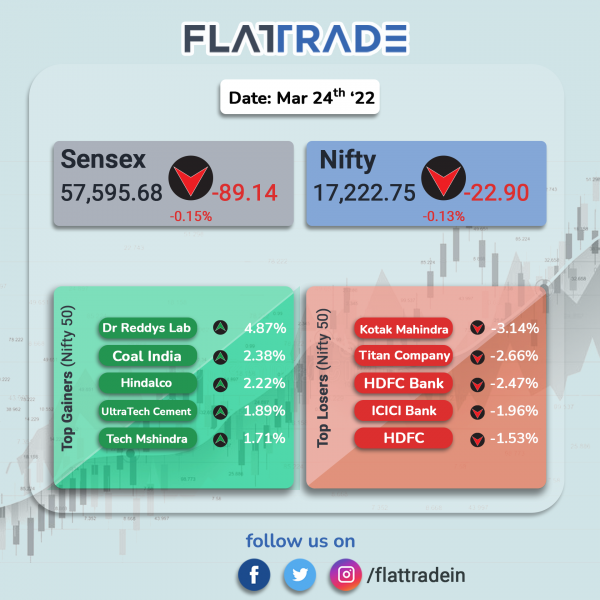

Benchmark indices closed lower in a volatile session as geopolitical tensions between Ukraine and Russia continued to weigh on the markets. Higher crude prices also added to investor woes. Banking and financial stocks were the biggest laggards. The Sensex closed 0.15% lower and the Nifty lost 0.13%.

Top losers among Nifty sector indices were Private Bank [-1.79%], Bank [-1.72%], Financial Services [-1.56%], Auto [-0.49%], PSU Bank [-0.45%]. Top gainers were Media [5.91%], Metal [1.54%], IT [1.2%], Pharma [1.14%] and Energy [0.86%].

Indian rupee fell 6 paise to 76.36 against the US dollar on Thursday.

Stock in News Today

Zee Entertainment Enterprises Ltd (ZEEL): Invesco Developing Markets Fund, the largest shareholder of the company, said that it had decided not to pursue an extraordinary general meeting (EGM) to add six independent directors as Zee’s merger with Sony will achieve the fund’s aim of strengthening board oversight. Shares of the company closed 16.74% higher.

Larsen & Toubro (L&T): The engineering conglomerate has approved long-term borrowings of as much as ₹10,000 crore ($1.3 billion), including refinancing, the company said in a regulatory filing. The debt can be via modes including external commercial borrowings, term loans, non-convertible debentures.

Maruti Suzuki India Ltd (MSIL): The automaker has appointed Kenichi Ayukawa as a Whole-time Director designated as Executive Vice Chairman for six months with effect from April 1, 2022. Hisashi Takeuchi has been appointed and redesignated as Managing Director and CEO for three years from April 1, 2022.

PVR Ltd: CRISIL Ratings has revised its outlook on the long-term bank facilities and debt programmes of PVR to ‘Stable’ from ‘Negative’. The revision in outlook reflects strong rebound in the operating performance of PVR during the third quarter of fiscal 2022. Shares of the company closed 1.12% higher.

One97 Communications Ltd (Paytm): Shares of the company surged nearly 13% boosted by higher volumes. The stock hit a high of ₹592.40 on BSE. However, it closed 9.53% higher at ₹574.35 apiece.

NMDC Ltd: The company closed over 4% higher after Kotak Institutional Equities raised target price of the company to ₹185 apiece from ₹175 per equity share and reiterated ‘buy’ rating. The company had reported a record output of 40 million tonnes during the fiscal year ending March 2022 and the company said it is on track to achieve an output of 100 million tonnes by 2030.

Lupin: The drugmaker received approval for Sildenafil for oral suspension, 10 mg/mL, from the US health regulator FDA. The drug is used to treat pulmonary arterial hypertension and it is a generic equivalent of Revatio of Viatris Speciality. The product will be manufactured at Lupin’s Goa facility.

IDBI Bank: The lender will consider the proposal for approval of rupee bond borrowings limit of ₹8,000 crore for FY23 on March 29. The approved amount is likely to be borrowed in one or more tranches.

Iraprastha Gas Ltd: The company has increased piped natural gas (PNG) prices by ₹1 per cubic meter across cities after global LNG costs jumped. PNG prices have been raised to ₹36.61 in Delhi, ₹35.86 in Noida, Greater Noida and Ghaziabad and ₹34.81 in Gurugram.

Godrej Agrovet: The company has made additional investment aggregating to ₹25 crore in the equity share capital of Godrej Maxxmilk (GMPL), a wholly owned subsidiary company, by way of subscription to Rights Issue. Accordingly, it has been allotted 7,35,295 equity shares of face value of Rs.10/- each of GMPL.

Easy Trip Planners Ltd (EaseMyTrip): The online travel platform said that it has opened a retail office in Dubai to cater to the growing B2C retail segment under its international expansion strategy. The company aims to increase its penetration across a dynamic international travel market, and further strengthen its position as a global travel and tourism company.

Shoppers Stop Ltd: Shares of the company closed 4.71% higher extending its rally into fourth day, after its promoters hiked stake in the company via open market.