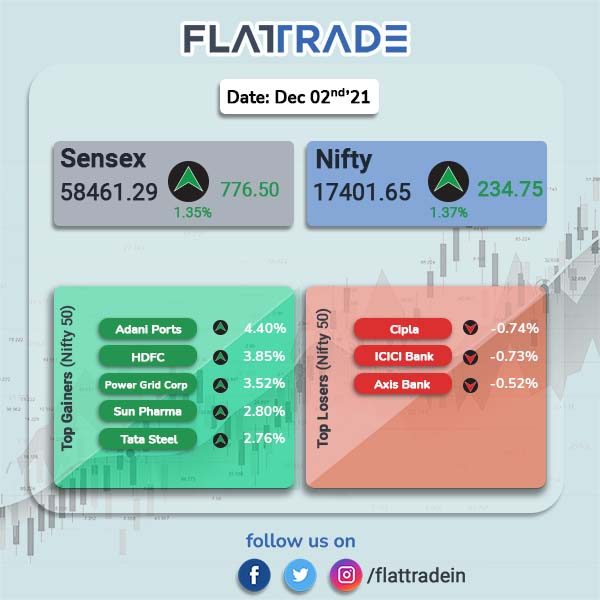

Indian equity indices closed higher for the second day in a row after India reported robust GDP data on Tuesday. The indices rose, boosted by gains in technology, energy and metal stocks. The Sensex closed 1.35% higher at 58461.29 and the Nifty was up 1.37% to 17401.65.

All sectoral indices closed in the green. The top gainers were Nifty IT [2.06%], Energy [1.65%], Metal [1.56%].

Indian rupee fell 9 paise to 74.99 against the US dollar on Thursday.

Stock in News Today

Larsen & Toubro [L&T]: The company has signed a partnership agreement with ReNew Power (ReNew) to tap the emerging green hydrogen business in India. Both the companies will jointly develop, own, execute and operate green hydrogen projects across the country.

Tata Power: The company will collaborate with am Stays & Trails, India’s first branded homestay portfolio by Indian Hotels Company Ltd, to set up EV charging stations. The charging station will come up at over 30 of its villas and heritage bungalows located in 11 destinations. A rising demand for sustainable transport infrastructure has resulted in an increasing number of hospitality brands investing in electric vehicle (EV) charging points, the company said.

Dish TV, Airtel: The company rejected media reports suggesting telecom operator Airtel is in early talks to pick up a majority stake in it. Dish TV said in a regulatory filing that it was not aware of the transaction. According to the news report, Airtel is looking to buy 5.93% stake from Dish TV’s promoter group and 25.63% stake owned by YES Bank Ltd.

Maruti Suzuki: The carmaker said that it is planning to increase vehicle prices from January 2022 to offset the impact of rise in various input costs. The price increase would vary from model to model, the auto major said, without sharing the details.

Skipper Ltd: Shares of the company surged 17.13% after the company said in an exchange filing that it has secured fresh new order of Rs 300 crore for Transmission and Telecom towers from Power Grid Corporation of india (PGCIL) and from various export markets. The comapny also said that its order inflows stood in excess of Rs 1,300 crores year-to-date, registering a growth of 160% over the same period last year.

Jet airways: The airline is in talks with Boeing, Airbus for $12 billion order, according to Bloomberg news report. Jet Airways is expected to to buy at least 100 narrowbody aircrafts, said new owners Murari Lal Jalan and Kalrock Capital. The group will invest around $200 million via equity and debt in the airline over the next six months.

Paytm: The fintech company got a buy rating from brokerage firm Dolat Capital Market, Bloomberg reported. The brokerage has initiated coverage and set a target price of Rs 2,500 as it believes Paytm’s transition to a “manufacturer” of financial services from an agent, cross-selling of services, and strong growth in the number of users will help the company. The brokerage expects the company to turn profitable by March 2026.

Hindustan Unilever Ltd: The FMCG major has decided to replace coal usage across its operations with green alternatives such as biomass and biodiesel, the company said in a release. To facilitate this, the company has collaborated with biomass suppliers and local farmers, to ensure sustainable supply of green fuel and made the necessary changes for the renewable transition in its coal-fired boilers.