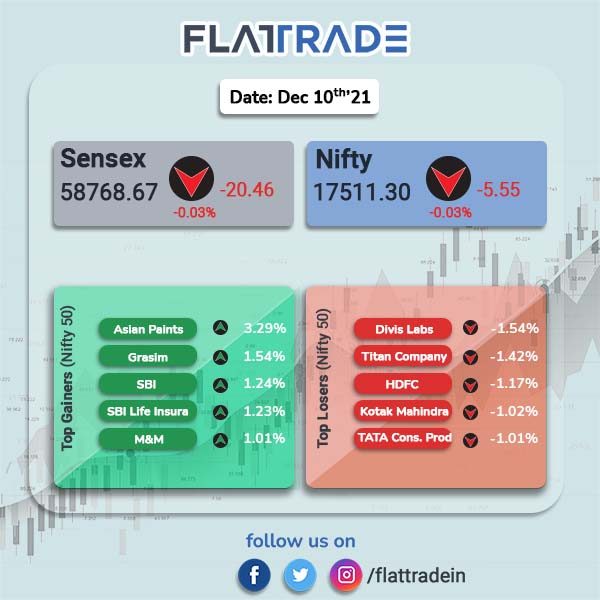

Benchmark equity indices closed fractionally lower following weak sentiments in the global markets and selling pressure from FIIs, while investors awaited the US inflation numbers. The Sensex closed 0.03% lower at 58786.67 and the Nifty closed 0.03% down at 17511.30.

Broader markets performed better compared to Nifty and Sensex. Nifty Midcap 100 rose 0.80% and BSE Smallcap index gained 0.85%.

Top sectoral gainers in BSE were Realty [2.90%], Oil and Gas [0.86%], Consumer Discretionary Goods [0.74%], Power [0.73%] and Utilities [0.56%]. Top losers were Consumer Durables [-0.28%], Telecom [-0.19%], Nifty Financials [-0.20%].

Indian rupee fell 25 paise to 75.77 against the US dollar on Friday.

Stock in News Today

IndusInd Bank: The lender said that it has received an intimation from the RBI that Life Insurance Corporation (LIC), a shareholder of the bank, to acquire up to 9.99% of the total issued and paid up capital of the bank, subject to compliance. The approval is valid for a period of one year i.e. up to December 8, 2022. LIC holds 4.95% of the total issued and paid up capital of the bank.

Star Health & Allied Insurance: The company had a tepid stock market debut as shares of the company got listed at 5.69% discount of Rs 849 to IPO issue price of Rs 900, on the NSE. Shares of the company close 0.76% higher at Rs 906.85 per share.

Lupin Ltd: The pharma company said that the launch of its diagnostics arm, Lupin diagonstics, as part of its strategy to provide integrated healthcare in India. In an exchange filing, the company said that it has established a 45,000 sq ft National Reference Laboratory in Navi Mumbai. The facilities in the laboratory include all key diagnostics services, preventive health check-ups, and a comprehensive range of tests.

Deepak Fertilisers & Petrochemicals Corporation: Shares of the company closed 2.25% higher after Smartchem Technologies, a fully-owned subsidiary, said that Odisha’s Chief Minister Naveen Patnaik had laid the foundation stone for a Rs 2,200 crore technical ammonium nitrate complex. The complex will be located at the Gopalpur Industrial Park and have an annual capacity of 377 kilo tonne. It is scheduled for commissioning by August 2024.

Siemens Ltd: Shares of the company closed 7.65% higher at Rs 2445.35 on strong growth outlook due to improved margin and higher volume, according to a few brokerage reports. For the financial year ended September 2021, Siemens had reported an increase of 32.4% in new orders, 33.1% in revenue and 40.3% in profit after tax from continuing operations over the previous financial year.

Dixon Technologies India Ltd: Shares of the electronics manufcturer closed nearly 3% higher after Jefferies reiterated its ‘buy’ recommendation on the stock and increased the target price to Rs 6,450 from Rs 5389.20, citing growth opportunities for the company from the PLI approvals. Jefferies also said Dixon is enhancing R&D capability and increasing capacities across products which is good for the company’s growth prospects.

Sun Pharma Advanced Research Co Ltd. [SPARC]: Shares of the company closed 3.76% higher after the company said in an exchange filing that it has been selected to present updated clinical data of Vodobatinib drug in leukemia subjects, at the 63rd American Society of Hematology annual meeting. The Phase 1 study outcomes will be presented by Prof. Jorge Cortes, the Principal Investigator for the study, on December 11, 2021.

Cadila Healthcare: The pharma company received the US drug regulator FDA’s approval to initiate Phase 2(b)/3 placebo-controlled adaptive clinical trial to evaluate the efficacy and safety of Saroglitazar Magnesium in subjects with primary biliary cholangitis (PBC). The global market for PBC treatment is expected to grow at a CAGR of 36.3% from 2018-2026 and is estimated to reach $10.8 billion by 2026, according to Coherent market insights, the company said in an exchange filing.