Shares of the company rose 6.87% in intraday trading ahead of US public issue via American Depository Receipts (ADR) route, accordign various news reports. According to a news report by moneycontrol.com, the ADR public issue will facilitate a partial exit for Barings PE Asia, one of the shareholders in the Coforge.

Macrotech Developers: Shares of the company (Lodha Developers) jumped 10.265 to Rs 1,4516.45 after the real-estate developer announced the opening of its qualified institutional placement (QIP) issue to raise Rs 4,000 crore on Monday. The funds would be used for acquiring land parcels, future expansion plans, deleveraging and for general corporate purposes.

Thermax Ltd: Shares of the company rose for the fourth day in a row and closed more than 10% higher on Tuesday, after the company reported robust quarterly results last week. Its net profit for the second quarter of FY22 rose to Rs 82.02 crore, up 164% year-on-year.

HCL Technologies: The IT major has announced a new multi-year deal with Euroclear Group to expedite its tech transformation journey and enhance digital capabilities. HCL Tech and Euroclear will also establish a co-innovation lab in Brussels. Euroclear is a provider of domestic and cross-border settlement and related services for bond, equity and fund transactions.