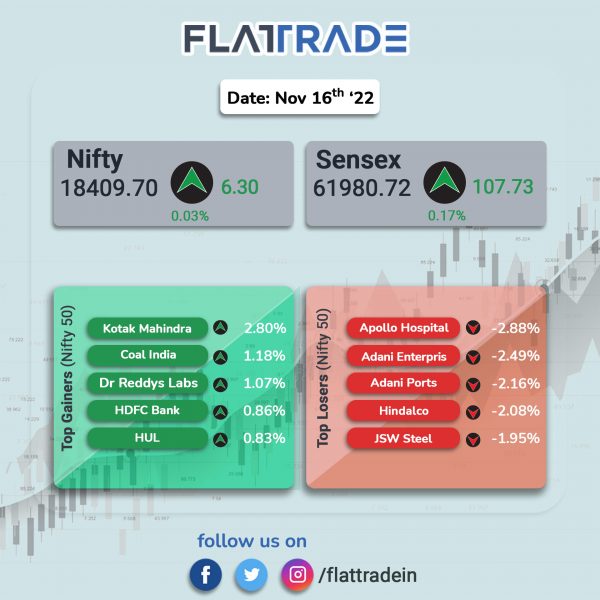

The Sensex gained modestly, while the Nifty was flat amid volatility in the markets. The Sensex rose 0.17%, while Nifty inched up 0.035. In the broader markets, Nifty Midcap 100 index fell 0.65% and the BSE Smallcap dropped 0.34%.

Top gainers among Nifty sectoral indices Bank [0.38%], Financial Services [0.34%], PSU Bank [0.29%], IT [0.29%] and Private Bank [0.26%]. Top losers were Metal [-1.94%], Media [-1.44%], Realty [-1.03%], Energy [-0.87%] and Oil & Gas [-0.75%].

Indian rupee fell 20 paise to 81.30 against the US dollar on Wednesday.

Stock in News Today

Adani Enterprises: Shares of the company fell 4.79% in intraday trading on Wednesday after the company received a regulatory nod to float an open offer for acquiring 26% stake in NDTV. The offer will begin on November 22 and end on December 5.

Hindustan Aeronautics Ltd (HAL): Shares of the defense company rose 7.4% in intraday trade after the the company received a letter of intent (LoI) for nine more advanced light helicopters (ALH) Mk-III from the Indian Coast Guard (ICG).

KEC International: Shares of the company gained after the company secured orders worth Rs. 1,294 crore across different business verticals. The orders include supply of towers in U.S., ballastless track works for Chennai and Mumbai Metro, and supply of cables.

CESC: The company announced that the board in its meeting has approved the allotment of non-convertible debentures (NCDs) aggregating to Rs 300 crore to Axis Bank. The company has allotted 3,000 secured, unlisted, redeemable, rated NCDs having a face value of Rs 10 lakh each aggregating to Rs 300 crore.

IDFC: The financial services company said that the media report on IDFC merger getting delayed on fair value issue is baseless, false and misleading and from unidentified sources, according to its regulatory filing. The company added that it is committed to the ongoing corporate restructuring plan to enhance shareholders’ value.

Bharat Rasayan: The company reported a consolidated net profit of Rs 23 crore in Q2FY23, down 13.6% from Rs 26.5 crore in Q2FY22. Its consolidated revenue was up 8.4% YoY to Rs 291.7 crore as against Rs 269.1 crore. Consolidated EBITDA was down 11.2% YoY to Rs 35.7 crore in the quarter under review.

Balrampur Chini Mills: Shares of the company rose over 4% in intraday trade as its share buyback commenced. Earlier, the board of directors at a meeting held on November 9 had approved Rs 145.44 crore share buyback at Rs 360 per share through the open market route. The company believes that the buyback will create long term value for shareholders.

Kirloskar Oil Engines: Shares of the company surged after it posted strong quarterly results. The company’s net profit nearly doubled to Rs 82.50 crore in Q2FY23 as against Rs 41.7 crore in Q2FY22. Revenue from operations grew 23% to Rs 1,228 crore in Q2FY23 from Rs 1,001 crore in the year-ago quarter. EBITDA margin improved 500 bps year-on-year to 14.7%.

Piramal Capital and Housing Finance: The company has withdrawn the insolvency proceedings against Reliance Power, according to its BSE filing. This follows an out-of-court settlement between both the companies over a Rs 526 crore loan default by Reliance Power and its subsidiary Reliance Natural Resources Ltd (RNRL). RNRL had defaulted on a loan of Rs 526 crore obtained from the erstwhile Dewan Housing Finance Corporation Ltd (DHFL), which was acquired Piramal Group in 2021 and merged it with Piramal Capital and Housing Finance .

IOL Chemicals: The company said that its board approved formation of a wholly owned subsidiary in United Kingdom (UK).

PNC Infratech: The National Highways Authority of India (NHAI) has awarded the mandate of Collection of User Fee at 135 km long Eastern Peripheral Expressway (EPE) Fee Plazas (National Highway No. NE II) in Haryana and Uttar Pradesh for one year to PNC Infratech effective from December 1, 2022.

Rajesh Exports: The company’s consolidated net profit rose 27.9% YoY to Rs 372.96 crore on a 94.62% YoY jump in revenues to Rs 80,270.06 crore in Q2FY23. Total expenses soared 95.06% YoY to Rs 79,876.32 crore in the quarter ended September 2022.

Godrej Properties: The realty major said that it has achieved a sales worth Rs 500 crore through the launch of its new project, Godrej Woodsville in Hinjewadi, Pune. The company added that it has sold more than 675 houses accounting for an area of over 6.9 lakh square feet for the project launched in September 2022.

Zydus Lifesciences: The company has announced that it will be exclusively marketing CanAssist Breast, an innovative and a highly advanced prognostic test for breast cancer patients in the early stages to help clinicians decide whether the patient needs chemotherapy. With the aid of CanAssist Breast and its precise findings, clinicians can avoid chemotherapy for their patients based on scientific evidence.

Natco Pharma: The company announced that the Appeals Court in the US has rejected its marketing partner Alvogen’s appeal on Ibrutinib tablets. Ibrutinib tablet is the generic equivalent of Imbruvica tablet. Natco and its co-development & marketing partner, Alvogen Pine Brook, USA, are assessing their option on the way forward, said the company.

DCX Systems: Shares of the company fell 3.1% after the company reported 32% drop in standalone net profit to Rs 7.88 crore in Q2FY23 from Rs 11.64 crore in Q2FY22. Revenue from operations declined by 8% YoY to Rs 173.88 crore during the quarter. Total expenses fell by 6% YoY due to higher raw materials cost. Shares of the company has fallen 13.71% from the closing price on its listing day (November 11, 2022).

Bikaji Foods International: The company had a weak stock market debut. Shares of the company closed at Rs 317.45 on its listing day as against its opening price of Rs 322.80 on the NSE. Its issue price was 300 per equity share. Share price touched a low of Rs 314.20 apiece and a high of Rs 334.70 apiece. .

Global Health Ltd (Medanta): The company had a strong debut on the Indian bourses. The opening price was Rs 401 apiece on the NSE as against its issue price of Rs 336 per share. The share price touched a low of Rs 390.05 apiece and a high of Rs 424.65. Shares closed at Rs 415.30 apiece on the NSE.