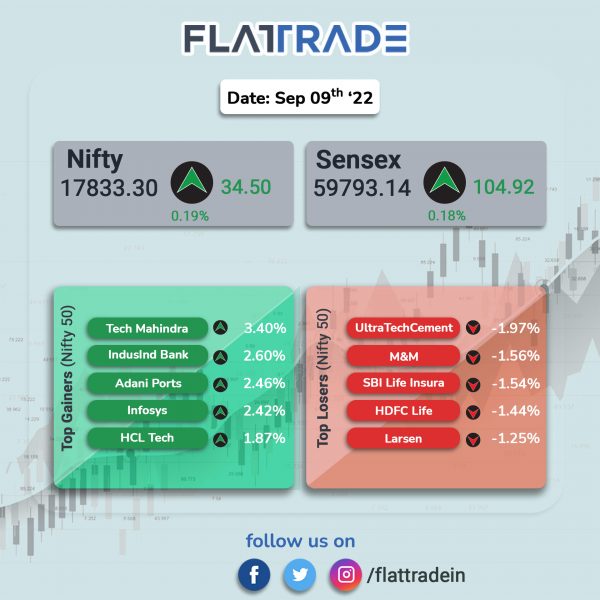

Benchmark stock indices closed in the green, aided by gains in IT, bank and auto stocks. The Sensex closed 0.18% higher and the Nifty 50 index rose 0.19%.

In broader markets, the Nifty MidCap 100 index gained 0.35% and BSE SmallCap edged up 0.18%.

Top Nifty sectoral index gainers were IT [2.21%], Private Bank [0.57%], Auto [0.52%], Bank [0.51%] and PSU Bank [0.48%]. Top losers were Realty [-0.47%], Energy [-0.33%] and Media [-0.2%].

The Indian rupee appreciated 13 paise to 79.58 against the US dollar on Friday.

Stock in News Today

Tata Motors: The automaker said that it will roll out the electric version of its entry-level car, Tiago, later this month. The new electric vehicle (EV) would be the company’s third EV product after Nexon and Tigor. Tata Motors aims to introduce 10 electric models over the next five years.

Mahindra & Mahindra (M&M): The company said its total production of automobiles soared 82.87% to 60,751 units in August 2022 as compared with 33,220 units sold in the same period a year ago. The company’s total sales zoomed 104.84% to 56,137 units in August 2022 as against 27,405 units sold in August 2021. Meanwhile, exports for the period under review stood at 2,912 units, a decline of 8.43% year-on-year.

PVR and Inox Leisure: Multiplex operator PVR will meet its shareholders and creditors on October 11 to seek their approval for the scheme of merger with rival company Inox Leisure. The development comes after the Mumbai bench of the National Company Law Tribunal (NCLT) on August 22 directed PVR to arrange for a meeting.

Lupin: The drugmaker has announced the launch of Sodium Sulfate, Potassium Sulfate and Magnesium Sulfate oral solution in the US market after getting approval from the US Food and Drug Administration (USFDA). The drug is an equivalent generic version of Suprep Bowel prep kit oral solution. The oral solution combination is used to cleanse the colon (bowel) before a colonoscopy. According to IQVIA MAT July 2022, the oral solution had estimated annual sales of $202 million in the US.

Happiest Minds Technologies: The company has announced that it has achieved Select tier partner status from Snowflake, the Data Cloud company. With this partner status, Happiest Minds can accelerate the digital transformation of its joint customers who can fully leverage the performance, flexibility, and near-infinite scalability of the Snowflake Data Cloud.

Mindspace REIT: Shares of the company rose over 1% after the credit rating agency CRISIL said that Mindspace REIT has a comfortable net loan-to-value (LTV) ratio, characterized by low debt, strong debt protection metrics supported by a cap on incremental borrowings, and stable revenue profile of the assets, amidst benefits of healthy occupancy and geographic diversification. Mindspace REIT is sponsored by K Raheja Corp group.

Zydus Lifesciences: The pharma company has acquired rights to market MonoFerric injection from Denmark-based Pharmacosmos in India and Nepal. The injection is used to treat iron deficiency in adult patients. The company did not disclose the financial details of the transaction.

Rain Industries: The company’s wholly-owned subsidiary, Rain Carbon, has temporarily closed an operating unit in Europe and is developing additional energy-related contingency plans for its other European production units. The decision was taken in anticipation of potential natural gas shortages and price rise during the upcoming winter months due to unprecedented and unpredictable geopolitical environment, the company said in an exchange filing.

Titagarh Wagons: Shares of the company fell 8.22% after the company said it has concluded fresh capital infusion into its unit Titagarh Firema from proposed third-party investors. After the fresh capital infusion, Invitalia and Hawk Eye hold 30.30% and 13.64%, respectively, in Titagarh Firema.

Life Insurance Corporation of India (LIC): The insurance company said that it has decreased its stake in Century Enka to 3.452% from 5.494%. LIC sold 4,46,125 shares, or more than 2% equity, at an average cost of Rs 333.90 via open market sale during the period from 22 November 2019 to 7 September 2022.

TTK Healthcare: The company’s board at its meeting held on September 9 has accepted the resignation of T T Jagannathan, chairman, from the directorship of the company, with effect from September 9. The board has elected TT Raghunathan, executive vice chairman as chairman of the board with executive responsibilities , with effect from September 9. Further, the board has approved the appointment of Dr T T Mukund as additional director of the company.

Karur Vysya Bank: The lender has opened its first High Net worth Individuals (HNI) branch in Banjara Hills, Hyderabad and plans to open more such branches across India. The new branch is the 792nd branch exclusively for retail assets and personal banking services.

Kaveri Seed: Shares of the company surged nearly 6% in intraday trading after the company said that Massachusetts Institute of Technology and 238 Plan Associates have bought more shares of the company in open market. Investors purchased 1 lakh shares of the company and the transaction has increased the shareholding in the company to 5.13% from 4.96% earlier.