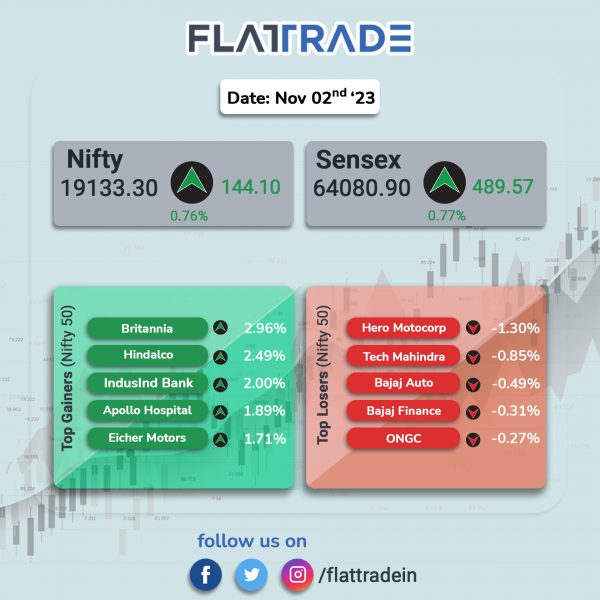

Benchmark equity indices closed higher as investors’ sentiments were boosted after the US central bank left benchmark interest rates unchanged and signalled that the rate hike cycle may be over.The Sensex and the Nifty rose 0.76%, each.

In broader markets, the Nifty Midcap 100 jumped 1.39% and the BSE Smallcap gained 0.96%

Top gainers were Realty [2.52%], PSU Bank [1.5%], Metal [1.4%], Oil & Gas [1.15%], and FMCG [0.98%]. All indices closed in the green.

The local currency strengthened 4 paise to close at 83.25 against the U.S dollar on Thursday.

Stock in News Today

Kotak Mahindra Bank: The lender, in an exchange filing, said that Zurich Insurance will acquire a stake of 51% in Kotak General Insurance for a total consideration of Rs 4,051 crore through a combination of fresh growth capital and share purchase. Zurich Insurance will further acquire an additional stake of 19% in Kotak General Insurance within three years. The transaction is subject to regulatory approvals from the RBI, IRDAI and the Competition Commission of India.

Adani Enterprises: The company said that its consolidated revenue fell 11.5% to Rs 22,517 crore in Q2FY24 from Rs 25,438 crore in Q2FY23. Consolidated Ebitda was down 3.7% at Rs 2,430 crore in Q2FY24 as against Rs 2,524 crore in Q2FY23. Consolidated net profit tumbled 50.8% to Rs 333 crore in Q2FY24 from Rs 677 crore in Q2FY23.

Adani Power: The consolidated revenue was up 18% at Rs 12,991 crore in Q2FY24 as against Rs 11,006 crore in Q2FY23. Consolidated Ebitda was up 47.2% at Rs 5,171 crore in Q2FY24 as against Rs 3,514 crore in Q2FY23. The company’s net profit declined 24.7% to Rs 6,594 crore in Q2FY24 from Rs 8,759 crore in Q2FY23.

Sun Pharma Advanced Research Company (SPARC): The company has entered into an agreement with Johns Hopkins University (JHU) and The Institute of Organic Chemistry and Biochemistry of the Czech Academy of Sciences (IOCB) to exclusively license SCD-153 including all patents and patent applications owned or controlled by licensors IOCB. SCD-153 is a first-in-class topical drug for the treatment of alopecia areata developed jointly by SPARC, JHU and IOCB, the company said in a regulatory filing.

Dabur India: The FMCG company said that its Consolidated revenue climbed 7.3% at Rs 3204 crore in Q2FY24 as against Rs 2986 crore in Q2FY23. Consolidated Ebitda rose 10% to Rs 660.9 crore from Rs 600.7crore in Q2FY23. Consolidated net profit was up 3.3% at Rs 507 crore in Q2FY24 from Rs 491 crore in Q2FY23.

