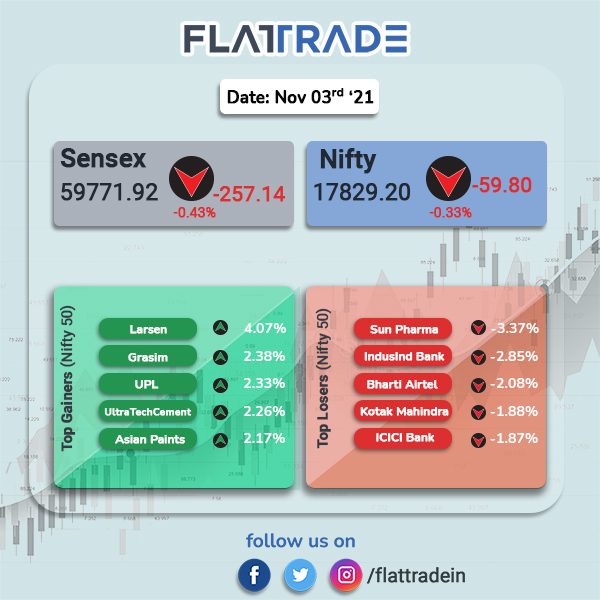

Benchmark Indian stock indices closed lower on Wednesday as banking, auto, pharma and FMCG stocks weighed on the market. The Sensex closed 0.43% lower at 59771.92 and Nifty fell 0.33% to 17829.20.

Top losers were Nifty Bank [-1.34%], Nifty Auto [-1.4%], Pharma [-0.75%] and FMCG [-0.64%]. Top gainers were Nifty Realty [1.94%] and Metal [0.93%] and Energy [0.29%].

Indian rupee rose 22 paise to 74.46 against the US dollar on Wednesday.

India’s services sector expanded in October, according to a survey by IHS Markit. The IHS Markit Services Purchasing Managers’ Index rose to 58.4 in October, from 55.2 in September as domestic demand improved.

Stock in News Today

State Bank of India: The lender’s standalone net profit rose on higher core income and lower provisions for bad loans. Net profit jumped 67% year-on-year to Rs 7,626.5 crore in Q2FY22 from Rs 4574 crore. Net interest income rose 10.65% YoY to Rs 31184 crore from Rs 28181 crore. Net NPA ratio fell 25 basis points to 1.52% on a sequential basis.

Adani Power: The company said that it has received an approval from National Company Law Tribunal (NCLT) to acquire Essar Power’s 1,200 MW thermal power project in Mahan, Madhya Pradesh. The acquisition shall be subject to satisfaction of conditions precedent mentioned under the Resolution Plan, it stated.

Mazagon Dock Shipbuilders: Shares of the company rose more than 6% and continued its rally for the third day in a row, after the company delivered the First Ship of Project 15B Class Destroyer i.e. Yard 12704 (Visakhapatnam) to the Indian Navy.

Devyani International: Shares of the company rallied after it posted a net profit of Rs 46.6 crore in Q2FY22, as against a net loss of Rs 65.5 crore in the year-ago period. The company’s operating revenue more-than-doubled year-on-year to Rs 516 crore, as business rebounded post the pandemic.

Infosys Ltd: The IT major has collaborated with Shell Global Solutions International BV (Shell) as commercialization partner. Both the companies will launch Shell Inventory Optimizer as the first product offered to its energy customers. The solution is expected to decrease time and labour required to complete maintenance operations and boosts cost efficiency.

Cipla: The company’ subsidiary InvaGen Pharmaceuticals has received a notice from US-based Avenue Therapeutics for termination of the acquisition deal they signed in 2018. InvaGen is reviewing the notice for any further steps that it may be required to take with respect to the same, it added.