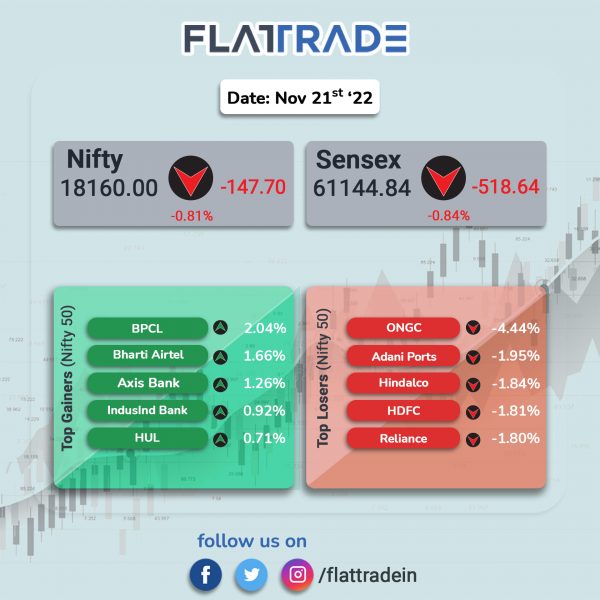

Benchmark stock indices closed lower as investors and traders were on the sidelines as they keenly awaited the minutes of the US Federal Reserve’s last monetary policy meeting to provide more details over their decision. The Sensex fell 0.84% and the Nifty dropped 0.81%.

Broader markets were nearly flat. The Nifty Midcap 100 index was down 0.05% and the BSE Smallcap index inched up 0.01%.

Top losers among Nifty sectoral indices were IT [-1.55%], Energy [-1.31%], Realty [-1.27%], Metal [-0.81%] and Financial Services [-0.64%]. Top gainers were PSU Bank [1.41%], Media [0.25%].

Indian rupee fell 15 paise to 81.84 against the US dollar on Monday.

Oil prices slumped following the biggest weekly decline since August as China’s tightened anti-Covid restrictions dampened oil demand outlook. The price of WTI Crude stood at $79.70 per barrel, while Brent Crude was $87 per barrel.

India’s foreign exchange reserves soared by $14.72 billion to reach $544.72 billion for the week to November 11, according to data released by the RBI.

Stock in News Today

Arvind Ltd: The company and PurFi Global, a sustainable technology company specializing in rejuvenating textile waste into virgin quality products, announced a joint venture to reduce the amount of textile waste going to landfills. The first fibre recycling facility will be located near one of Arvind’s manufacturing facilities in India. The facility will process textile wastes such as white cotton, colored cotton, denim and synthesis into virgin like fibres for reuse from two lines, where each line will have a 5,500- ton capacity per year with plans to expand over the next five years. The investment for these two lines is seen at Rs 200-250 crore. The joint venture is slated to start construction in the fourth quarter of 2022 with full production expected to commence in the fourth quarter of 2023.

Deepak Fertilisers and Petrochemicals Corp: Shares of the company jumped more than 7% in intraday trading it signed a pact with Aarti Industries to supply Nitric acid. The companies signed a binding sheet for a 20 year period for offtake and supply of Nitric Acid. The deal cost is estimated to be more than Rs 8,000 crore. The supply arrangement will start from April 1, 2023.

Kabra Extrusiontechnik: Shares of the company jumped 20% after it signed an agreement to supply 3 lakh battery packs to Hero Electric. The company’s Battrixx has inked a partnership with Hero Electric to supply 3 lakh lithium-ion battery packs and chargers in the next fiscal. The batteries will be fitted across Hero Electric’s entire e-scooter range.

Paytm: The company’s Payments Bank has announced that users on the Paytm app will now be able to make UPI payments to mobile numbers across all UPI payment apps, even if the recipient is not registered with Paytm. With this, Paytm app users can instantly send and receive money to and from any mobile number with a registered UPI ID, regardless of the service provider. The National Payments Corporation of India (NPCI) has enabled all payment services providers to access its universal database and make UPI payments interoperable, the firm said in a statement.

Ahluwalia Contracts: Shares of the company rose over 4% in intraday trading after it secured an order worth Rs 120.23 crore. The company won a project from the Government of Assam to construct Lachit Moidam Memorial & Cultural Complex at Lahdoigarh in Assam.

Allied Digital: Shares of the company surged over 8% after the company won a contract worth Rs 207.21 crore in consortium with KEC International. The company won a ‘Smart City’ contract for the Punjab Municipal Infrastructure Development Company. The company expects the project to be completed in a period of 57 months which includes nine months for implementation and 48 months of project support.

Aurobindo Pharma: Shares of the company fell after the US Food and Drug Administration issued Form 483 with ten observations after inspecting the company’s Unit-IX, which is an intermediate facility in Telangana state. The USFDA inspected the facility from November 10-18. The company said that it will respond to the USFDA within the stipulated timeline and shall work to address the observations at the earliest.

Easy Trip Planners: Shares of the company surged 20% as it traded ex-bonus and ex-split on Monday. Earlier, the company in a stock exchange filing said that it has fixed November 22 as record date for 1:2 stock split and 3:1 bonus issue.

3i Infotech: The company said it has bagged a multi-year digital infrastructure managed services contract of Rs 51 crore from oil refiner Hindustan Petroleum Corp (HPCL). The contract is for three years. 3i Infotech’s Digital Infrastructure Managed Services (DIMS) comprises of IT Infrastructure and Cloud services that will manage and support the IT Infrastructure of HPCL.

Responsive Industries: The company, in an exchange filing, announced that Santosh Kudalkar has tendered his resignation from the office of chief financial officer (CFO) of the company due to personal reasons. The company has accepted his resignation and relieved him from his responsibilities with effect from November 18, 2022.

Sheetal Cool Products: The company shares surged after the company said its shares will migrate to the mainboard of the BSE and the NSE from November 22. Sheetal Cool Products is currently listed on the BSE SME platform. The company shares will migrate to the BSE’s mainboard platform in the list of ‘B’ Group. It will also enter the main board of the National Stock Exchange of India on the same day.

Alembic Pharmaceuticals: The company has received final approval from the drug regulator USFDA for its Abbreviated New Drug Application (ANDA) Nifedipine Extended-Release Tablets USP, 30 mg, 60 mg and 90 mg. The approved ANDA is therapeutically equivalent to the reference listed drug product (RLD), Procardia XL Extended-Release Tablets, 30 mg, 60 mg and 90mg, of Pfizer Inc.

Vishvprabha Ventures: The company has received an order of Rs 36.15 crore from Kalyan-Dombivli Municipal Corporation (KDMC) for construction of road. The company said it will construct the road within the municipal boundary of KDMC. The company is engaged in construction business and involved in civil construction projects.