Suzlon Energy: Consolidated revenue was down 0.9% at Rs 1417 crore in Q2FY24 as against Rs 1430 crore in Q2FY23. Consolidated Ebitda rose 36% to Rs 221 crore in Q2FY24 as against Rs 162 crore in Q2FY23. Consolidated net profit was up 81.1% at Rs 102 crore in Q2FY24 as against Rs 56.5 crore in Q2FY23.

Minda Corp.: The automotive components supplier has entered into agreement for forming a Joint Venture (JV) with HSIN Chong Machinery Works Co. Ltd. (HCMF) from Taiwan, a leading global manufacturer of automotive Sunroof and closure systems. the JV aims to provide cutting-edge technology backed by state-of-the-art manufacturing of Sunroof and Closure Technology Products for passenger cars by localization in India. The joint venture will offer a full system solution ranging from design, development to manufacturing of sunroof for passenger vehicles.

Separately, the company’s operating revenue stood at Rs 1,196 crore in Q2FY24, up 7.1% YoY from Rs 1117 crore in Q2FY23. The growth was driven by robust demand in the domestic market and product premiumisation. Ebitda stood at Rs 131 crore in Q2FY24, a rise of 6% from Rs 124 crore in Q2FY23. Profit after tax rose 1.7% YoY to Rs 59 crore in Q2FY24. The company secured its highest-ever lifetime orders of more than Rs.6,500 crore in H1FY24.

Skipper: The company announced that it has secured new orders worth Rs 924 crore. The orders in the Domestic T&D business is worth Rs 788 crore from Power Grid Corporation of India. Further, the company bagged orders worth Rs 136 crore for several other domestic T&D projects including telecom.

Godrej Properties: The realty company said its revenue soared 107.9% to Rs 343 crore in Q2FY24 from Rs 165 crore in Q2FY23. Consolidated Ebitda loss stood at Rs 61.6 crore in Q2FY24 as against a net loss of Rs 68 crore in Q2FY23. Its net profit rose 8.3% to Rs 72.6 crore in Q2FY24 from Rs 67 crore in Q2FY23.

Infibeam Avenues: The company’s consolidated revenue was up 65.7% to Rs 790 crore in Q2FY24 from Rs 477 crore in Q2FY23. Consolidated Ebitda was up 75.6% at Rs 70.2 crore in Q2FY24 from Rs 39.9 crore in Q2FY23. Its net profit increased marginally by 1.5% to Rs 40.5 crore in Q2FY24 from Rs 39.9 crore in Q2FY23.

Dr. Lal Pathlabs: The company’s consolidated revenue jumped 12.6% to Rs 601 crore in Q2FY24 from Rs 534 crore in Q2FY23. Consolidated Ebitda grew 23.6% to Rs 178 crore in Q2FY24 from Rs 144 crore in Q2FY23. The company’s net profit surged 52.9% to Rs 110.7 crore in the reported quarter from Rs 72.4 crore registered in the year-ago period.

Berger Paints: The company’s consolidated revenue rose 3.6% at Rs 2767 crore in Q2FY24 as against Rs 2671 crore in Q2FY23. Consolidated Ebitda rose 30.2% to Rs 474 crore in Q2FY24 from Rs 364 crore in Q2FY23. Consolidated net profit increased 33.1% to Rs 292 crore in Q2FY24 from Rs 220 crore in Q2FY23.

Thomas Cook India: The travel agency company’s consolidated revenue from operations rose 51.5% to Rs 1,871.3 crore in Q2FY24 from Rs 1,235.1 crore in Q2FY23. Consolidated Ebitda was up 138.7% YoY to Rs 130.8 crore in Q2FY24 from Rs 54.8 crore in Q2FY23. The company’s net profit soared multifold times to Rs 51.5 crore in Q2FY24 from Rs 0.15 crore in Q2FY23.